3 February 2021

3 February 2021

Michael Gasiorek is Professor of Economics and Director of the UKTPO. Guillermo Larbalestier is Research Assistant in International Trade, and Nicolo Tamberi is Research Officer in Economics, both for the UKTPO.

As widely anticipated and signalled in advance, the International Trade Secretary announced on Monday 1 February that the UK notified the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), of its intention to join. The CPTPP is a free trade agreement between 11 ‘Pacific’ countries which was signed in 2018.[1] This is an early step in the UK’s newfound and hard-won sovereign and independent trade policy.

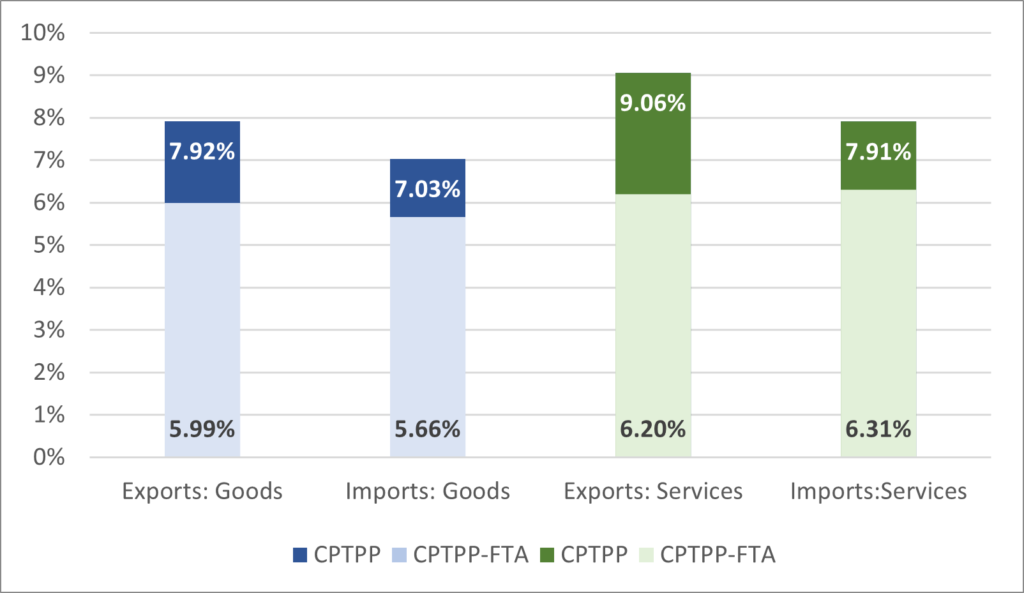

On the face of it, the CPTPP could be seen as significant for the UK. The CPTPP countries between them in 2019 account for close to 15% of world exports and world imports of goods.[2] The share of the CPTPP in the UK’s trade in goods in 2019 was around 8% with regard to exports and 7% with regard to imports (see chart below). The corresponding figures for trade in services are that the CPTPP accounts for just over 9% of UK exports, and just under 8% of UK imports.[3]

Shares calculated as the total value of UK trade with CPTPP countries divided by the total value of UK trade with the World; CPTPP-FTA are those CPTPP countries the UK already has an FTA with; Source: ONS data on international trade; author’s calculations.

For both trade in goods and trade in services, and both imports and exports, the principal partners are Canada, Japan, Australia and Singapore. Table 1 below shows that, out of the UK’s total trade with CPTPP members, these four countries account for around 87% of the UK’s export of services with the CPTPP, 85% of the UK’s imports of services, 80% of UK exports of goods, 75% of UK imports of goods. Finally, if we consider investment, the data is harder to come by but foreign affiliate sales data (FATS) suggests that around 16% of the UK’s overseas turnover comes from the CPTPP, and inward investment from the CPTPP accounts for around 10% of total inflows.[4] If we consider the share of greenfield (new FDI) and brownfield FDI (expansion of an existing plant/office) projects over 2018-19 the latest year for which the data was available, the share of the CPTPP was around 9% for UK outflows to the CPTPP, and almost 13% in the reverse direction.[5]

Table 1: UK’s total trade with CPTPP countries, 2019 |

||||

| Goods | Services | |||

| Exports | Imports | Exports | Imports | |

| Canada | 19.8 | 28.2 | 20.1 | 14.8 |

| Japan | 24.6 | 23.2 | 25.7 | 32.9 |

| Australia | 16.2 | 19.3 | 25.5 | 15.1 |

| Singapore | 20.3 | 3.9 | 16.0 | 23.0 |

| Others | 19.1 | 25.4 | 12.7 | 14.2 |

| Total | 100 | 100 | 100 | 100 |

| Shares calculated as the value of UK trade with a CPTPP country (or countries) divided by the total value of UK trade with the CPTPP; Source: UN Comtrade and ONS combined data; | ||||

However: Out of the 11 CPTPP countries, the UK already has continuity / free trade agreements with 7 of them[6], and these include three of the most important markets identified above (Canada, Japan, Singapore). Figure 1 above also shows that the share of UK trade accounted for by those countries the UK has an FTA with (the CPTPP-FTA portion of the bars) correspond to almost 6% and 5.6% of the UK’s exports and imports of goods, respectively; and just over 6% of exports and imports of UK services. Hence, de facto with regard to improved market access, joining the CPTPP will primarily serve to enhance the UK’s access to Australia, New Zealand, Brunei and Malaysia – who between them account for around 2% of the UK’s exports and imports of goods, with similar figures for services. That is a much smaller number.

The conclusion from this is that improved market access for goods via tariff reductions from joining the CPTPP is unlikely to have a big positive economic impact on the UK. So if there are more substantial gains to be had, they would need to be found elsewhere.

First, negotiating free trade agreements can be costly and intensive in terms of the human resources involved. Instead of negotiating separately with the four remaining CPTPP countries, accession could be much easier, for notionally the same benefits.

Second, the CPTPP has fairly generous rules of origin arrangements which allow for the full cumulation of inputs from any of the partner countries. This could be a non-negligible gain for the UK, as it would allow for much more flexible use of inputs from any of the CPTPP partner countries when exporting back to the CPTPP. However, the extent to which the UK imports intermediate inputs from the CPTPP in order to export back to the CPTPP (or vice versa) is almost certainly low – simply because of the distances involved. Thus, while the rules of origin may help some firms or sectors, on balance it is hard to see this being of much economic significance for the UK.

Third, China, Korea and the US (the US was part of the original negotiations that led to the CPTPP) have ‘mooted’ the possibility of joining at some point. Clearly, that would make a substantial difference because it would give enhanced access to these markets. However, it is far from clear how high is the probability of any of these accessions.

First, it is important to note that in principle for the UK this would be accession and not the negotiation of a new FTA. The existing CPTPP members are not going to change the agreement because of the UK’s entry. Hence the UK will need to accept whatever market accession concessions the countries are already offering while negotiating the degree of market access the UK needs to agree to in order to ‘join the club’. The bargaining power here is largely in the hands of the CPTPP countries for whom the UK market is less important (the average share of the UK in the exports of the CPTPP in 2019 is less than 2%).

Second, and relatedly, an important element of market access for the UK is for services. It is highly likely that in a bilateral negotiation the UK could obtain a better deal than the many services exceptions which exist in the CPTPP, as for example in the UK-Japan agreement. If so, this would be more beneficial for UK services exporters who would thus have better access to those markets. Improving the degree of market access under the CPTPP would not be possible as the UK is acceding to an existing agreement with existing concessions already in place. It is worth noting that of total UK exports to the CPTPP, 50% of these are services exports, whereas on the import side the share of services drops to 33%.[7]

Third, there are issues around standards and regulations. The CPTPP relies on a US-style approach to standards and certification procedures, which are different to those in the EU. Hence, signing up to the CPTPP may result in the need to reconcile different regulatory regimes, or at least the need to manage different regulatory approaches.

On balance, therefore, the economic gains from the UK acceding to the CPTPP do not appear to be very high. This does not make the accession worthless, but it does need to be put in perspective.

[1] Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

[2] Source : UN Comtrade.

[3] Source: ONS, https://www.ons.gov.uk/businessindustryandtrade/internationaltrade/datasets/uktradeinservicesallcountriesnonseasonallyadjusted

[4] Source: Authors’ calculation based on Eurostat FATS database, average 2016-17. Data for turnover of CPTPP’s multinationals in the UK exclude financial services.

[5] Source: Author’s calculations based on the FDI Markets database.

[6] Canada, Chile, Japan, Mexico, Peru, Singapore and Vietnam.

[7] 2019 figures from ONS and Comtrade data combined.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

I fully agree that “the economic gains from the UK acceding to the CPTPP do not appear to be very high” , but we will be able to evaluate this accession only after a certain time.

[…] Michael Gasiorek, Director of the UK Trade Policy Observatory, University of Sussex, caveat “The bargaining power here is mainly in the hands of CPTPP countries. For these countries, the […]

[…] Michael Gasiorek, director of the UK Trade Policy Observatory at the University of Sussex, warned that “the bargaining power here is largely in the hands of the CPTPP countries for whom the UK […]

[…] Michael Gasiorek, director of the UK Trade Policy Observatory at the University of Sussex, warned that “the bargaining power here is largely in the hands of the CPTPP countries for whom the UK […]

[…] Michael Gasiorek, director of the UK Commerce Coverage Observatory on the College of Sussex, warned that “the bargaining energy right here is essentially within the fingers of the CPTPP nations for […]

[…] Gasiorek, director of the United Kingdom Industry Coverage Observatory on the College of Sussex, warned that “the bargaining energy this is in large part within the fingers of the CPTPP nations for whom […]

[…] Michael Gasiorek, director of the UK Commerce Coverage Observatory on the College of Sussex, warned that “the bargaining energy right here is essentially within the fingers of the CPTPP […]

[…] Gasiorek, Director of the United Kingdom Trade Policy Observatory at the University of Sussex, warned that “the bargaining power here is largely in the hands of the CPTPP countries to which the UK […]

[…] Michael Gasiorek, director of the UK Trade Policy Observatory at the University of Sussex, warned that “the bargaining power here is largely in the hands of the CPTPP countries for whom the UK […]

[…] but if the anticipated accession to CPTPP is simply trumpeted as a Brexit benefit rather than a minor piece of damage limitation, and itself damaging to some sectors, it will suggest that the Brexiter […]