04 October 2024 – Peter Holmes is a Fellow of the UK Trade Policy Observatory and Emeritus Reader in Economics at the University of Sussex Business School.

04 October 2024 – Peter Holmes is a Fellow of the UK Trade Policy Observatory and Emeritus Reader in Economics at the University of Sussex Business School.

The 2024 World Trade Organization (WTO) Public Forum was sure to be a fascinating occasion given the interest in the topic, inclusivity and green trade, and the stellar cast of speakers. But what of the future of the WTO itself? Many observers have come to feel that with the negotiating function and the Appellate Body (AB) both log-jammed, there wasn’t much for the WTO to do apart from hosting events like the Public Forum.

Despite the logjam in negotiations and the apparent death (certainly more than a very deep sleep) of the Appellate Body, the WTO is still delivering value to its members in its routine committee work. It continues to promote transparency etc, and Dispute Settlement Panels still operate, though more like the way they did in the GATT era. Among DS nerds there was sympathy for the idea put forward by Sunayana Sasmal and me[1] that concerns over judicial overreach could be assuaged if the AB (if there were one) could decline to rule if the law was genuinely unclear. But as several Indian experts told us, if there is no AB, it’s not an issue.

Meanwhile, I only found one panel focussing on how to restore negotiations: our very own CITP panel on “Responsible Consensus”, i.e. persuading countries not to use their power to block decisions. It didn’t generate a lot of optimism. India, as well as the US, attracted quite a lot of criticism for its vigorous use of its legal right to veto moves that could affect its interests – even where there was a big majority of supporters. India’s position was elegantly and forcefully explained and defended by Prof Abhijt Das, an old friend of Sussex. He argued that even where other states might want to agree amongst themselves, India had a right to object to Plurilateral deals which might affect them adversely even when no actual obligations were created for them. But, interestingly, despite the delight of seeing many old friends from Delhi, there was little open official Indian engagement. It was striking that the Indian Foreign Minister chose last week to visit Geneva, to consult with UN agencies, but he didn’t visit the WTO. And there was no visible official US profile. On the other hand, China’s CGTN was listed as a Forum sponsor and hosted a lecture by Jason Furman, former senior adviser to Barack Obama. On CGTN, the Chinese DDG Zhang Xiangchen stated how the public Forum, “is a platform for all to make their voices heard” and he “encourages more communication among stakeholders and calls on the active participation of developing countries for a balanced outcome.”

This echoed the message that WTO DG Dr Ngozi Okonjo-Iweala pushed in the sessions she spoke at. It was spelled out in the first ever WTO Secretariat Strategy document.

The WTO Secretariat as a body is seeking to do more than just service the wishes of the Member States. It is seeking to act as a facilitator, convenor and broker, in the absence of, and perhaps to recreate, the missing consensus. Inclusivity and sustainability were being pushed in sessions organised by the Secretariat. The message was that we cannot assume globalisation will benefit everyone without action being taken. This was the underlying theme: the Forum offered Public Diplomacy on behalf of the organisation. Was it just bland PR? One senior legal official told Sunayana and me that the WTO did seem to have found a way to create a new role and a new narrative for itself. The WTO had been very closely involved in the efforts to keep vaccine supply chains and some border crossings open during Covid, at the request of concerned parties and had brokered important agreements. It was “more important than ever”. The Secretariat is beginning to be more proactive and encouraging global dialogue.

Following these conversations, many of the observers we spoke to were somewhat sceptical, but not all. One of the UK’s leading trade specialists thought that this message of pro-active broader engagement was real and had been effective during the COVID period. Dr Ngozi has called for action on carbon pricing in an FT interview. If it could work, seeking to mobilise soft power rather than being the home of rulemaking and rule enforcement would be an excellent strategy. But there are pitfalls. Would it be too controversial in the face of division among members? Is there a risk that the Secretariat could be seen as overreaching its legitimacy in the same way as the Appellate Body? Can the WTO really survive without its key rulemaking and enforcing role? And what if Trump wins?

[1] https://blogs.sussex.ac.uk/uktpo/files/2024/02/Holmes_Sasmal_Not-Liquet-UKTPO-WP.pdf

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or the UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Jessie Madrigal-Fletcher October 4th, 2024

Posted In: UK - Non EU, UK- EU

Tags: WTO

27 September 2024 – Ana Peres is a Lecturer in Law at the University of Sussex and a member of the UKTPO.

27 September 2024 – Ana Peres is a Lecturer in Law at the University of Sussex and a member of the UKTPO.

Lawyers, economists and political scientists are increasingly using a new term to frame discussions on current trade relations and policies: geoeconomics. This means that countries are intervening in strategic economic sectors not primarily for profit but to ensure autonomy, build resilient supply chains and secure access to valuable capabilities. Such approach contrasts with the ideals of free trade, market access and interdependence that shaped international trade for decades. These traditional ideals, even when supported by a so-called ‘rules-based system’, always posed challenges for developing countries to meet their objectives. So, what does geoeconomics mean for developing countries? Unfortunately, it threatens to sideline them even more.

Consider one of the main areas where geoeconomic strategies are at play: the development of clean technologies. Governments are implementing industrial policies to secure access to critical raw materials, an input for electric batteries, and to protect domestic production of electric vehicles (EVs). Such policies often require substantial subsidies. Recent discussions at the WTO Public Forum highlighted that a clear distinction between “bad” and “good” subsidies is not only desirable but essential to deal with many of the new and standing issues in the organisation. Beyond the question of their legality, we need to consider which countries have the financial resources to engage in this new wave of industrial policies – and what happens to those that do not. For instance, the UK’s former Conservative Secretary of State for Business and Trade, Kemi Badenoch MP, stated that the UK government would provide “targeted support (…) looking at what we can afford (…)”. If the UK, as a G7 economy, is concerned about affordability, developing countries face even greater challenges in this context.

An analysis of the proposed “Clean Energy Marshall Plan” suggests that a Harris administration in the US could use industrial policies to make developing countries dependent on US exports of clean technologies. Chinese foreign direct investment (FDI) to Latin America is shifting to “new infrastructure” sectors, such as energy transition. The EU signed a memorandum of understanding with Chile to promote sustainable raw materials value chains. All these developments reflect the geoeconomic trend, by prioritizing autonomy, resilience and access for wealthy countries, at the expense of those objectives for poorer countries.

Resource-rich developing countries are not defenceless in this geoeconomic world. For instance, Chile is one of the world’s largest suppliers of lithium (around 80% of all EU imports). The Chilean government’s response, creating the National Lithium Strategy to strengthen control over its reserves and maximise their benefits, offers a glimpse of one path resource-rich developing countries may follow. Similarly, Southeast Asian countries like Indonesia and Malaysia are trying to capitalise on the EV industrial policies of the US and China.

These examples show the power dynamics underlying international trade flows. While geoeconomics brings power and politics to the fore of current trade relations, it does not introduce them to the existing trade order. The process leading to the creation of the WTO and the surge of free trade agreements during the 1980s and 1990s reaffirmed the rule of law as central to promoting trade liberalisation. A rules-based framework should favour the stability and predictability of the global trading system, enabling countries to negotiate new topics and settle trade disputes. However, even in this ‘traditional’ WTO-led approach, law and power are closely linked. Restricting the role of power in trade agreements and institutions does not eliminate it from trade rules and negotiations. Developing countries have long struggled to have their voices heard in trade rulemaking and negotiations. For them, it has always been political.

The novelty of the geoeconomic framework is the recognition that economic and geopolitical powers are intertwined in policymaking. Governments are implementing policies beyond trade, covering areas like environmental protection, defence, health, and digital technologies. Geoeconomics shows how states use their economic and political power to achieve domestic goals and assert or maintain global leadership.

While geoeconomics is useful for describing the current context, it has not yet adequately addressed the position of developing countries. Like many frameworks applied to international trade, geoeconomics explains trade relations and trends from the perspective of the main players. In this case, the US, China and, to a lesser extent, the EU. Tensions between the US and China are driving a new division between allies and adversaries. This raises important questions: who decides which countries are friends or foes? Can – or should – developing countries take sides? What are the potential consequences? Could developing countries leverage the conflict between the world’s two largest economies to strengthen their positions? What will happen to developing countries that are not resource-rich? These will become defining questions for developing countries in the era of geoeconomics.

During the Cold War, the polarisation of global powers led third world nations to advocate for a New International Economic Order. They understood that their interests were sidelined in the global debate driven by ideological and political conflicts between the two superpowers. At the WTO Public Forum, the possibility of “third nations” or “middle powers” guiding multilateral trade efforts was raised, as an alternative to overcome the stalemate created by the clash between the US and China. However, such a heterogeneous group will have to find common ground if they move forward without the two biggest world economies. That is no easy task. This is why including developing countries in discussions about the geoeconomics of trade is so important today – to ensure their concerns are not overlooked or marginalised as they once again risk being caught in the middle of power struggles that threaten to leave them powerless.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Jessie Madrigal-Fletcher September 27th, 2024

Posted In: UK - Non EU, UK- EU

Tags: Geoeconomics, WTO

23 July 2024

23 July 2024

Minako Morita-Jaeger is Policy Research Fellow at the UK Trade Policy Observatory, a researcher within the Centre for Inclusive Trade Policy (CITP) and Senior Research Fellow in International Trade in the Department of Economics, University of Sussex. She currently focuses on analysing UK trade policy and its economic and social impacts.

The UK is a services economy which accounts for 81% of output (Gross Value Added) and 83% of employment.UK services exports (£470 billion in 2023) are the world’s second largest after the US and 75% of its services exports are digitally delivered. The UK is ranked as world-leading in terms of data governance. Under the new Labour government, it is time to take the initiative on data flow governance at the global stage to achieve a sustainable and accountable digital environment. With the set back in the US negotiations on free data flows at the WTO, the UK can take the initiative to collaborate with the EU and Japan.

The EU-Japan EPA, which entered into force in 2019, lacked provisions on free data flows and personal data protection. This has now been addressed with the signing of the new protocol on 31 January this year which is incorporated into the EU-Japan EPA. The new EU-Japan protocol can be seen as game changers. First, they strike a balance between free data flows and legitimate public policy objectives. Under Article 8.81, measures that prohibit or restrict cross-border data flows, such as localisation requirements of computing facilities or network elements, are restricted. These provisions are similar to the existing digital trade provisions under FTAs/digital trade agreements led by the Asia-Pacific countries, such as the CPTPP.

Yet a significant difference with the Asia-Pacific style FTAs is the scope and definition of “legitimate public policy objective” (Art. 8.81.3 and its footnotes). The new protocol reflects the EU’s approach under the UK-EU Trade and Cooperation Agreement (TCA) which provides more detail compared to the Asia-Pacific led digital trade agreements.

Another striking difference is that personal data protection is set as a fundamental right. The provisions regarding cross-border data transfers go together with the new provisions regarding protection of personal data (Art. 8.82). The clause is comprehensive and could be seen as the highest standard among existing digital trade agreements, including the EU-UK TCA. It underlines the importance of maintaining high standards of personal data protection to ensure trust in the digital economy and to develop digital trade. Such deep commitments between the EU and Japan were enabled by ongoing policy dialogues, including the EU-Japan Digital Partnership Council.

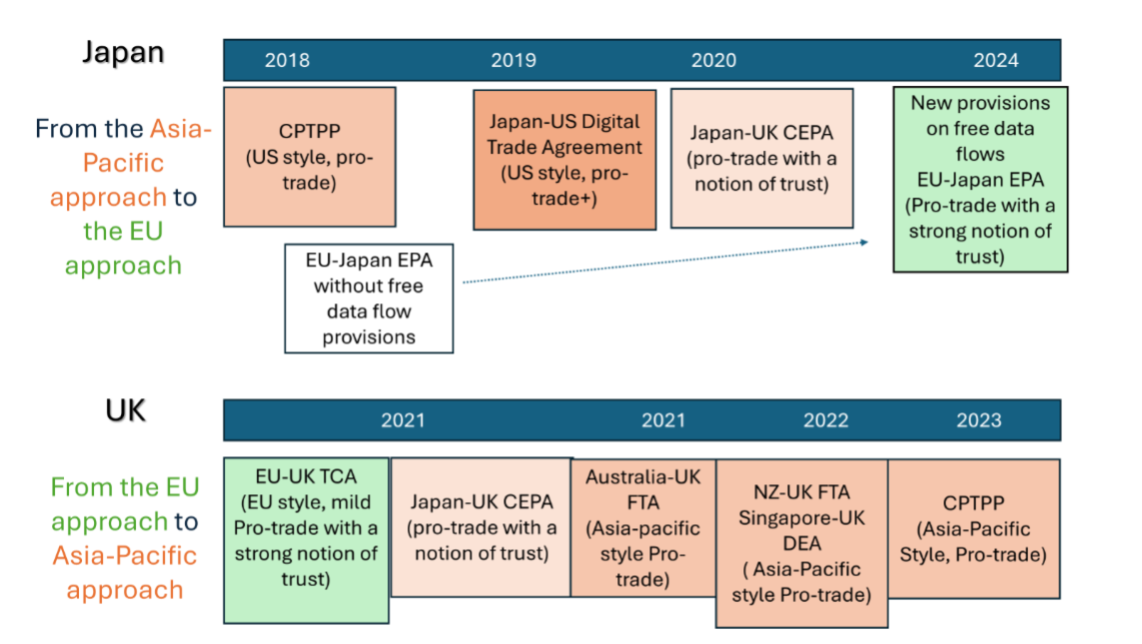

An interesting aspect here is Japan’s policy journey on digital trade agreements, which reflects a shift from the US or Asia-Pacific style pro-trade approach to the EU-style human-centric approach. The starting point of Japan’s policy journey was the CPTPP e-commerce chapter (originally the TPP e-commerce chapter) which strongly reflected US tech-companies’ desire for a laissez-faire international digital environment. The agreement prioritises free data flows with a very narrow public policy space. Under the Japan-US Digital Trade Agreement (DTA), the Japanese government accepted the US approach, which leans even more towards business interests than the CPTPP.

Subsequently Japanese policy preference shifted more towards the EU’s human-centric approach. The Japan-UK Comprehensive Economic Partnership Agreement (CEPA) signed October 2020, which reflects both the CPTPP and the EU-UK TCA, could be seen as a first step in this direction.

Why the change? At the domestic level, data privacy regimes have been legally and institutionally strengthened over the last decade. At the international level, the Japanese government has been advocating the new norm of “Data Free Flow with Trust” from 2019 through G7, G20, OECD and beyond.[1] The Japanese government considers that the new EU-Japan protocol, incorporating the principle of “DFFT”, will contribute to a more balanced approach to digital trade and could become a model of a 21st century digital trade agreement.

In contrast, the UK’s policy journey has unfolded in the opposite direction (Figure 1). Other than the EU-UK TCA, the UK has tended to depart from the EU style digital governance approach. With the tilt to the Indo-Pacific, the UK has aligned itself more to the Asia-Pacific style market-driven approach to digital trade governance. The digital trade rules under the Australia-UK FTA, UK-New Zealand FTA, and Singapore-UK DEA are modelled on the CPTPP.

Indeed, the Conservative UK government’s efforts to reform of the UK data protection regime (Data Protection and Digital Information Bill), reflects a drift away from EU-style data governance. It has also enabled the UK to strike these digital trade deals. The reforms prioritised data-driven innovation with an ambition of making the UK an international data hub, but legal experts raised concerns over their ethical, social and legal implications.

The Labour Party manifesto was silent about digital trade governance, and the approach of the new government to digital trade is an important question as it will, in part, shape tomorrow’s world.

At the multilateral level, we have entered a new phase of negotiations. It seems that cross-border data flows provisions are being dropped from the on-going WTO Joint Statement Initiative (JSI) negotiations on e-commerce. This is because of the lack of support, if not opposition, from the US as it wants stronger tech regulation. Although there was not a consensus over the balance of free data flows and public policy objectives even before the US’s objections, the US’s position has proved a key obstacle to multilateral rules on data flows. Under such circumstances, promoting a new digital trade model like the EU-Japan new agreement and the UK-EU TCA could help mitigate US’s concerns over limited public policy space.

The quality of the UK’s data governance is ranked as world-leading according to the Global Data Governance Mapping Project. This means that the UK is well positioned to show the best practice to its trade partners while enhancing the trust side of digitisation and promoting digital trade at the bilateral, plurilateral and multilateral levels.

With the new UK government, there is an opportunity to revisit its role at the international level. Given that the Labour government values individual / human rights while promoting innovation, the UK could play an active role in forging a broader consensus on the balance between free data flows and public policy space. As part of it, it seems natural for the UK to collaborate with Japan and the EU to promote the balanced approach achieved under the EU-UK TCA and the EU-Japan EPA. This could help regain support from the US administration for the WTO negotiations and other international forums.

[1] As for “DFFT” and its relation with trade policy, see “Can trade policy enable “Data Free Flow with Trust?“

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Jessie Madrigal-Fletcher July 23rd, 2024

Posted In: UK - Non EU, UK- EU

30 May 2024 – I

30 May 2024 – I

ngo Borchert is Deputy Director of the UKTPO, a Member of the Leadership Group of the Centre for Inclusive Trade Policy (CITP) and a Reader in Economics at the University of Sussex. Michael Gasiorek is Co-Director of the UKTPO, Co-Director of the CITP and Professor of Economics at the University of Sussex. Emily Lydgate is Co-Director of the UKTPO and Professor of Environmental Law at the University of Sussex. L. Alan Winters is Co-Director of the CITP and former Director of the UKTPO.

ngo Borchert is Deputy Director of the UKTPO, a Member of the Leadership Group of the Centre for Inclusive Trade Policy (CITP) and a Reader in Economics at the University of Sussex. Michael Gasiorek is Co-Director of the UKTPO, Co-Director of the CITP and Professor of Economics at the University of Sussex. Emily Lydgate is Co-Director of the UKTPO and Professor of Environmental Law at the University of Sussex. L. Alan Winters is Co-Director of the CITP and former Director of the UKTPO.

A general election is underway, and the parties are making various promises and commitments to attract voters, and both the main parties – the Conservatives and Labour – are keen to persuade the country that they have a credible plan. Now it might just be that the authors of this piece are trade nerds, but one key aspect of economic policy has not yet been clearly articulated, or even mentioned – and that is international trade policy.

In our view, this is a mistake. As a hugely successful open economy, international trade constitutes a significant share of economic activity, supports over 6 million jobs in the UK, spurs innovation, and enhances consumption choices. In short, trade and investment flows are an important element in leading to higher economic growth and welfare. In addition, trade and investment relations intertwine considerably with increasingly fraught geopolitics. Against this backdrop, the UK cannot afford to give trade policy short shrift.

Admittedly, though, trade policy is complex. It is also, more than ever, linked to other dimensions of public policy – and that does make it harder to have simple soundbites. That is no doubt part of the explanation why trade hasn’t been mentioned. The other part is that discussions of trade policy are closely intertwined with the ‘B’ (Brexit) word, and those discussions have become somewhat toxic.

Nevertheless, we argue that sound trade policy is a high priority for the UK. Listed below are some practical, feasible, and specific policy proposals that would help to ensure a better and more coherent UK trade policy, and thus lead to more equity in trade outcomes as well as higher rates of economic growth for the UK.

Process and consultation

1. Publish a Trade Strategy, which should elucidate principles as well as concrete policy objectives and intentions. Recognise the importance of both goods and services trade policy for the UK economy, nationally and across the regions.

2. Reduce executive power over trade policy, through establishing an independent Board of Trade, strengthening Parliamentary oversight over Free Trade Agreements (FTAs) and improving consultative processes with devolved nations and with stakeholders in trade.

3. Ensure and commit to transparency in UK trade data, good access to data for researchers and be transparent about the analyses undertaken by government.

Policy Areas:

4. Plurilateral / Multilateral / World Trade Organization (WTO):

a. Ensure that UK trade policy remains consistent across its various partner countries and across the different free trade agreements notably with regard to regulatory approaches.

b. Ensure that trade policy supports the rules of the multilateral trading system. Work on policy areas, such as supply chain security, bilaterally and multilaterally in ways which are at a minimum consistent with this, if not designed to strengthen multilateral cooperation.

c. In the absence of an effective WTO dispute settlement mechanism, join the Multi-party Interim Appeal Arbitration Arrangement (MPIA).

5. Bilateral trade relations:

a. Do not expect too much from further, notionally comprehensive, free trade agreements with more countries. Focus more on improving the workings and utilisation of existing agreements.

b. Work to reduce costs of trade with the EU in both goods and services, e.g. by mutual recognition agreements on standards, qualifications and certification and negotiating an EU-wide youth mobility scheme. As a first step seek a veterinary agreement.

c. Seek to cooperate with the EU on environmental regulation that impacts upon trade, most immediately by linking ETS schemes with the EU and introducing a compatible CBAM.

d. Review rules of origin with the EU and seek improvements where there may be benefits to both parties (eg. Electric vehicles and car batteries).

6. Domestic:

a. Provide better resourcing and introduce more robust border checks to uphold the UK’s high food standards and prevent the introduction of pest and animal diseases.

b. Work closely with industry to make sure that the implementation of new border arrangements, including the Border Target Operating Model and the Windsor Framework/UK internal market, are understood by businesses and don’t create perverse incentives to UK internal trade, imports or exports. SMEs are likely to face particular challenges.

c. Have a clear digital strategy which deals both with the digitisation of trade transactions and processes, and the rise in digital trade. This strategy should set out the balance of objectives with regard to consumer protection, cyber security, and competitiveness.

This is by no means intended as a comprehensive list, but focusses on some key principles, and specific priorities which are feasible, would make a difference, and could be immediately focussed on. When the manifestos are published it will give an opportunity to assess the parties’ approaches to trade policy and to see whether proposals go beyond broad statements of intent by providing practical details and commitments in line with any of the above.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or the UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Jessie Madrigal-Fletcher May 30th, 2024

Posted In: UK - Non EU, UK- EU

Tags: Brexit, General Election 2024, trade policy, UK Election

Share this article: ![]()

![]()

![]()

![]()

![]()

![]() 13 December 2023

13 December 2023

James Harrison is Professor in the School of Law at the University of Warwick. Emily Lydgate is Professor in Environmental Law at the University of Sussex and Deputy Director of the UK Trade Policy Observatory (UKTPO). Ioannis Papadakis is a researcher at the Centre for Inclusive Trade Policy (CITP) and a Research Fellow in Economics. Sunayana Sasmal currently serves as a Research Fellow in International Trade Law at the UKTPO. Mattia di Ubaldo is Fellow of the UKTPO and Research Fellow in Economics of European Trade Policies. L. Alan Winters is Founding Director of the UKTPO, Co-Director of the CITP and Professor of Economics at the University of Sussex.

In answering this important question, different disciplinary approaches have emerged as have a range of different and sometimes contradictory findings. At the moment, scholars from the different disciplines are not talking to each other about the implications of this. The authors of this blog suggest it is vitally important that they begin to do so.

Trade agreements around the world increasingly include environmental and labour provisions. Their presence attests to policymakers’ recognition that trade agreements cannot simply focus on economic issues. They should also address environmental and social concerns. But the existence of these provisions on paper is not itself a cause for celebration. Such provisions are only meaningful if they have positive outcomes in reality – if they, for instance, lead to decreased carbon emissions or enhanced conditions for workers.

Different methodological approaches to researching this issue have come to different conclusions about their real-world impact. First, quantitative studies, largely undertaken by economists, have tended to identify significant and generalised positive impacts for at least some provisions.

On the environmental side, one early influential study found that EU FTAs with environmental provisions improve environmental conditions in countries with strong civil societies. It also concluded that US FTAs are effective during the negotiation period in improving the environmental policy environment of partner countries. Another, covering 680 PTAs with environmental provisions, found that environmental provisions can help reduce dirty exports and increase green exports from developing countries.

In relation to labour provisions, one study found that the likelihood of a state fully protecting workers’ rights rises by 10% once it has signed an FTA with the EU which contains labour provisions. Another study found that labour provisions had a positive impact on (particularly female) labour force participation rates (although not on other labour rights).

On the other hand, more recent work, carried out with more advanced statistical techniques and more granular data on both the content of FTAs and the environmental outcomes, tends to find only mixed evidence: some specific provisions on greenhouse gases appear to be effective, but results are not consistent across models. No significant effects are found for labour provisions. Some recent work has also focused on specific outcomes produced by environmental provisions. Thus, one study, focused on deforestation, found that environmental provisions are effective in limiting deforestation following the entry into force of FTAs, but only because FTAs without such provisions increase deforestation and the provisions offset this.

There is also some indirect evidence of the effects of FTAs. One study suggests a positive relationship between domestic environmental legislation (not environmental outcomes) and preferential trade agreements with environmental provisions, while another finds that FDI is deterred if FTA labour and environmental provisions have a higher degree of legalization. However, others suggest that such provisions might increase the costs of trade and production.

To sum up this first side of the literature, quantitative studies tend to suggest that some generalisable, although often limited, effects can be ascribed to labour and environmental provisions in FTAs. Across a wide range of different agreements, these studies suggest that some changes will happen as a result of the presence of some types of provisions – for instance that deforestation will be limited or domestic environmental legislation will be signed.

Legal scholars are often puzzled by these results. Environmental and labour provisions take multiple forms in different FTAs and are often not the kind of binding and enforceable provisions that are expected to produce significant results. In high-level summary, trade and sustainable development (TSD) chapters (as found in EU FTAs) and equivalent provisions in other FTAs often consist of ‘best endeavours’ clauses that commit parties to work towards high standards; cooperation on thematic issues, including through upholding agreements such as conventions of the International Labour Organization or the Paris Agreement; and obligations not to reduce levels of protection, often described as non-regression clauses.

Much debate has focused on whether these non-regression clauses should be tied to sanctions, as the US has done, and more recently the UK, Australia and New Zealand. In contrast, EU FTA commitments emphasize implementation through stakeholder dialogue of bespoke committees, such as a Civil Society Forum and Domestic Advisory Group. The EU has unveiled a plan for a limited increase in the use of sanctions in TSD chapter enforcement, and the USMCA has introduced new and innovative forms of labour rights enforcement.

Enforcement mechanisms remain an important focus for legal scholarship, as does the influence of FTA negotiations in changing domestic environmental and labour laws. However, focusing solely on treaty texts and the strength of the bodies that potentially enforce them, doesn’t provide a full account of the impacts of particular provisions.

Qualitative studies have been used by political scientists, geographers, business and socio-legal scholars to attempt to understand how obligations contained in treaty texts have translated into changes in labour and environmental outcomes. Such studies have generally involved case study methodologies and techniques such as in-depth interviews, focus groups and participant observation that allow deep exploration of the causal effects of certain sustainability provisions.

Most of the detailed studies have focused on EU trade and sustainable development (TSD) chapters and the labour standards provisions therein – although as environmental provisions are implemented and enforced in the same way, there are some learnings from these studies on the environmental side. Case studies on impacts in the EU’s FTAs with the CARIFORUM countries, Colombia, Korea, Moldova and Peru have found little or no evidence that the existence of TSD chapters led to improvements in labour standards governance, nor that there were significant prospects for longer-term change. Less robust studies of labour standards provisions in individual US agreements have led to similar conclusions. Positive impacts have been found to occur only in very limited scenarios when accompanied by specific actions by key actors (government officials, civil society actors, trade unions etc.), in relation to specific trade agreements where those issues became politically contentious, such as prior to the ratification of the EU-Vietnam FTA.

Overall, the findings of the studies presented here are very different. But their methodological strengths and weaknesses can also be contrasted. Quantitative studies are able to consider labour and environmental provisions across a wide range of agreements, thereby providing information about general tendencies. But these studies, particularly the earlier ones, are less compelling on the issue of causality. While sustainability provisions are posited as a likely cause of improvements in environmental and labour protection, there are generally weak attempts to substantiate causal links. The few studies that do make serious efforts to identify causal (and unbiased) links, tend to come up with many fewer positive effects. Most importantly, however, they all lack a convincing narrative about the mechanisms leading from FTA provisions to impacts on the ground.

Qualitative studies take causality seriously and can give detailed answers on the direct causal questions of how and why sustainability provisions have or do not have effects. On the other hand, they are weaker when it comes to generalisability; reliance on individual case studies leaves qualitative studies open to accusations that they have missed the ‘bigger picture’.

Scholars who have adopted these different approaches should come together to try to understand the rationale for these different findings and to promote better understanding of their respective research methods. Drafting this blog challenged some of our assumptions about how different disciplines tackle research questions, and facilitated our understanding of the strengths and weaknesses of our research approaches.

But this is not only an academic question. Understanding these methodological strengths and weaknesses has implications for policy making, as correct and full facts are essential to make good policy. For instance, there are policies with unintended consequences that can be identified by talking to people. When these are not considered, empirical analysis may lead to misleading policy prescriptions, even if the effects it estimates are precise, causal and generalisable.

Policymakers need to understand the effects of labour and environmental provisions if they are to take the right kinds of actions to promote better social and environmental outcomes through trade agreements. The authors of this blog all agree that there is a big difference between (1) telling policymakers they can achieve meaningful change through inserting environmental or labour provisions into trade agreements and (2) that to be effective, they must think very carefully about both the design of those provisions and how they will be taken up and utilised by key actors thereafter.

A broad account of how the disciplines can work together might go something like this: Economic studies identify FTAs where the correlation between environmental or labour provisions and positive outcomes appears to be high. Legal scholars bring a detailed understanding of the typology of FTA environmental and social provisions within these FTAs, using this to further refine economists’ findings about causal mechanisms. Political scientists, geographers, business, and socio-legal scholars interrogate how issues such as relationships, power asymmetries, access to information and access to resources shape the effectiveness of the environmental and social provisions in practice.

Disclaimer:

The opinions expressed in this blog are those of the authors alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Jessie Madrigal-Fletcher December 13th, 2023

Posted In: UK - Non EU, UK- EU

Tags: Environment, environmental law, EU, FTAs, labour standards, Trade agreements, trade policy

31 March 2023

31 March 2023

Minako Morita-Jaeger is Policy Research Fellow at the UK Trade Policy Observatory and Senior Research Fellow in International Trade in the Department of Economics, University of Sussex

On 31st March, the UK announced an agreement in principle to become a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Politically, this is a positive step, especially as the Prime Minister can sell accession as a tangible achievement of the UK’s independent trade policy. But what is the real value of joining the CPTPP, and what are the key issues to examine? (more…)

Cosmo Rana-Iozzi March 31st, 2023

Posted In: UK - Non EU

Tags: Comprehensive and Progressive Agreement for Trans-Pacific Partnership, CPTPP, Free Trade Agreement, Indo-Pacific, Pacific, trade, Trade agreements, trade negotiations, trade policy, UK economy, UK-Japan

Share this article: ![]()

![]()

![]()

![]()

![]()

![]()

12 September 2022

12 September 2022

Michael Gasiorek is Director of the UK Trade Policy Observatory and Co-Director of the Centre for Inclusive Trade Policy. He is Professor of Economics at the University of Sussex Business School.

Once again, the UK has a new Prime Minister, a new cabinet, and thus a new Secretary of State for International Trade. This is the 4th Secretary of State for trade in five years! (more…)

Cosmo Rana-Iozzi September 12th, 2022

Posted In: UK - Non EU, UK- EU, Uncategorised

Tags: agriculture, Australia, Brexit, China, Climate policy, Conservatives, CPTPP, digital trade, Free Trade Agreement, new zealand, Services, supply chains, trade, Trade agreements, Trade and Cooperation Agreement, trade negotiations, trade policy, World Trade Organization

Share this article: ![]()

![]()

![]()

![]()

![]()

![]()

22 August 2022

22 August 2022

Peter Holmes is a Fellow of the UK Trade Policy Observatory and Emeritus Reader in Economics at the University of Sussex Business School. Guillermo Larbalestier is Research Assistant in International Trade at the University of Sussex and Fellow of the UKTPO.

After time in the shade, Freeports are back in the news. The policy has been embraced and a subject of discourse by both PM candidates, Rishi Sunak and Liz Truss, as part of their “benefits from Brexit” claims and “levelling up” strategies. There has also recently been concern by some commentators that Freeports risk becoming ‘Charter Cities’. (more…)

Cosmo Rana-Iozzi August 22nd, 2022

Posted In: UK - Non EU, UK- EU, Uncategorised

Tags: Brexit, Brexit dividend, Conservatives, free ports, free trade, Free Trade Agreement, free zones, Tory leadership

Share this article: ![]()

![]()

![]()

![]()

![]()

![]()

8 August 2022

8 August 2022

Minako Morita-Jaeger is Policy Research Fellow at the UK Trade Policy Observatory and

Senior Research Fellow in International Trade in the Department of Economics, University of Sussex. Guillermo Larbalestier is Research Assistant in International Trade at the University of Sussex and Fellow of the UKTPO.

The UK-Japan Comprehensive Economic Partnership Agreement (CEPA) came into force in January 2021, as part of the UK’s post-Brexit trading arrangements. CEPA was designed to largely replicate the EU-Japan Economic Partnership Agreement (EPA), to which the UK had been a party. On the face of it, there was little additional economic value to the UK, since CEPA provisions follow EPA provisions so closely, except for a chapter on digital trade. (more…)

Cosmo Rana-Iozzi August 8th, 2022

Posted In: UK - Non EU, Uncategorised

Share this article: ![]()

![]()

![]()

![]()

![]()

![]()

18 July 2022

18 July 2022

Michael Gasiorek is Director of the UK Trade Policy Observatory and Co-Director of the Centre for Inclusive Trade Policy. He is Professor of Economics at the University of Sussex Business School.

Boris Johnson was elected on the slogan and promise of ‘Get Brexit Done’. It is perhaps somewhat ironic, then, to see disagreement between the contenders to succeed him as to whether Brexit has actually yet been done. (more…)

Cosmo Rana-Iozzi July 18th, 2022

Posted In: UK - Non EU, UK- EU

Tags: Brexit, Brexit dividend, Brexit means Brexit, Brexit uncertainty, Conservatives, Tory leadership, Trade agreements, trade policy