23 April 2024

23 April 2024

Adriana Brenis is a Research Fellow of the UK Trade Policy Observatory (UKTPO) at the University of Sussex Business School. She holds an MSc in Business, Finance and Economics and a PhD in Economics from the University of Sheffield. Adriana’s research focuses on international trade, economic policy analysis and innovation.

The UK government recently announced its plan to implement common user charges for imports coming into the country. This has generated some controversy and, just this week, rumours that the government may again suspend the introduction of elements of the new Border Target Operating Model (BTOM).

The common user charges, set at a flat rate of £10 or £29 per commodity line, are capped at 5 charges per consignment, resulting in a maximum fee of £145. These charges will be applied to low-risk products of animal products (POAO), medium and high-risk animal products, along with plants and plant products. Initially, they will only be collected at border controls in Dover and Eurotunnel starting April 30th. This is part of the new BTOM system, aimed at improving border procedures. The goal is to cover the expenses of running these border facilities while protecting the UK’s food supply, farmers and the environment from diseases that could come in through these routes.

This blog explores the significance of these ports in facilitating the importation of goods into the UK and examines the extent to which the announced charges may affect incoming shipments.

Our calculations suggest that the animal and plant products that could face common charges represent about £38 billion of imports into the UK, making up 6% of all UK imports. Among these, 5.8% represent animal products and 0.2% plant products. Table 1 shows that 78% of these ‘at risk’ imports come from the EU, while 22% are from other parts of the world.

| Products at risk | EU | Non – EU | Total |

| Animal | 28.68 | 8.18 | 36.86 |

| Plants | 1.22 | 0.24 | 1.46 |

| Total | 29.90 | 8.41 | 38.32 |

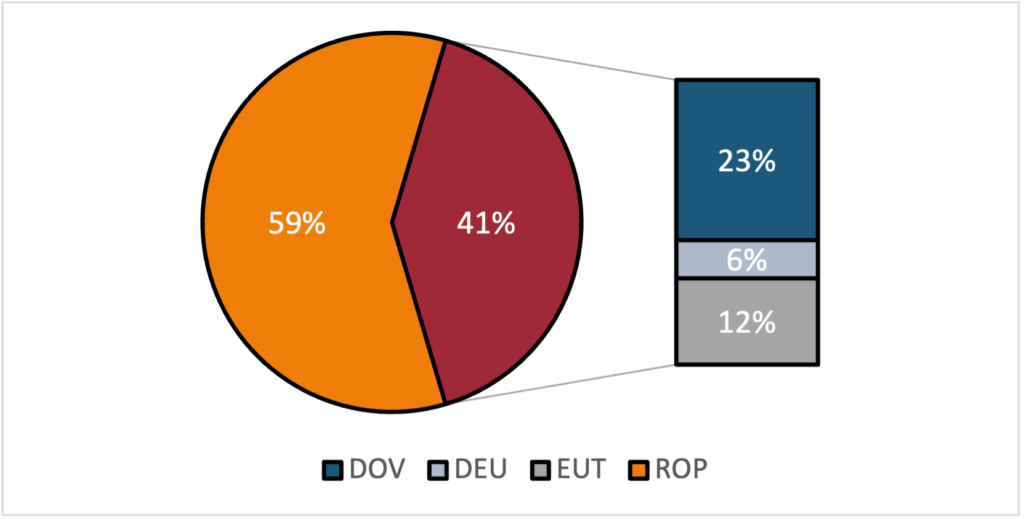

Given the substantial proportion of animal imports from the EU, we examine what share passes through the controlled borders – where the common user charges will be implemented starting April 30th. As illustrated in Figure 1, of the eligible animal products subject to charges (£28.7 billion), 41% (£11.7 billion) are imported through the controlled borders of Dover (DOV), Eurotunnel (EUT), and Dover/Eurotunnel (DEU), while the remaining 59% come through other ports in the UK (ROP). Among these, Dover stands out as the primary port for imports at 23%, followed by 12% via Eurotunnel, and 6% through Dover/Eurotunnel.

Source: HMRC and Animal & Plant Health Agency (2023)

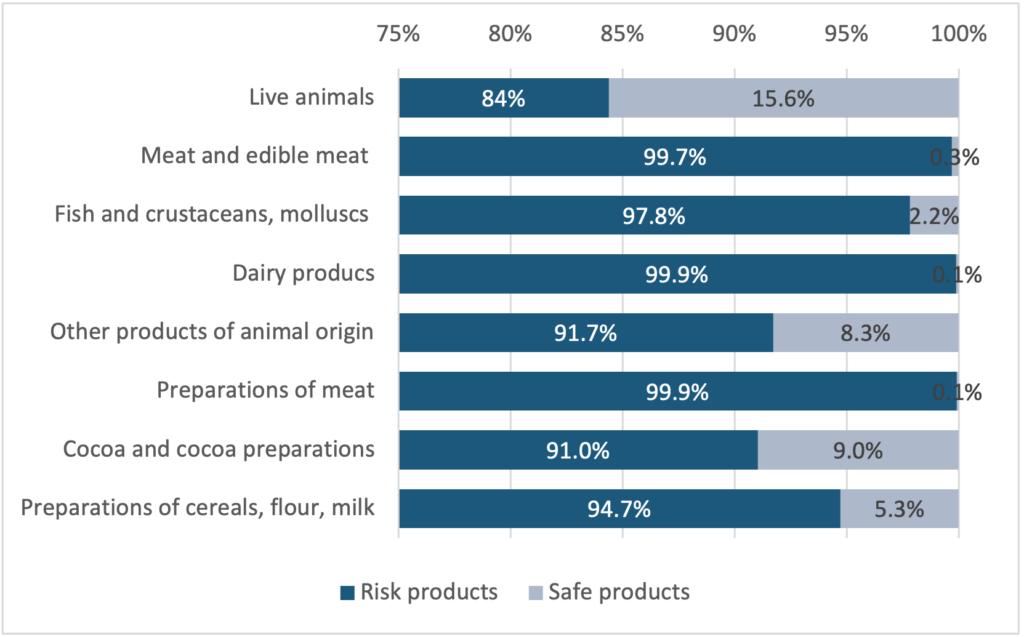

Among the different types of animal products classified under the Harmonized System (HS) at the 2-digit level, 31 out of the total number of 97 HS chapters have a percentage of animal products that could be subject to charges. Figure 2 highlights the HS classification at a 2-digit level, with the highest percentage of imported animal products at risk. Particularly, almost all imported products in HS 02 “Meat and edible meat”, HS 04 “Dairy products”, and HS 16 “Preparations of meat” are at risk. Other sections with more than half of their imported products at risk include HS 21 “miscellaneous edible preparations” (73%), and HS 23 “Residues and waste from the food industry” (75%). In addition, 91% of imported products in HS 18 “Cocoa and cocoa preparations” and 95% in HS 19 “Preparations of cereals, flour, starch or milk” could face charges, depending on whether they contain products of animal origin (POAO).

Source: HMRC and Animal & Plant Health Agency (2023)

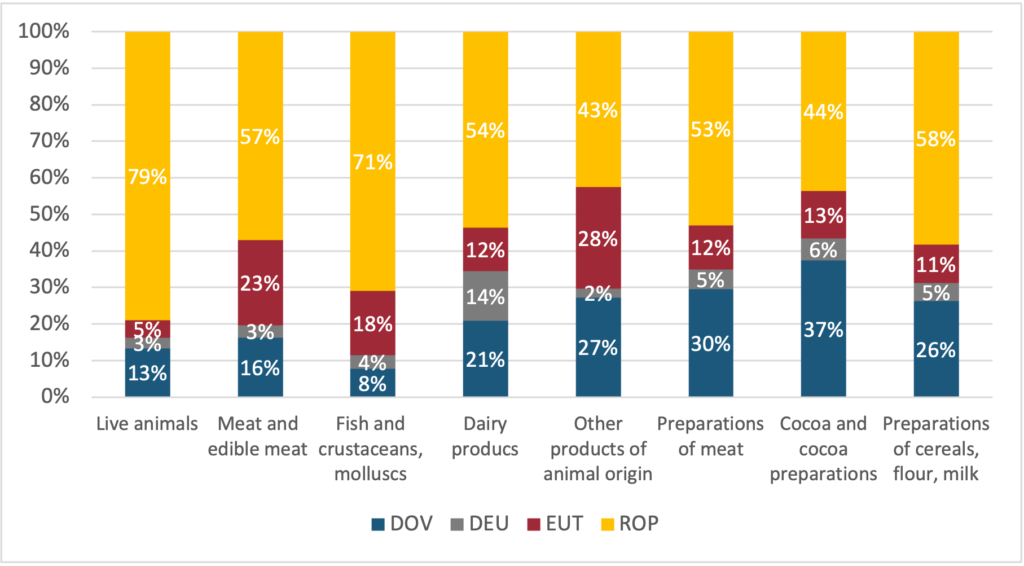

Focusing on the eight sections where most imports face potential fees, Figure 3 illustrates the share of the imports coming through the ports where charges apply. Live animals and fish, crustaceans and molluscs mainly come through other ports (79% and 71% respectively). In contrast, other products of animal origin primarily come through fee-charging ports, with Eurotunnel (EUT) at 28%, and Dover (DOV) at 27%. Similarly, cocoa and cocoa preparations products mostly enter through ports with charges, with 37% through Dover. Moreover, a large proportion of meat and edible meat (43%), dairy products (46%), preparations of meat (47%), and preparation of cereals, flour, and milk (42%) are brought in through these controlled borders with fees.

Source: HMRC and Animal & Plant Health Agency (2023)

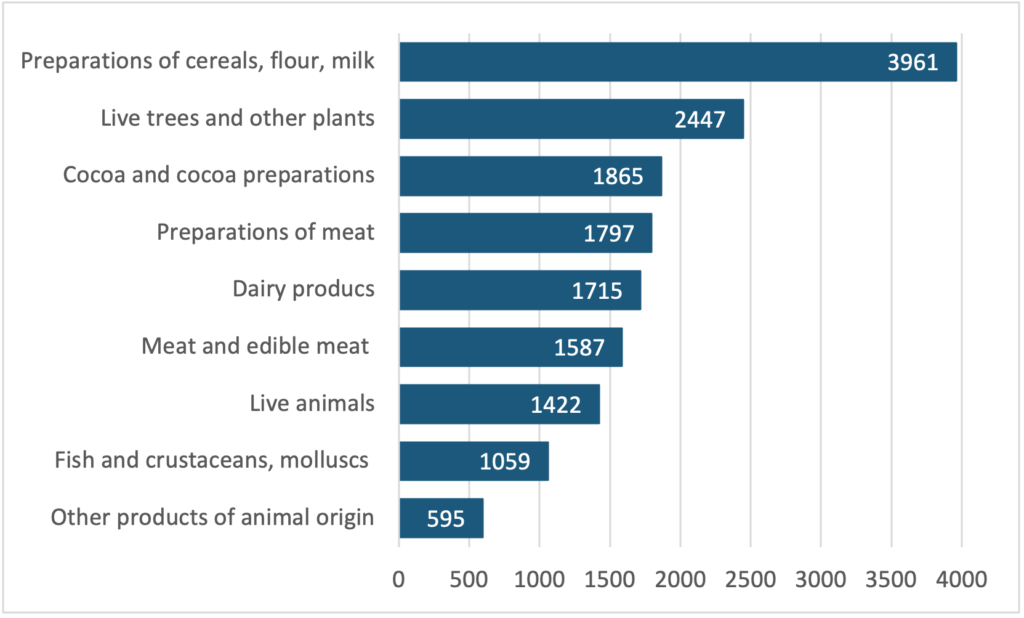

In 2023, out of the total Great Britain firms importing products globally (248,445 firms), those importing goods at risk from both EU and non-EU countries accounted for 16%, totalling 40,619 firms. Figure 4 provides the number of firms primarily importing within these eight categories, along with plant products from both EU and non-EU countries. The figure shows a significant number of firms fall within preparations of cereals, flour, and milk, followed by live trees and cocoa and cocoa preparations. As seen in Figure 3, these two categories – cocoa and cocoa preparations, as well as preparations of cereals – show a considerable percentage of imports arriving through the charged ports of Eurotunnel and Dover. Consequently, many of these firms could be affected by the upcoming common user charges starting on April 30th.

Table 2 provides a detailed view of the number of firms importing large amounts of animal and plant products within these categories. Considering the sections with high percentages of animal imports arriving through charged ports, like other products of animal origin and cocoa preparations, along with those with substantial imports (such as meat, dairy, and cereal preparations) are also, products like animal products n.e.s, including fresh cheese, pizzas, chocolate and other cocoa preparations, and sausages, which could be among the most affected.

Source: HMRC and Animal & Plant Health Agency (2023)

| 8-digi level | Name | Number of Firms |

| 01012100 | Pure-bred breeding horses | 859 |

| 02013000 | Fresh or chilled bovine meat, boneless | 390 |

| 03047190 | Frozen fillets of cod “Gadus morhua, Gadus ogac” | 101 |

| 04061050 | Fresh cheese “unripened or uncured cheese”, incl. whey cheese and curd | 258 |

| 05119985 | Animal products, n.e.s.; dead animals, unfit for human consumption | 351 |

| 06029050 | Live outdoor plants, incl. their roots | 761 |

| 16010099 | Sausages and similar products of meat | 609 |

| 18063100 | Chocolate and other preparations containing cocoa | 368 |

| 19059080 | Pizzas, quiches and other bakers’ wares | 1370 |

The introduction of common user charges for imports (especially for firms dealing with products subject to these fees) could have significant implications for both businesses and consumers. For firms, particularly those importing goods through charged ports, there may be a notable increase in operational costs due to the additional charges incurred. This could potentially impact their profitability and competitiveness. Additionally, firms may need to reevaluate their supply chain strategies, potentially exploring alternative ports or sourcing options to mitigate the impact of fees. Furthermore, the rise in costs could prompt changes in consumer behaviour, with some individuals opting for alternative imported products not subject to fees. Overall, the implementation of common user charges has the potential to reshape import dynamics, affecting both firms and consumers alike.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Thank you for this very useful analysis. It would be also good to know whether the “£ 334 million” cost to businesses branded by Government is correct or the ” £ 2 billion” quoted by Allianz Insurance is right. This will disproportionally affect animal source food with the inflationary pressure imposed on fresh and processed meat, and fish, so the 0.2% added inflation were a told to expect will be concentrated on a few food categories. The added cost will also disproportionally affect small importers with mixed loads. Finally, expect some short term disruptions to trade.