Briefing Paper 50 – December 2020

As a signatory of the EU-Japan Economic Partnership Agreement (JEEPA) that entered into force in February 2019, the UK will enjoy its benefits only until the end of the transition period on 31st December 2020. To avoid falling into trade on WTO terms at the end of the transition period, the UK and Japanese governments have negotiated the UK-Japan Comprehensive Economic Partnership Agreement (CEPA) based on JEEPA. They aimed to create an ambitious and high standard bespoke trade deal.[1]

After an unprecedentedly short negotiating period of about four months over the summer, the UK and Japan signed the Agreement on 23rd October 2020. After ratifications by the UK Parliament and the Diet of Japan, CEPA is expected to enter into force on 1st January 2021 without disruption.[i]

Evaluating CEPA is important as the UK Government has presented it as the first Free Trade Agreement (FTA) for the UK as an independent trading nation. CEPA thus sets a benchmark for the UK’s future FTAs and post-Brexit trade policy. This paper aims to identify substantive and institutional lessons from CEPA for the UK’s future trade agreements. To begin, this paper provides an overview of UK and Japan trade and investment relations and reviews the economic rationale behind the trade deal. We then analyse the major developments as well as shortcomings of CEPA in relation to JEEPA in order to examine its potential economic and social implications. Overall, the analysis shows that CEPA largely replicated JEEPA, hence de facto in most areas does not go much further than being a continuity agreement.[2] We shed light on market access in goods and services and the provisions regarding regulatory cooperation, with regard to digital trade / e-commerce and investment. Lastly, we summarise what can be learnt from CEPA for the UK’s future FTA negotiations.

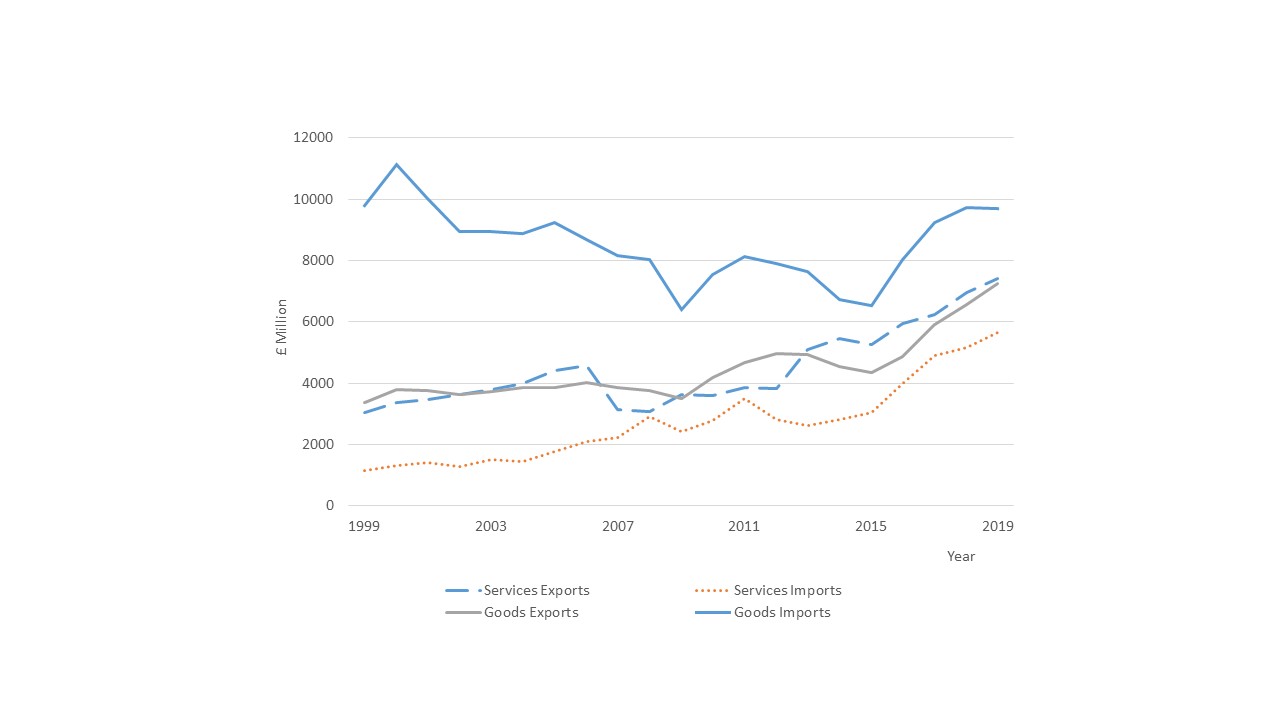

The UK and Japan have a strong trade and investment relationship. Japan is the world’s third-largest economy and the UK’s fourth-largest non-EU export market. Both UK exports in goods and services to Japan show an upward trend over the last 20 years (Figure 1). While UK services imports from Japan have been increasing over the last 20 years (with some fluctuation), goods imports had been declining until 2015, and since then have returned to the levels seen in the early 2000s. In 2019, UK goods exports to Japan accounted for 1.9% (£7,262 million) of its total goods exports and its services exports accounted for 1.6% (£7,987 million) of its total services exports. UK goods imports from Japan accounted for 1.9% (£9,703 million) of its total goods imports and its services imports accounted for 3.0% (£6,615) of its total services imports.[3] Supply chains constitute an important feature of UK-Japan trade given that 59% of UK goods imports from Japan and 44% of UK exports to Japan are intermediate goods.[4] In 2015, Japan’s share of the foreign valued embodied in gross UK exports was 2.7%, and the UK share in the foreign value added embodied in Japan’s exports was 2.1%.[5]

Source: The ONS

Investment is at the heart of the UK-Japan economic relationship. Japan remains the largest foreign investor abroad, accounting for $227 billion in 2019 ($143 billion in 2018). [6] The UK is the second-largest Foreign Direct Investment (FDI) destination for Japan accounting for $171.9 billion of FDI stock in 2019.[7] The UK has been a hub for Japanese business in Europe and a gateway to the EU market for Japanese companies since the 1980s. Japanese investment to Europe has been concentrated in the UK, accounting for almost 40% of its total FDI stock in Europe (2018).[8] Japanese companies play an important role in the UK economy, creating 132,168 jobs on average in the UK between 2011 and 2017 (Table 1). Investment in manufacturing and in wholesale and retail trade are the major source of employment (Table 1).

| NACE description | Persons employed –

Average 2011-17 |

Enterprise number –

Average 2011-17 |

|||

| Number | share | Number | share | ||

| Manufacturing | 51,396 | 38.9 | 193 | 20.2 | |

| Wholesale and retail trade; repair of motor v. | 34,130 | 25.8 | 342 | 36.0 | |

| Transportation and storage | 5,236 | 4.0 | 41 | 4.4 | |

| Information and communication | 15,532 | 11.8 | 78 | 8.0 | |

| Financial and insurance activities | 11,532 | 8.7 | 55 | 5.2 | |

| Professional, scientific and technical activities | 8,322 | 6.2 | 136 | 14.1 | |

| Total economy | 132,168 | 962 | |||

Source: Author’s calculation based on Eurostat FATS data (fats_g1a_08). Shares are computed as average shares over the period 2011-17 and do not necessarily correspond to the share of the average number of persons employed/firms reported in this table.

To examine market access in goods, we have calculated how much of the UK’s goods exports would face zero tariffs under the JEEPA and under CEPA. By way of comparison, we note that close to 89% of UK exports to Japan would face zero tariffs if there was no trade agreement with Japan, and trade took place on the basis of Japan’s MFN regime.

| UK-Japan CEPA | EU-Japan EPA | |||||

| Year | Zero Tariff | Non-Zero Tariff | non ad-valorem duty | Zero Tariff | Non-Zero Tariff | non ad-valorem duty |

| 2021 | 98.67 | 1.33 | 1.23 | 98.67 | 1.33 | 1.33 |

| 2022 | 98.69 | 1.31 | 1.16 | 98.68 | 1.32 | 1.26 |

| 2023 | 98.69 | 1.31 | 1.16 | 98.68 | 1.32 | 1.26 |

| 2024 | 98.94 | 1.06 | 1.02 | 98.93 | 1.07 | 1.13 |

| 2025 | 98.94 | 1.06 | 1.02 | 98.93 | 1.07 | 1.13 |

| 2026 | 99.01 | 0.99 | 1.02 | 99.00 | 1.00 | 1.13 |

| 2027 | 99.01 | 0.99 | 1.02 | 99.00 | 1.00 | 1.13 |

| 2028 | 99.01 | 0.99 | 1.02 | 99.01 | 0.99 | 1.13 |

| 2029 | 99.43 | 0.57 | 0.78 | 99.42 | 0.58 | 0.88 |

| 2039 | 99.66 | 0.34 | 0.75 | 99.66 | 0.34 | 0.85 |

Note: For Japanese duties years refer to 12-month periods starting on 1st April of the year named.

Table 2 shows the share of UK exports to Japan in 2019 that would face zero tariffs, non-zero tariffs and non-ad-valorem duties[9] under these two trading regimes. The FTA agreements call for tariff reductions over a number of years, so in each case, the pattern changes through time.

The table shows that under JEEPA close to 99.7% of UK exports to Japan would face zero tariffs by 2039.[10] The total share of UK exports facing non ad-valorem duties at the tariff line level decreases from 3.1% (under MFN) to 0.85% under JEEPA. Our calculation for the same exercise for CEPA reveals almost identical figures to JEEPA: 99.7% of UK (2019) exports to Japan would be under zero tariffs as of 2039 and 0.75% would face non ad-valorem duties.

We also calculated the number of products that face different tariff rates in JEEPA and CEPA. We find that under CEPA, there are only 10 tariff lines out of the 9,444 where the UK tariff is lower (and only marginally so in nine of them), and that rises to 11 products in the 5th year (2025). In 2019, the UK had no exports to Japan in any of these goods/services. After 12 years, there are no differences between CEPA and JEEPA tariffs.

Any Free Trade Agreement provides preferential tariff treatment for its signatories. However, to get preferential tariff treatment each FTA has its own rules of origin. The rules of origin determine the economic origin of each specific product. A single or a variety of criteria in combinations can be applied to determine whether a specific product is originating in the partner country. Typically, four criteria are usually applied: wholly obtained (WO) rule, value-added (VA) rule, change in tariff classification (CTC) rule, and specific production process (SP) rule.[11]

We compare the rules of origin in CEPA and JEEPA. Both agreements use the change in tariff classification, specific production processes, a maximum value of originating materials, and a minimum regional value content to determine whether a product is originating and in most cases, the same rules of origin are used in both agreements.[12]

On Specific Rules of Origin: In general, the product-specific rules of origin in CEPA mirrors JEEPA. However, a total of 380 Harmonised System (HS) six-digit products (among the more than 5000 HS2017 product lists) have different rules or slightly changed rules of origin in CEPA in comparison to JEEPA. Appendix Table 2 shows the main sectors and number of products. For 363 of these products, the rules of origin appear to be easier / less constraining under CEPA compared with JEEPA. For 17 products, because of the nature of the rules, it is harder to ascertain.[13] In terms of export value, however, the share of these 363 products in UK-Japan trade is small. For the UK the value of these exports in 2019 was $295 million, which represents only 3.6% of UK goods export to Japan (Appendix Table 2).

Rules on Accumulation: In determining whether the product from the exporting country qualifies for preferential treatment, the rules on cumulation matter—these determine the extent to which inputs sourced from a third (non-partner) country can be counted as originating in the exporting country (e.g. the UK).[14] Regarding cumulation, CEPA allows inputs originating in the EU to be considered as originating in the UK when used in the production of another product which is then exported to Japan. In other words, UK exports to Japan can include inputs from the EU and count as originating from the UK. This applies to most of the inputs from the EU, however, there is a list of 208 products that are excluded.[15] In terms of the export value of these excluded products, in 2019 the UK exported $188 million (amounting to 2.3% of UK exports to Japan), and $8 billion to the EU in the same year.

Miscellaneous differences: On the validity of a statement of origin, CEPA gives more time for a single shipment of one or more products than JEEPA—it allows the validity of a statement of origin to extend more than 12 months from the date on which it was made. The validity of the statement of origin for multiple shipments of identical products imported is identical between CEPA and JEEPA. On small consignments and waivers, CEPA leaves limits to the rules and standards of the importing country while in JEEPA it puts €500 in the case of small packages or €1200 for travellers’ personal luggage and ¥100K for Japan.

In summary, except for a small number of products for which CEPA provides less restrictive rules of origin requirements, the product specific rule of origins in JEEPA and CEPA are very similar. The CEPA agreement includes articles on the potential to include Japan’s inputs as counting as UK in origin in the UK’s exports to the EU (which could prove to be significant for the car industry)[16], but this would require the EU to agree to this in a future UK-EU agreement.[17]

In general, enhancing regulatory cooperation on SPS and TBT[18] is expected to reduce non-tariff barriers to trade and facilitate trade and investment. On the other hand, differences in the regulatory regimes of FTA signatory countries have to be carefully examined to ensure public policy objectives in the field of health, safety, and environment.

With regard to SPS provisions in CEPA, the Agreement made one significant change from JEEPA. Whereas SPS measures are within the scope of the JEEPA dispute settlement with limited exclusion for certain areas (e.g. risk assessment and equivalence and import procedure), SPS measures under CEPA are now entirely outside the scope of its dispute settlement. This implies that the WTO dispute settlement procedures will be applied if any disputes take place under CEPA. The rationale behind this decision is not clear.

As for TBT, some minor changes were made with regard to the functions of a national contact point on technical barriers to trade (TBT) in the text. With regard to mutual recognition agreement, The EU-Japan Agreement on Mutual Recognition Agreement (2018) was incorporated into CEPA as the Protocol on Mutual Recognition, instead of transferring into the UK-Japan Mutual Recognition Agreement as a standalone agreement.

Like JEEPA, the liberalisation commitments of CEPA cover cross-border trade in services; investment; and entry and temporary stay of natural persons. With regard to services commitment, as with JEEPA, the agreement takes a negative list approach – hence the list of services which cannot satisfy liberalisation obligations under CEPA (e.g. market access, national treatment, most-favoured-nation treatment, prohibition of nationality requirement for senior management and boards of directors, and prohibition of performance requirements) are listed as a reservation in an Annex to the agreement.[19]

Japan’s reservations for existing measures for cross-border services and investment liberalisation in CEPA is identical to the one for JEEPA. As for future measures, the number of reservations was reduced from 18 under JEEPA to 17 under CEPA. This means that relative to JEEPA, the UK did not achieve better access to the Japanese market in terms of liberalisation obligations.[20]

The number of UK reservations for existing measures was reduced from 17 in JEEPA to 9 in CEPA, and the number of UK reservations for future measures was reduced from 23 reservations in JEEPA to 16 in CEPA.[21] However, the UK’s reservations are somewhat difficult to interpret. This is because currently for five out of nine reservations, the EU’s directives and regulations are listed as relevant measures.[22] Also, the two reservations (Reservation 1 and 4) do not provide relevant measures.[23] This appears to be because the UK is still to transform the EU’s directives and regulations into domestic law. Hence the UK’s position on a range of services and investment-related measures still adhere to those EU directives/regulations. It is only once these have been transformed into UK domestic law, that the full nature of the reservations can be understood. This is also an important issue for the UK’s future FTA negotiations since domestic law and regulations should be the foundation of UK offers to FTA partners.

Another critical issue is the coverage of audio-visual services in the agreement. The EU exempts audio-visual services from its WTO commitments and Free Trade Agreements including JEEPA to protect European cultural diversity.[24] In CEPA, audio-visual services are still retained outside the scope of the Agreement. The only difference from JEEPA is that possible regulatory cooperation and inclusion of the sector into the Agreement is noted in the clauses.[25] It is generally understood that the UK had a relatively liberal position on the audio-visual sector in comparison with other EU members, such as France, when the UK was an EU member. Especially with regard to the UK’s future FTAs, the government needs to establish a clear position on an audio-visual services policy and its treatment under FTAs, as well as the rationale behind that position.[26]

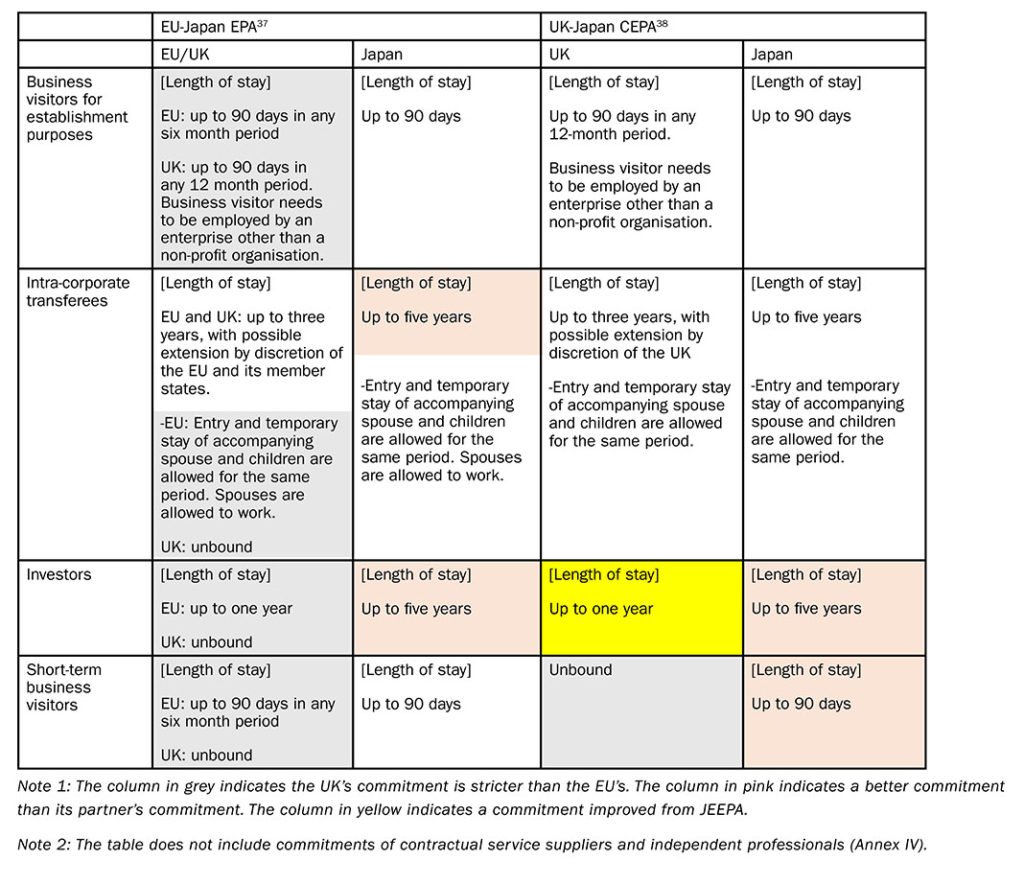

Lastly, we turn to the treatment of the temporary stay and movement of natural persons for business purposes. This area shows some improvements in comparison to JEEPA (Table 3).[27] For example, the definitions of ‘intercorporate transferees’ and ‘investors’ were improved with specific references to UK law and Japanese law.[28] In JEEPA, the UK’s commitments were stricter than the EU level commitments. In CEPA, the UK made some improvements in its schedule of ‘Business visitors for establishment purposes, intra-corporate transferees, investors and short-term business visitors’.[29] Furthermore, the UK matched Japan’s commitment of a visa procedure within 90 days.[30] These improvements could facilitate Japanese investment activities in the UK. However, it should be noticed that the UK’s commitments have not entirely improved to a reciprocal basis in CEPA and some of its commitments are still stricter than the EU’s commitments in JEEPA. For example, the length of stay for ‘Business visitors for establishment purposes’ is still stricter than the EU’s commitment under JEEPA. Also, the UK remained “unbound” (no-commitment) regarding ‘short-term business visitors’ while Japan allows up to 90 days stay.

In general, the regulations that are covered within the schedule of commitments[31] cannot represent all types of de-facto barriers. Yet, regulatory barriers, such as regulatory divergence; transparency of qualification requirements and procedures; measures which restrict competition; and domestic regulations that are more burdensome than necessary, do matter for business in practice.[33] Since liberalisation commitments in CEPA are almost identical to that of JEEPA, the value-added segment of rule-making (provisions for domestic regulation and regulatory cooperation) is key to assessing the UK-Japan CEPA’s impact in this regard.

Looking at the provisions for sectoral regulatory framework, CEPA basically replicates the regulatory framework of JEEPA (which includes sectoral regulatory cooperation in postal and courier services; telecommunications services; and financial services) except for in financial services.[34] The major developments made in financial services include: (i) UK financial service suppliers can offer ‘new financial services’ on the same basis as Japanese financial services suppliers;[35] (ii) a ban on requiring services providers to use or locate financial service computing facilities in the host country with some safeguards for governments;[36] and (iii) more detailed tasks of the joint UK-Japan Financial Regulatory Forum than those of the EU-Japan Financial Regulatory Forum in JEEPA. Since the financial sector is the major sector in UK-Japan services trade (about 55% of UK’s exports to Japan and 40% of imports from Japan),[37] the development is especially welcomed by the UK financial sector. These improvements are expected to facilitate financial services activities, especially cross-border services (i.e. internet) and cooperation between the financial regulatory authorities in the UK and Japan.

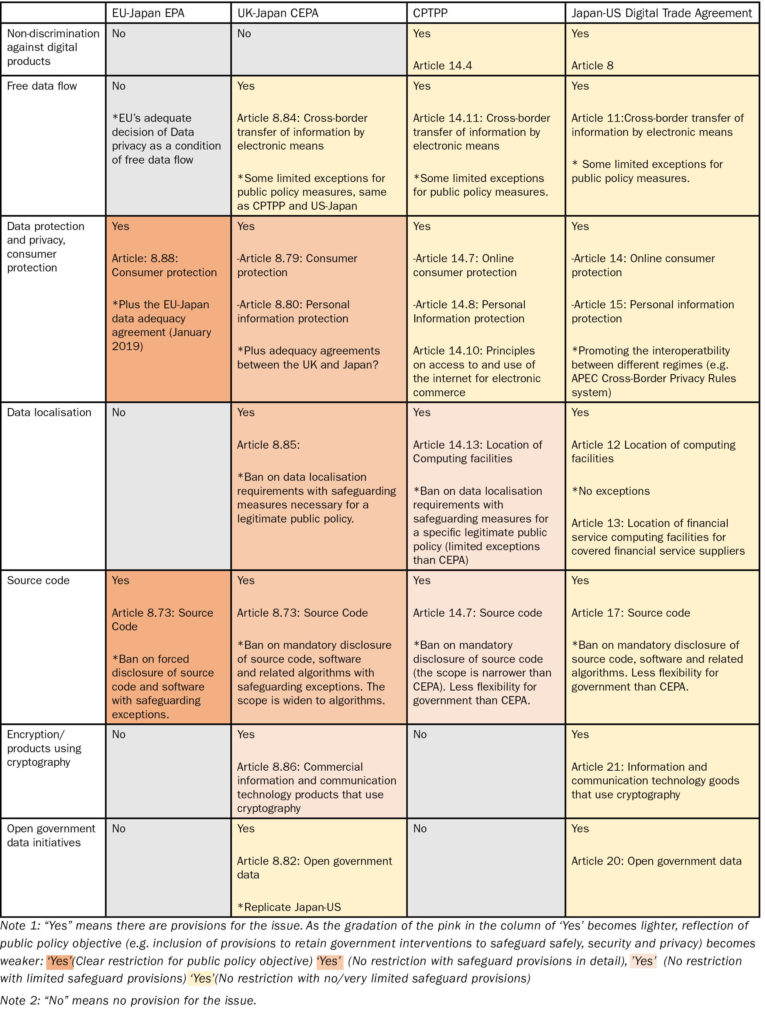

The e-commerce section (Chapter 8 Section E) is a highlight of CEPA. By reflecting new technologies (e.g. algorithm and artificial intelligence), the e-commerce provisions in CEPA go much further than the e-commerce provisions in JEEPA in some areas.

Table 4 compares the major e-commerce provisions in JEEPA, CEPA, CPTPP and the Japan-US Digital Trade Agreement. In comparison with JEEPA, CEPA introduced provisions on the cross-border free flow of data (Article 8.84); a ban on unjustified data localisation requirements (Article 8.85); net neutrality (Article 8.78), and protection of source code (Article 8.73). In comparison with the CPTPP, the e-commerce provisions in CEPA, such as provisions relating to protections for software, algorithms, and encryption technology go beyond the CPTPP e-commerce chapter as there is no provision for these in CPTPP. Furthermore, some provisions in the US-Japan Digital Trade Agreement, which provides similar high-standard e-commerce provisions in the USMCA, are incorporated into the UK-Japan CEPA (e.g. encryption/products using cryptography and open government data initiatives). From this perspective, CEPA can be seen as providing a strong foundation towards the UK’s future negotiations on digital trade agreements with its trade partners, including accession to the CPTPP and bilateral FTAs with countries that are proactively developing digital trade rules, such as Australia, New Zealand, and the US.[38]

The e-commerce provisions in CEPA clearly indicate the UK’s departure from the EU’s digital trade policy approach that values data privacy and security, towards the Asia-Pacific and the US-style market-oriented approach that values market dynamism and innovation.[39] The UK’s position reflects its post-Brexit ‘National Data Strategy’ (September 2020), which aims to promote innovation; flow of information across borders and enable regulatory cooperation with international partners.[40] UK and Japanese business widely welcomed the substantial developments of the CEPA e-commerce provisions.[41] Indeed, these provisions are expected to facilitate trade and support innovation and CEPA would provide incentives to promote collaboration between the UK and Japanese business.

However, the social implications of the UK’s policy shift are not yet known.[42] As can be seen from Table 4, government ability to safeguard data privacy, safety, and security, becomes weaker with fewer provisions that allow government intervention for such purposes, and inclusion of provisions that completely ban government intervention under CEPA in comparison with that of JEEPA. For example, UK civil society organisations express strong concerns about privacy and personal data protection in relation to free data flow in international trade agreements.[43] In addition, to a balance between free data flow and data privacy, some argue that the implication of a balance between accountability and intellectual property rights and online harms and freedom of expressions in CEPA requires scrutiny.[44]

E-commerce provisions in CEPA reveal that ensuring a good balance between economic objectives and public policy objectives is crucial to develop the UK’s digital trade policy after leaving the EU’s digital trade framework. For the UK’s future FTA negotiations, the UK government should analyse the implications of CEPA and conduct multi-stakeholder policy discussions to achieve inclusive digital trade.

An FTA can enhance investment incentives by tariff reduction/elimination; market liberalisation in services and investment; and regulatory cooperation in goods and services as these can reduce trade costs, increase corporate profits and provide companies with incentives to make new investments or enhance existing investments. In addition, investment provisions that cover investment-related rules and investment protection provide legal certainty to business.

Observing CEPA, there is a lack of a pro-active Post-Brexit FDI strategy both in terms of inward and outward FDI, including the role that FTAs might play in achieving investment-related policy objectives. CEPA could have been a chance for the UK to show a strong commitment to Japanese investors, which does not appear to have been taken.[45]

There are three issues to be raised in this regard. The first concerns tariffs and rules of origin. With regard to tariffs, as seen earlier, there is no significant advantage over the JEEPA status quo from the investment perspective. This is because tariff-liberalisation under CEPA is almost identical to that under JEEPA (see the previous section on market access in trade in goods). The provisions on rules of origin, such as extended cumulation for EU inputs in both UK and Japanese products, are unambiguously worse than was the case under JEEPA, although better than trading on WTO terms. Replicating the JEEPA arrangements would require trilateral diagonal cumulation arrangements which includes the EU. However, it is highly unlikely that the EU will agree to such diagonal cumulation arrangement with the UK (see the previous section on rules of origin). In any case, these arrangements cover only manufacturing sectors and cannot support investment in services sector.

The second issue concerns the UK’s commitments for entry and stay regarding the temporary movement of personnel for business. The UK could have done more in this area to support Japanese investment by improving its commitments up to the level of the EU’s commitments under JEEPA (i.e. business visitors for establishment purposes and short-term business visitors) or by ideally matching Japan’s commitments under CEPA (i.e. intra-corporate transferees, investors and short-term business visitors).

The third issue concerns investment protection provisions. JEEPA covers only the provisions on investment liberalisation (Chapter 8: Section B). Although CEPA was an opportunity to introduce a comprehensive investment chapter that encompasses investment protection and a dispute resolution mechanism, CEPA included only the provision for a review on the investment protection and Investor-State Dispute Settlement (ISDS) issues and a possible inclusion of these functions in the Agreement in the future.[46] Inclusion of a possible review is the only difference from JEEPA.

Although conventional bilateral investment treaties (BITs) generally reflect investors’ interest in ensuring a high degree of investment protection with minimal host state rights to regulate, many developed countries are now seeking to adjust the balance between safeguarding a state’s right to regulate for public policy objectives (e.g. environment) and investors’ rights in favour of the former. In addition, policy debates for reforming the ISDS mechanism are going on at the international level.[47] Currently, the UK has 89 BITs in force and 87 of them include an ISDS mechanism. Relating to its FTA negotiations, it is not clear whether the UK supports an ISDS mechanism or an investment court system as the EU is promoting. For future FTA negotiations, the UK has to establish its position on an investment resolution mechanism by reviewing its existing BITs (its own BITs as well as ones replaced by the EU’s investment protection agreement, such as EU-Singapore and EU-Viet Nam) as well as clarify how the UK wants to incorporate investment protection provisions into FTAs.

CEPA, as the UK’s first FTA as an independent trading nation, provides important lessons for the UK’s future FTAs. From our analysis above, we draw two lessons.

The first lesson is about substance. CEPA is seen as a replication of JEEPA except for some developments made in areas such as e-commerce, and moderate developments in some rules of origin and with regard to regulatory cooperation in financial services. The limitations of these developments arise not only from limited bilateral negotiating time between the UK and Japan, but also from the UK’s domestic limitations in formulating established policy positions in the areas where the UK could have used its independence from the EU to break new ground (e.g. movement of natural persons, investment, audio-visual services, and mutual recognition in goods). Before ambitious and bespoke FTAs with trade partners become possible in practice, the UK’s policy and regulatory alignment with the EU will need to be clarified.

The second lesson is about institutions and how domestic-policy making is conducted. In the e-commerce section, the UK’s steps towards the Asia-Pacific style of digital trade governance were taken without any material public scrutiny or discussion of their social implications. It is a matter of concern that such a big policy step was taken without non-business stakeholders’ involvement and with highly limited opportunities for scrutinising the negotiating results.[48]

The substantive and institutional lessons above imply that an FTA is not simply the way to expand the UK’s market access. Deep FTAs are comprehensive and mostly about non-tariff issues that affect multiple stakeholders. In order to make meaningful, deep FTAs or join CPTPP in the future, substantive and inclusive policy discussions within the UK are critical precursors to negotiating deals with trade partners. Failure to conduct them could undermine the legitimacy of the resulting FTAs and even of the whole process of signing FTAs.

This research was supported by grant ES/T002050/1, ‘Post-Brexit trade and investment’ from the Economic and Social Research Council.

[1] The Japan-UK Foreign Ministers’ Strategic Dialogue 2020, Joint press statement (8th February 2020). https://www.mofa.go.jp/files/000566013.pdf

[2] See Appendix Table 1.

[3] ONS (2020). UK total trade: all countries, non-seasonally adjusted.

[4] Value of UK-Japan trade in goods according to end-use, 2016-2018 average, DIT (2020) UK-Japan Free Trade Agreement: The UK’s Strategic Approach, p35.

[5] The share of Japanese value added in the UK’s gross exports in 2015 was 0.4% ($2.8 Billion), while in the same year the share of total foreign value-added content of gross UK exports in 2015 was 15.07%. Hence Japan’s share of the foreign value added was 0.4/15.07. The share of UK value added in Japan’s exports was 0.28% ($2.06 billion) in 2015, while the share of total foreign value-added in Japan’s exports is 13.2%. OECD (2018). “Trade in Value Added database”. https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

[6] Figure 1.9 in UNCTAD “World Investment Report 2020”. The UK is ranked at 8th ($31 billion). World Investment Report 2020 (unctad.org)

[7] The UK’ FDI stock in Japan accounts for $22.9 billion (2019). JETRO Investment data. https://www.jetro.go.jp/world/japan/stats/fdi.html

[8] Source: JETRO investment data.

[9] An advalorem tariff is expressed as a percentage of the value of the imported product.

[10] Our calculations shows that close to 89% of UK exports to Japan would face zero tariffs under Japan’s MFN regime while the remaining 11% faced non-zero tariffs.

[11] For more detailed discussion of each rules, see Gasiorek and Garrett (2020). “We’re going to make them an offer they can refuse: rules of origin and the UK-EU free trade agreement”, UK Trade Policy Observatory Briefing Paper 45, University of Sussex. https://blogs.sussex.ac.uk/uktpo/files/2020/07/Briefing-paper-45-1.pdf

[12] For more see, Annex 3-C, Note 1 General Principles of the UK-Japan CEPA.

[13] Product specific rules of origin in CEPA is categorized as easier (1) if more non-originating material is allowed or (2) if there is alternative new rule that origin can be fulfilled compared with JEEPA.

[14] There are different forms of cumulation: bilateral cumulation, diagonal cumulation, full cumulation, and extended cumulation. For a more detailed explanation of each of the cumulations, see: Gasiorek and Garrett (2020). “We’re going to make them an offer they can refuse: rules of origin and the UK-EU free trade agreement”, UK Trade Policy Observatory Briefing Paper 45, University of Sussex. Available at: https://blogs.sussex.ac.uk/uktpo/files/2020/07/Briefing-paper-45-1.pdf

[15] Annex 3-C of the UK-Japan CEPA provides the list of chapters and heading of the Harmonized system

[16] See Article 3.5 (10) and Article 3.5 (10) of the UK-Japan CEPA

[17] https://www.bbc.co.uk/news/business-54345882

[18] Chapter 6: SPS and Chapter 7: TBT.

[19] The UK and Japan commit to liberalisation covering all sectors except for measures provided in the reservation lists for existing measures (Annex 8-B: Annex I) and the reservation lists for future reservation (Annex 8-B: Annex II). Also, the measures for public purposes (i.e. security, environment, privacy protection and safety) are outside the scope of liberalisation commitments (Article 8.3: General exceptions).

[20] As for the reasons why the UK has a difficulty in achieving better market access from its trading partners, see M. Morita-Jaeger (2020). The Japan-UK Free Trade Agreement – Continuity or no continuity? How can it be still “ambitious”?, UKTPO Briefing Paper 46, July 2020; and M. Morita-Jaeger and Winters, L. A. (2018). The UK’s future services trade deals with non-EU countries: A reality check, UKTPO Briefing Paper 24, November 2018.

[21] Annex 8-B, Annex I and II in CEPA and Annex 8-B, Annex I and II in JEEPA.

[22] These reservations include: reservation No. 2, 5, 6, 7 and 9. For example, Annex 8-B: Annex I Reservation 2 lists EU’s directives as relevant measures for Auditing services’ reservation. Annex 8-B: Annex I Reservation 5 lists EU and EEC regulations as relevant measures for Business services reservation.

[23] For example, in Reservation 4: Research and development services, “all currently existing and all future research or innovation programmes” is provided as relevant measures.

[24] Article 167 of the Treaty on the Functioning of the European Union.

[25] Article 8.4 (b) and (d).

[26] See study on Brexit and the EU-UK relation in the audio visual sector, Policy Department for Structural and Cohesion Policies Directorate-General for Internal Policies (2018). Research for CULT Committee – Audiovisual Sector and Brexit: the Regulatory Environment, European Parliament.

[27] Chapter 8: Article 8.21. Annex 8-B: Annex III and IV and Annex 8-C.

[28] Section D: Article 8.21.

[29] Annex III, Schedule of the United Kingdom.

[30] Annex 8-C.

[31] JEEPA: Annex 8-B, Annex III and Annex 8-C: Understanding on movement of natural persons for business purposes.

[32] CEPA: JEEPA: Annex 8-B, Annex III and Annex 8-C: Understanding on movement of natural persons for business purposes.

[33] These include measures inhibiting market access, national treatment, most-favoured-nation treatment, prohibition of nationality requirement for senior management and boards of directors, and prohibition of performance requirements as defined in Chapter 8.

[34] Morita-Jaeger, M. and Winters, L. A. (2018).

[35] Chapter 8: Section E Regulatory framework stipulates cross-sectoral domestic regulation and sector specific regulatory cooperation: postal and courier services; telecommunications services; and financial services.

[36] Chapter 8: Article 8.60 in CEPA. In comparison with JEEPA (Article 8.60), new types of financial services are defined in detail.

[37] Chapter 8: Article 8.63.

[38] DIT (2020). UK-Japan Free Trade Agreement: The UK’s Strategic Approach, Chart 2 (p34).

[39] See Australia-Singapore Digital Trade Agreement (signed August 2020), Digital Economy Partnership Agreement (signed in June 2020) among Chile, New Zealand, and Singapore and the e-commerce provisions under USMCA (US, Mexico and Canada).

[40] Schwartz, P. M., and Peifer, K. (2017). Transatlantic Data Privacy Law, Georgetown Law Journal, vol. 106, No. 1, pp.115-180. Wolfe, R. (2019). Learning about Digital Trade: Privacy and E-commerce in CEPA and TPP.

[41] https://www.gov.uk/government/publications/uk-national-data-strategy/national-data-strategy

[42] For example, see CBI (https://committees.parliament.uk/writtenevidence/14956/pdf/), TechUK (https://committees.parliament.uk/writtenevidence/14927/pdf/), Japan Electronics and Information Technology Industry Association (0911.pdf (jeita.or.jp) in Japanese.

[43] Jones, E. and Kira, B. (2020a). It’s time to talk digital trade, UKTPO blog, 13th November, 2020: It’s time to talk digital trade « UK Trade Policy Observatory (sussex.ac.uk) And Jones, E. and Kira, B. (2020b). The digital trade provisions in the new UK-Japan Trade Agreement, Submission to the International Trade Committee, UK House of Commons. https://committees.parliament.uk/writtenevidence/14812/pdf/

[44] For example, see Which? (https://committees.parliament.uk/writtenevidence/14897/pdf/) and Trade Justice Movement (https://committees.parliament.uk/writtenevidence/13884/pdf/) .

[45] For example, Jones, E. and Kira, B. (2020a); Jones, E. and Kira, B. (2020b) and Aaronson, S. A. (2019) Data is different, and that’s why the world needs a new approach to governing cross-border trade flows, Digital Policy, Regulation and Governance, Vol. 21 No.5, pp.441-460.

[46] See Morita-Jaeger, M. (2020). Japan-UK Free Trade Agreement –What is missing?, UKTPO Blog, 22 October 2020. https://blogs.sussex.ac.uk/uktpo/2020/10/22/japan-uk-fta-what-is-missing/

[47] Section A: General provisions, Article 8.5.3.

[48] Kaufmann-Kohler, G. and Potesta, M. (2020). Investor-State Dispute Settlement and National Courts, Springer Nature, 2020. And Kofman, M. (2018). Investor-state dispute settlement challenges and reforms, Australian international law journal, Vol.25 (2018), pp.49-62.

[49] Jones, E. and Kira, B. (2020a) and Jones, E. and Kira, B. (2020b).