Effect of Exchange Rate Changes on Prices and on Trade Quantities

Entry and Exit in Export Markets

Understanding the UK Economy’s Response to the Brexit depreciation

On June 23 2016, Britain voted to leave the European Union. The immediate effect of the result of the Brexit referendum was the depreciation of sterling relative to all major currencies, a change that has proved to be persistent. The sterling depreciation was expected to boost the UK’s export sector because it should have given UK firms a competitive advantage in foreign markets in terms of lower prices. But the export boom never arrived (e.g. De Lyon and Dhingra, 2019; Economist, 2017). In fact, depreciations have never reversed the secular decline in the UK share of world trade, but they can temporarily stem it. Not in 2016, though.

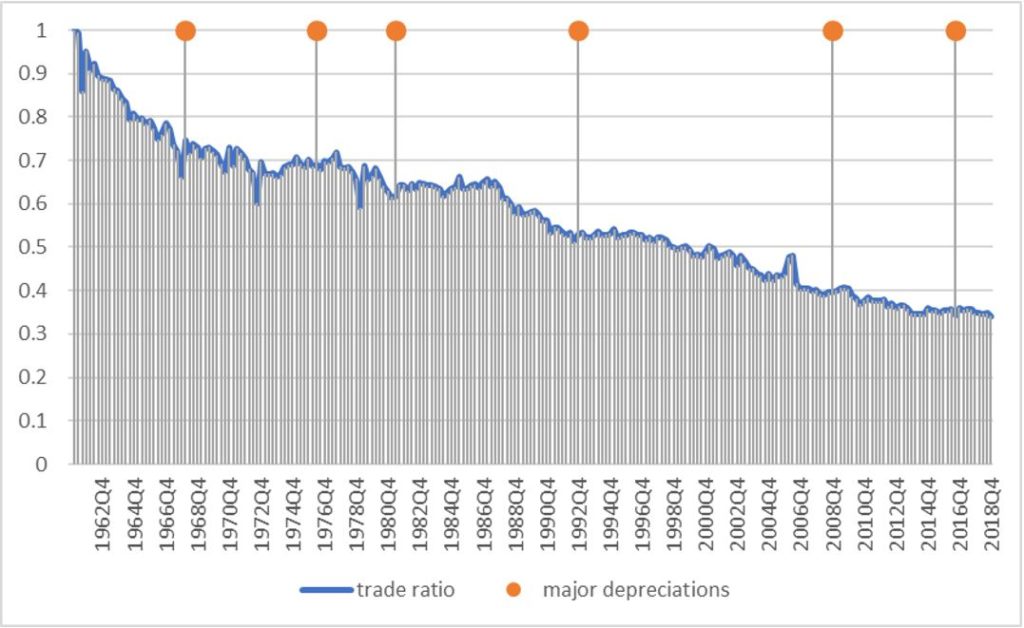

Figure 1 plots the volume of UK exports (goods and services) relative to the volume of world trade for 1961 Q1 to 2018 Q4, setting the initial value at one. (Thanks to the NIESR for providing data). In addition, it shows, as dots, the six major depreciations of sterling in that period. It shows a precipitous decline in relative trade until around 1967, followed by a gentler decline punctuated by periods of stability. The average quarter-on-quarter change in relative trade over the whole period is -0.27%; if we treat the eight quarters after a depreciation as affected by that depreciation, the average change for non-depreciation quarters is -0.39%, while the depreciation quarters average +0.31% before 2000 and -0.25% after 2000.

Source: NIESR NiGEM dataset.

This paper asks whether the failure to increase UK exports after 2016 could have been foreseen. It reviews a selection of empirical studies on the effect of exchange rate change on import prices, consumer prices, export prices and trade quantities over recent decades. Having reviewed the general literature, we specifically discuss the sterling depreciation of 2016: whether its pass-through to UK prices was higher than expected and its failure to boost exports predictable. The latter discussion considers specifically the role of global value chains, the nature of UK exports, issues surrounding the currency in which exports are invoiced and finally whether, uniquely to the UK following the referendum, the effects of the depreciation were merely eclipsed by the huge increase in uncertainty about trade policy.

In a nutshell, although there is a good deal of variation between countries, the empirical literature broadly finds that

The effect of exchange rate changes on international trade and trade prices is quite complicated. We present a brief account of what one might expect and the factors that influence it in the Appendix to this paper. Overall, however, there are no general answers and so to understand the way things work we have to turn to empirical analysis, which is the subject of this Briefing Paper.

We therefore provide a brief description of recent UK trade history; followed by a review of different studies of the effect of exchange rate changes on trade prices, consumer prices and trade quantities; finally, we explore the apparent effect of the sterling depreciation in June 2016 on UK trade and price behaviour. The Appendix provides a simple theoretical discussion of the effects of exchange rate change on trade and trade prices and the references referred to in the text below. In addition, Ayele and Winters (2020) go into the theory and evidence in a little more detail.

This section briefly presents the recent history of the UK economy so far as exchange rates are concerned. Essentially, we take the depreciation of 24th June 2016 as an exogenous shock and ask what happened to related series following that. At this stage, we are describing, not explaining.

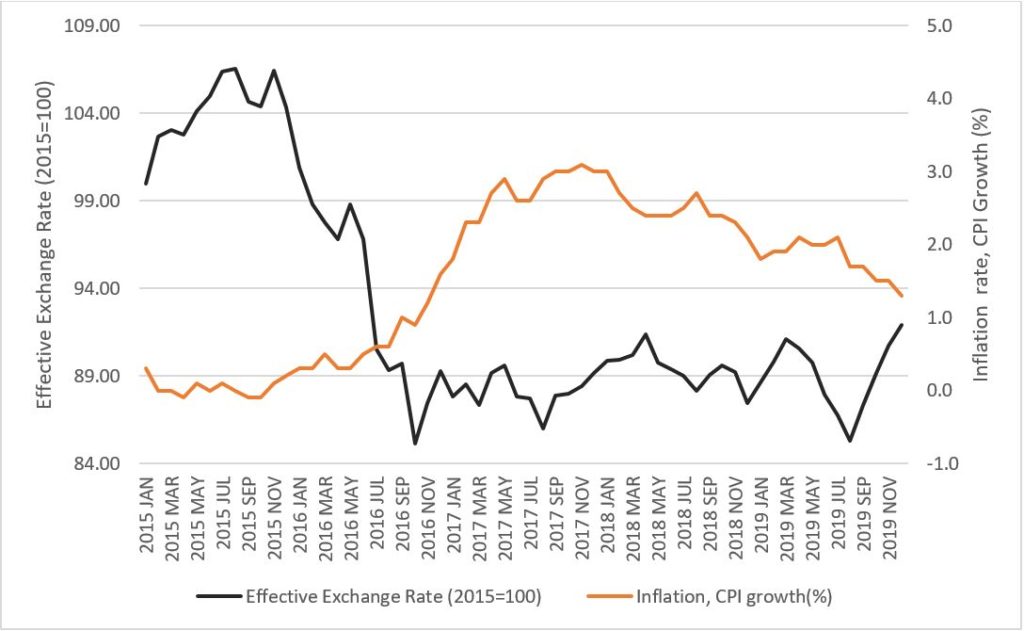

Source: ONS

Figure 2 shows the monthly effective exchange rate for sterling (its rate relative to a basket of other major currencies) and also inflation. Focusing on the former (in black), the figure shows the immediate and large depreciation of sterling following the EU referendum result, and that unlike the stock market, it never recovered. Depreciations are generally expected to increase consumer prices and this, indeed, proved to be the case: the figure also plots the annual rate of inflation (the change in the consumer price index relative to the same month a year previously). The exchange rate started to dip at the end of 2015 (after the UK election) and fell precipitously in June 2016. Inflation picked up from the latter date.

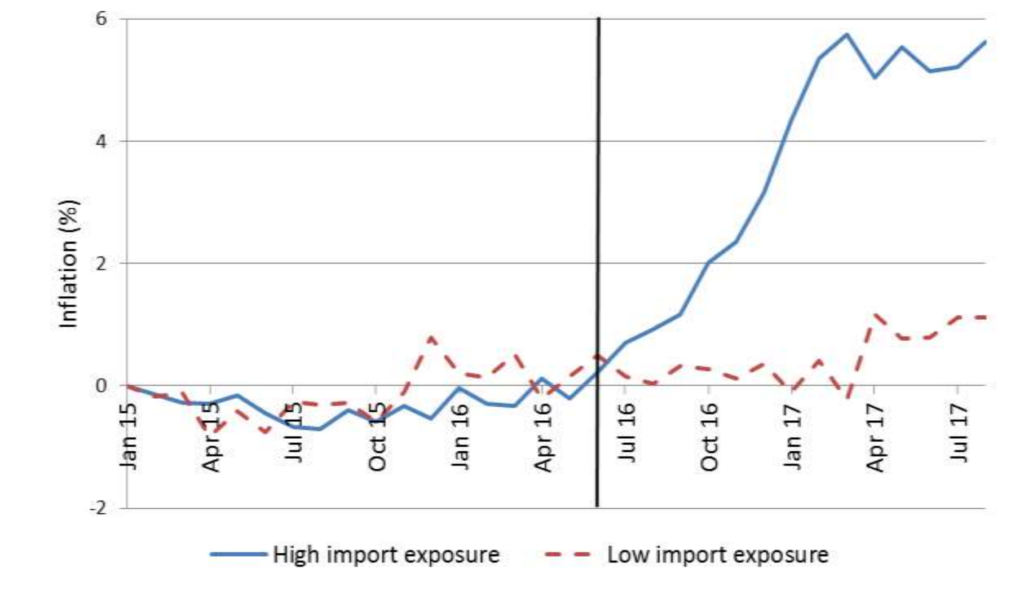

The increases in prices were not spread evenly across goods and services, however, but concentrated on those that were most exposed to imports either because imports account for a large share of consumption or because they account for a large share of UK production costs – see Figure 3.

Source: Adopted from Breinlich et al, 2019

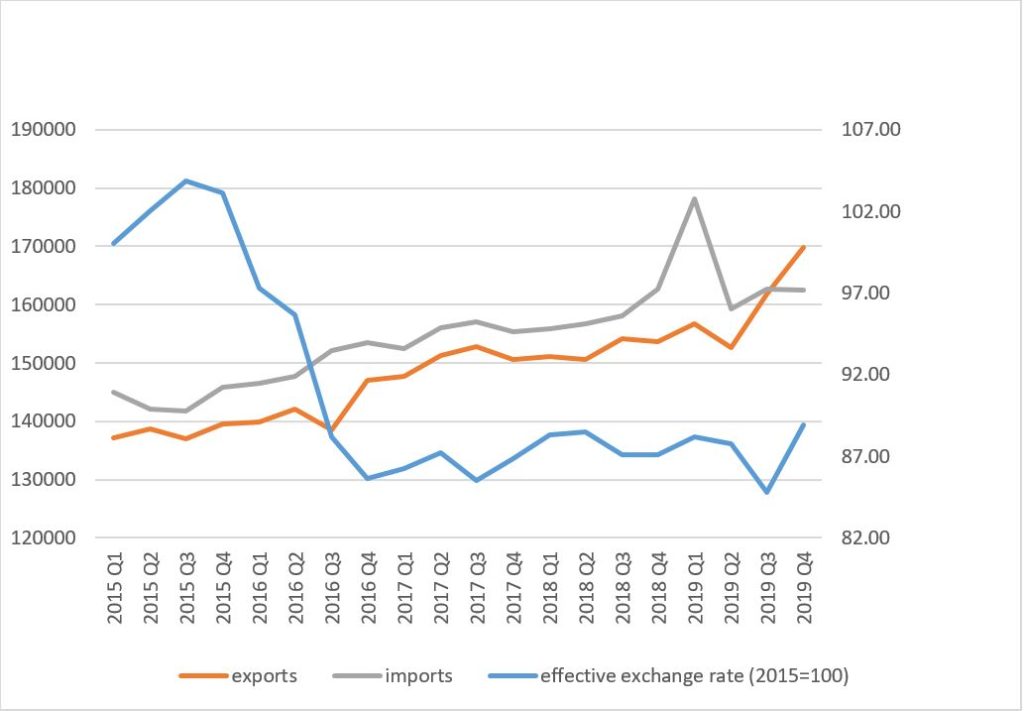

As noted above, we also expect a depreciation to affect the quantities traded. Figure 4 looks at the evolution of the quantity (volume) of UK exports and imports since 2015 along with the effective exchange rate. There is a hint of an export increase in the latter half of 2016, but the underlying trend resumes from 2017 Q1 until 2019 Q3 and Q4, when an upturn appears. For imports, it appears that the depreciation did not affect the underlying trends, the peak in 2019 Q1 probably just being a timing anomaly.

Source: ONS, 2019 Q4 estimated

Of course, simple outcome measures like figure 4 do not allow us to isolate the effects of the exchange rate change because other factors influence trade flows, including for exports, the growth of world trade, which was fairly buoyant between 2016 Q3 and 2018 Q4. Hence, one would have expected reasonable export growth over that period, so the actual outcome over that period is surprising.

This section reviews a selection of the more important pieces of evidence on exchange rate changes. We discuss estimates in terms of elasticities – the percentage change in a price or quantity induced by a one percent change in the exchange rate. In keeping with the bulk of the literature surveyed, we measure the exchange rate as units of local currency per unit of foreign currency – the opposite to the usual practice in the UK – so that a depreciation corresponds to an increase in the exchange rate. Ayele and Winters (2020) offer a much more extensive discussion of the evidence.

The principal route through which a change in the exchange rate affects trade and economic welfare is via prices, and hence it is of critical value to know the extent to which such changes actually affect prices. There are two approaches to the estimation of exchange rate elasticities on prices and quantities; the macroeconomic approach that considers aggregate trade prices and flows (Bussiere et al 2014; 2016, Leigh et al 2015), and a microeconomic approach that estimates the impact of exchange rate change at a highly disaggregated level, usually at firm level (Berman et al 2012, Amiti et al 2014, Fernandes and Winters 2018).

The macro approach regresses changes in a measure of prices in an importing country (i.e. import prices, consumer prices) on those in the exchange rate and some additional controls such as the cost of production in the exporting country and destination country’s demand conditions.

These studies almost invariably show that exchange rate pass-through to import prices is incomplete. For example, using quarterly data from 1975 through 2003, Campa and Goldberg (2005) find that the average elasticities of exchange rate pass-through into aggregate import prices is approximately 0.46 and 0.64 in the short-run (one quarter) and longer-term, respectively, with some heterogeneity across sectors. Energy and raw material import pass-throughs are closer to unity while those for manufacturing and food sectors are lower.

Similarly, Bussiere et al (2016) provided the estimates of the elasticities of trade prices for exchange rate change using data from 25 advanced and 26 emerging countries, covering 1995-2012 with more than 160 trading partners. They regress bilateral trade flows at the level of about 5,000 products (HS-6 level) on bilateral exchange rates and find that, on average, pass-through to import prices in importer currency is around 0.48, broadly confirming the earlier findings of, say, Leigh et al (2015) and Campa and Minguez (2006). While Bussiere et al find a good deal of heterogeneity across countries, they find that the average pass-through for developed countries and for emerging countries is the same.

The results just quoted average each importer’s import prices in its own currency over all products and all sources of imports. Bussiere et al also look at the same detailed prices from the exporter’s perspective, averaging the price behaviour of each exporter over all its export products and all markets. [1] Here they find prices in the importer currency to show a greater responsiveness to exchange rate changes, but with differences between advanced countries (0.72) and emerging countries (0.59).[2] Thus, compared with those of emerging countries, advanced country exporters appear better able to maintain export prices in their own currencies (they fall by only 0.28% for a 1% depreciation of the importer currency) and thus to pass more of the exchange rate change onto consumer/users. The suggestion is that developed countries’ more differentiated and sophisticated export bundles grant them more market power.

A second stream of evidence comes from microeconomic studies using highly disaggregated firm and transaction-level data. These confirm that the pass-through of exchange rate changes to import and export prices is incomplete and they also start to identify some of the underlying reasons for its incompleteness.

Amiti et al (2014) suggest that incomplete exchange rate pass-through is a result of a firm’s import-intensity of export (i.e. the share of imported intermediate inputs in total costs) and its share in the foreign market. Using Belgian firm-level data from 2000-2008, Amiti et al (2014) find that the unweighted average pass-through elasticity of changes in the bilateral exchange rate to export prices in the exporter currency (the euro) is 0.2, implying a pass-through to Belgian firms’ prices in the importer’s currency of 0.8.[3] The latter varies from 0.87 for a typical firm with zero import intensity to 0.63 for a firm with 40 percent import intensity.[4]

In a similar exercise but on French firm-level data from 1995-2005, Berman et al (2012) emphasise the role of firm productivity and size on exchange rate pass-through. They find an average pass-through of the bilateral exchange rate to export prices in the destination currency of 0.92, but with significant variation by productivity. More productive firms have lower pass-through, perhaps because they have larger mark-ups to squeeze or because they provide more sophisticated goods with lower price elasticities. Fontagné et al (2018), who also use French firm-level data, find average pass-through to the destination currency export prices of 0.97 but of ‘only’ 0.90 for firms’ core products. Both sets of results are consistent with French firms having sufficiently large markets in the Euro Area that they do not feel much pressure to adjust export prices when the exchange rate changes.

Possibly related to productivity, pass-through may also vary with product-quality. Using Argentinian firm-level wine export data, Chen and Juvenal (2016) find that pass-through decreases as quality increases across products in multiproduct exporting firms. Auer et al (2018) also examined the role of quality and find higher pass-through for low-quality cars than for top quality ones; a one standard deviation increase in quality is associated with a decline of 0.085 in pass-through. Both results are consistent with higher quality products facing lower price elasticities of demand.

Auer and Schoenle (2016) analyse market structure as a determinant of pass-through. They work on US micro-level import data to identify the effect of exporters’ exchange rate changes relative to the dollar on US import prices in dollars. Their principal concern is to demonstrate the joint roles of marginal costs and of competitors’ prices in the determination of firms’ delivered prices, the latter depends heavily on the firm’s market share: a larger market share (a proxy for market power) attenuates exchange rate pass-through. Using a variety of proxies for firms’ market shares of US imports of their commodities, Auer and Schoenle suggest that whereas the pass-through elasticity for a near-monopolist firm is 0.07, for a firm with a negligible market share it is 0.19.

As the theoretical discussion above suggested, the currency of invoice for exports also affects pass-through, at least over the short to medium run – with evidence to be found in, for example, Chen et al 2019, Auer et al 2018, Boz et al 2017, Gopinath 2016, Cravino 2014, Gopinath et al 2010. The immediate valuation effect is purely mechanical but it will persist until exporters reset their prices, and since such adjustments take time they may persist in full or in part for some time.[5] We discuss currency of invoice in more detail later on.

The lessons from this sketch of the literature are that pass-through varies with a number of characteristics. It tends to be smaller for import prices in importer currency

It tends to be smaller for export prices in exporter currency

Consumers consume both foreign and domestic products. A change in the exchange rate affects the prices of the former directly, but the prices of the latter are also affected if their production uses imported intermediate inputs because the prices of these will typically rise. The costs of domestic production will also increase if wages rise to meet cost of living increases, or if the change in the exchange rate boosts the economy via export growth and so tightens local markets.

A universal finding is that the exchange rate pass-through to consumer prices is lower than to import prices. As noted above, the exchange rate pass-through to import prices is incomplete, and its effect on consumer prices is further diluted because the consumer prices index (CPI) includes both domestically produced tradable goods and non-traded goods and services. In addition, distributors’ and retailers’ margins (which account for between a third and half of the price that consumers pay) are likely to absorb a significant part of the change in import prices, further cushioning the effect on consumer prices.

Working with data for 21 OECD countries, Campa and Goldberg (2010) estimated pass-through to import prices and the consumer price index (CPI) and find substantial variations across countries, mainly related to economies’ openness to imports (the more open the economy the larger the pass-through to the CPI). They also provided simulations of the contributions of the various links between changes in import prices and the CPI. These suggest that the largest effect quantitatively comes through changes in the costs of imported inputs, followed by the cushioning effect of distribution margins and then the direct effect of exchange rate change on the prices of imported consumer goods. Practically, the extent of exchange rate pass-through to consumers depends first on how exporters pass on the change into their export prices (the importer’s import prices), second, on how importers pass the price change through to consumers, and, third, on how important imports are in consumption and in inputs into production.

Fontagné et al (2018) offer a similar disaggregation when considering the effect of exchange rate change on exports: they argue that the reaction of export volumes to exchange rate change depends first on the pass-through to export prices, second on how importers pass the changes to consumers, and third on how consumers react to the change in prices. Any estimation of the elasticity of firm export volumes with respect to tariff or exchange rate changes, they say, will be misleading unless it controls for the extent of export price changes discussed above. They find, however, that while an exchange rate change is almost entirely passed through to export prices in the destination country’s currency, the elasticity of exports with respect to the exchange rate is only around -0.7. This limited response to exchange rates compared to the shocks deriving from tariff changes or changes in firms’ non-import-related costs may arise from the irreversibility of export decisions coupled with the frequently volatile nature of exchange rate changes (Ruhl, 2008). From the firm’s perspective, why make costly adjustments to purchasing patterns when the exchange rate change is likely to be reversed quite soon?

Bussiere et al (2016) find similarly small elasticities with respect to exchange rate changes in a multi-country sample: 0.34 to 0.40 for exports and -0.4 to -0.2 for imports, as do Berman et al (2012) on French firm-level data from 1995-2005 (-0.4) and Fitzgerald and Haller (2014) for Ireland (0.5 for export values in exporter currency terms, increasing to 0.8 in the long term). Berman et al also find that these elasticities decrease as firm size and productivity increase: that is, more productive firms and those with more market power respond to exchange rate change by adjusting their markups more and their export volumes less. These are the very firms that tend to dominate countries’ exporting.

What difference do global value chains (GVCs) make? We have already seen from Amiti et al (2014) that large import-intensive exporting firms have lower pass-through (in producer currency) than average firms, and Berman et al (2012) also suggest that these firms’ export elasticities with respect to the exchange rate are likely to be absolutely smaller. Ahmed et al (2017), focusing on the manufacturing sector for 46 countries for 1996-2012, show that the more heavily a country is involved in the global production process, the smaller the response of its aggregate exports to exchange rate change. In their preferred specification, they find that the elasticity of manufacturing exports with respect to real effective exchange rate with zero participation in the global value chains is 1.11, while the elasticity of exports becomes 0.87 for countries with an average global value chain participation and 0.79 at the 80th percentile.

There are several reasons why GVCs should attenuate trade responses. The most obvious is that following a depreciation of its currency, the costs faced by an input-importing exporter rise, thus curtailing its ability to reduce its foreign currency export price. In essence, a change in the exchange rate affects the foreign-currency value only of local value added (the local contribution), and if this is a relatively small part of the overall cost of a good, the scope for a depreciation, say, to increase export competitiveness is correspondingly reduced.

However, global value chains also introduce further complications, especially in the short run. First, prices may be determined by long-run contracts. Second, if an exporter is selling parts to another link in the chain, it probably accounts for only a small share of the final cost of a good and thus depreciation of its currency has only a small effect on the final price and demand. Third, to the extent that GVCs entail co-ordination with up- and down-stream partners, for example of specifications, length of runs, etc it will be more difficult to change the direction or level of sales in response to local exchange rate changes. In the long run, GVCs are probably rather sensitive to real exchange rates, but only to permanent changes, which most changes are not.

There are (at least) two dimensions to the response of aggregate exports to an exchange rate shock: how many firms buy/sell abroad and how much, on average, each does so. Several models explain why the former might be important; most of them revolve around the sunk costs of entering foreign markets (e.g. Baldwin and Krugman 1989, Campa 2004). Sunk costs may involve researching demand, modifying products, setting up legal cover and distributor networks, etc. A firm will enter a foreign market if the expected discounted total gross profit from selling there exceeds the sunk costs of entry. These expectations may have to be formed for a period of years if sunk costs are high, so the likely permanence of an exchange rate change becomes a critical factor. Observe also that sunk costs create asymmetries between entry and exit. Reversing an exchange rate change that was large enough to drive a firm out of a market, will not necessarily entice it back in. Similarly, a change large enough to encourage entry may not generate exit when it is reversed (Krugman 1989).

Evidence on the so-called extensive margin – the number of firms trading – is mixed. Berman et al (2012) and Campa (2004) on France and Spain respectively, find some effects but others, e.g Greenaway et al (2008) on the UK, do not. All studies agree, however, that the contribution of the extensive margin to the total trade effect is small, mainly because new entrants are small and less productive than incumbent exporting firms (Crowley et al 2019, Berman et al 2012).

The immediate effect of the “leave” result of the Brexit referendum was the major depreciation of sterling relative to all major currencies, and the depreciation has been persistent since then. The depreciation was widely expected to boost UK exports, but, in fact, the export boom never materialized (Coresetti et al 2019; Economist, 2017) and the pass-through to UK import and consumer prices was probably more than most people expected.

In this section, we ask, first, whether, in the light of the literature we have reviewed, the expectations about an export boom and pass-through were reasonable. That is, whether, given the structure of the UK economy, experience elsewhere should have led us to expect the observed outcome. Then we ask whether the observed response was actually due to some other, unanticipated, factor.[6] In this section, therefore, we focus solely on studies of recent UK history, discussing UK value chains, firms’ currency of invoicing and trade policy uncertainty.

The production of goods and services is increasingly fragmented across the world and the UK is no exception. The OECD (2020) shows that in 2016 the UK’s average import content of export was 15.4% of gross exports and Figure 5 shows the details by industry. The share is high in industries such as manufacturing (30%), mining (26%) and health (25%), and it is even higher for some sub-sectors such as computers and electronics (50%) and motor vehicles (40%), Ijtsma et al (2018). From the results above, this would seem to indicate modest expected trade effects. And somewhat reinforcing this view, Costa, Dhingra, and Machin (2019) show that, following the 2016 depreciation, firms and sectors which were more involved in GVCs experienced lower wage growth and reduced training programs and suggest that these outcomes reflect the increased cost of imported intermediate inputs.

Some have argued, however, that the UK’s share of foreign valueadded is low compared with other EU countries, and that, in fact, it has been falling recently (Ijtsma et al 2018). This is true, but it is not the comparison we require for understanding the depreciation of sterling. Most EU member states have very high integration with each other, and most intra-EU trade is denominated in Euro. Thus, while high shares of member states’ inputs are imported from outside their borders, the shares denominated in foreign currencies are significantly lower. Figure 5 of Ayele and Winters (2020) illustrates the point. Hence, the UK is more exposed to rising input costs following a depreciation than are its EU counterparts. [7]

This suggests that the relative failure of the depreciation to reduce UK foreign-currency prices and stimulate exports has some basis in past experience.

Atkeson and Burstein (2008) present some evidence that the pass-through of local exchange rate changes to export prices and to exports will be lower for products with lower elasticities of demand. And, indeed, Fernandes and Winters (2019) find evidence of this for Portuguese exports to the UK after the referendum. It has been suggested that since the UK specialises in sophisticated manufacturing and services this could explain its lower than average low pass-through in the post-referendum period. However, at least looking at goods the UK is less specialised in high tech exports than France or Germany (19% compared with 22% and 20% respectively).[8]

In more direct evidence on price elasticities, Broda et al (2017) estimate the price elasticity of substitution for exports for around fifty countries: the UK’s is the lowest recorded. However, their exercise is completely different from a pass-through estimation, so it may not be perfectly applicable to our case.

One of the reasons why the sterling depreciation was expected to boost export volume arises from the competitives advantage that arises as UK firms sell their products at lower prices in the foreign market. Using customs data all UK export and import transactions over the period 2010-2017, Corsetti et al (2019) dispute this. They write ‘[b]y the end of the 2017, ….. UK export prices in the currencies of the destination markets were essentially unaffected by the Brexit depreciation.’ The authors do, however, find that different invoicing practices generate quite different patterns of price adjustment between June 2016 and December 2017.[9] Following approximately a month during which no sterling export prices changed (Corsetti et al attribute this to having to submit customs forms in advance), they find that:

For very simple (commodity) goods one might expect exports to expand during the period of incomplete pass-through, but recognising that building up export markets requires long-term commitment, one can see why the UK’s relatively sophisticated export bundle did not show such behaviour.

The studies above suggest that an exporting country’s depreciation generally induces a nearly full pass-through to export prices in the exporter’s currency. Corsetti et al are at the top of this range, or arguably a bit above it, but recall that their estimates refer to 2010-17, not just the post-referendum period.

Turning to import and consumer prices, Chen et al (2019) examine the pass-through of the depreciation of sterling to UK import prices, also using customs data over 2010-17. They find that the largest pass-through elasticity (approx. 0.7) pertains to goods invoiced in producer currencies, while that for goods invoiced in vehicle currencies is about 0.6, provided that the estimates are based on the extent of the depreciation relative to the vehicle currency. These pass-throughs are roughly the same for the short (immediate) and long (two years) term. For goods invoiced in sterling, on the other hand, they find the initial impact is zero, rising to around 0.1 after two years. They argue, following Gopinath et al (2010), that this suggests that choice of currency of invoice is endogenous. Firms decide how much pass-through they are willing to bear in the UK and then choose to invoice in sterling (low pass-through) or other currencies (high).

Based on their estimates of pass-through, Chen et al estimate that the 10 percent depreciation in 2016 raised average import prices by 2.9 percent by mid-2018. This is quite a lot less pass-through than was found in the studies described above from other European countries. It is also less than the actual change in import prices, which was 7.61% from July 2016 to June 2018.

Breinlich et al (2019) calculate the effects of the depreciation on UK consumer prices recognising both the direct consumption of imported goods and the use of imported inputs in domestic production.[10] Their results are consistent with complete pass-through of import costs to consumer prices and imply an aggregate exchange rate pass-through of 0.29. Given the 10 percent depreciation, they estimate that the Brexit vote increased consumer prices by 2.9 percent, costing the average household £870 per year. This corresponds almost exactly to the growth in prices over the 18 months following the depreciation – see figure 4 above.

It is impossible to conclude definitively whether the post-referendum behaviour of UK international trade prices and quantities was atypical. The small amount of evidence is mixed. However, it is worth reflecting briefly that the depreciation was not the only shock resulting from the 2016 referendum. At a stroke the unfettered access to the EU market that businesses had taken for granted for decades fell under severe doubt. No trade policy changed, but the prospect of change was real. Recent scholarship has concluded that the uncertainty associated with prospective changes in policy is indeed antithetical to trade, e.g. (Pierce and Schott, 2016; Handley and Limao, 2015; Handley and Limao 2017). Handley and Limao (2017) conclude that one third of the Chinese export boom from 2000-2005 is explained by the reduced threat of tariff increases in the US that joining the WTO delivered.

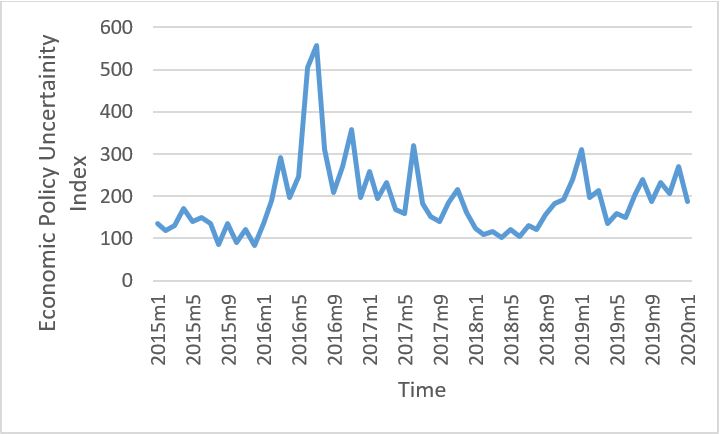

Figure 5 shows a monthly economic policy uncertainty index for the UK based on Baker et al (2016). It spikes before and after the referendum, and has remained above the 2015 level ever since. The fact that much exporting involves sunk costs and long-term commitment, growing uncertainty could dampen adjustment to exchange rate shocks and/or suppress export levels.

Source: https://www.policyuncertainty.com/

Two recent empirical studies examine the effect of Trade Policy Uncertainty (TPU) on UK trade in relation to Brexit—one studying the effect of uncertainty in the pre-Brexit referendum (Graziano et al 2018), and the other examining the effect of trade policy uncertainty in the post-Brexit referendum (Crowley et al 2019).

In the post-Brexit analysis, Crowley et al (2019) estimate the impact of trade policy uncertainty (i.e. trade agreement renegotiation) on UK firms’ decisions to participate in the export market. Representing trade policy uncertainty by the rise in the tariff on exports to the EU that would follow the failure of the UK and the EU to conclude a trade agreement, they find that the uncertainty affected the extensive margin UK-EU trade (i.e. the number of products UK firms exported).[11] Specifically, they find that firms’ entry in 2016 would have been 5% higher and exit 6.1% lower if the UK had not faced increased trade policy uncertainty after 2016. These are large numbers, but the effect on the total export volume would have been smaller because new entrants are generally small and less productive than incumbent firms.

Graziano et al (2018) combined the same measure of uncertainty with the time-varying odds of the referendum voting ‘exit’ as measured in the betting markets. They too found that uncertainty decreased UK-EU exports and net export entry.

This section has asked whether the responses of prices and exports to the post-referendum depreciation of sterling should be viewed as disappointing given existing analyses of exchange rate pass-through and export performance. It is too early to say definitively. However, the UK’s relatively heavy involvement in international value chains is a reason to expect significant pass-through to UK consumer prices and also attenuated export responses. Low elasticities of demand for UK exports would also suggest a weak export response but currency of invoice of exports appears to have little role in the longer-run. In addition, however, we believe that export responses were curtailed by the increased trade policy uncertainty.

Possibly the largest change in economic conditions in the UK between mid-2016 and January 2020 was the dramatic and persistent depreciation of sterling that followed the vote to pursue Brexit. Many commentators heralded this as an economic lifeline that would allow UK exports to boom even before Brexit occurred and that would (more than) compensate for the likely loss of exports to the EU that Brexit would induce. In the event, depreciation was followed by significant domestic price increases and only modest increases in the volume of exports. This paper has asked whether this should have been a surprise.

We have showed that the pass-through of exchange rate changes to trade and consumer prices and thence to trade quantities is rather complex, and hence difficult to predict with any confidence. We then surveyed some key literature which suggested, inter alia, that when a country depreciates its currency:

Finally, we reviewed some evidence on UK price and trade behaviour since 2016. The UK’s relatively heavy involvement in international value chains is consistent with the significant increase in UK prices and also with the attenuated export responses. There are suggestions that the elasticity of demand for UK exports is rather low and this is further consistent with a weak export response. Overall, however, we conjecture that these factors are not sufficient to explain the failure of UK exports to boom, and so conclude that some part of that failure is due to the dramatic increase in trade-policy uncertainty that the Brexit result heralded.

The Appendix provides a theoretical discussion of the effects of exchange rate change on trade and trade prices and a full list of references referred to in this paper

A more detailed version of the analysis presented here is available in:

Ayele, Yohannes and L Alan Winters (2020) “How do exchange rate depreciations affect trade and prices? A Survey and Lessons about UK experience after June 2016”, Economics Working Paper No. WPS-14-2020 University of Sussex:

[1] When measured for importers, the prices also include transportation costs (i.e. the cif price), whereas when measured for exporters the do not (prices are fob prices).

[2] The difference between the importer-based and exporter-based averages reflect the different partner mixes: the export data refer to a country’s exports to 160 partners and import data to their imports from 160 sources.

[3] The bilateral exchange is the rate of conversion from Euro to the destination currency. As noted, above, this can change either because the Euro changes (relative to the SDR, say) or the destination currency does. In the latter case, if the destination is not an important market for Belgium, exporters may not bother to change their Euro prices because they can easily switch sales elsewhere. By the same token neither will Belgian costs change significantly if the exchange rate change is driven by the change in the importer currency relative other currencies.

[4] Import intensity is calculated as the ratio of total non-euro import value of the firm to the total variable cost of the firm.

[5] The adjustments may take considerable time if there are rigidities in certain nominal values such as debt or wage contracts.

[6] Many commentators expect depreciation to take a long time to work through, as firms may need time to find new markets to exploit their new competitive advantage (the so-called J-curve). However, while this may be true for quantities, pass-through to prices is generally held to be a fairly rapid phenomenon.

[7] For example, in 2014, the shares of inputs imported from countries using a different currency are 12.2% for Germany and 18.6% for the UK.

[8] Estimates from WITS based on Lall’s (2000) classification – an arguably rather dated set of definitions.

[9] They find that while firms tend to invoice different transactions in different currencies, for a given firm, product, destination combination changes in invoice practice are fairly rare.

[10] This study does not test for pass-through but assumes it and follows it though the economy to consumer prices.

[11] In the absence of an agreement the tariff for UK exports to the EU would rise from zero to the EU’s MFN tariff rate. Thus, the degree of uncertainty varies by product, which is what Crowley et al use