Business Challenges and Opportunities

Difficulties and disadvantages of the TCA

It is now over two years since the introduction of the Trade and Cooperation Agreement (TCA) between the UK and the EU. The introduction of the TCA’s new trading arrangements has led to a range of challenges and opportunities for firms in the UK. In addition, the global economy has been beset by some further stiff challenges over the past few years, notably the Covid-19 pandemic, and, over the last year, the disruptions caused by Russia’s invasion of Ukraine to both energy markets and food security. The British Chambers of Commerce (BCC) undertakes regular surveys of its firms across a range of issues – including international trade, and the results of these are regularly published in BCC reports and press releases. The most recent BCC report, published in December 2022, evaluated the TCA two years since its inception and was largely based on the July 2022 survey.

In this Briefing Paper, we have worked with the BCC to produce a long-term perspective on the challenges facing UK firms, based on the BCC’s previous three trade-focussed surveys undertaken over 2021 and 2022. Each of these surveys asks a set of standard multiple-choice style questions as well as ‘free text’ questions where, instead of choosing from multiple-choice options, firms are asked to report directly on the challenges and opportunities they face. We apply a wide variety of text mining and natural language processing (NLP) techniques to these textual responses and then use a range of powerful machine learning techniques to analyse around 3000 sentences from the respondents’ answers across all three surveys. Machine learning is a branch of artificial intelligence that has received significant traction in recent years to help businesses draw conclusions and meaningful insights from large volumes of unstructured, raw data. This approach is used to identify which sentences are challenges and opportunities and then also to distinguish which sentences are more negative or positive i.e., to capture the intensity of these challenges and opportunities. The models work by looking for patterns in the data; they continuously learn from these patterns which informs the model’s decision on new data.

The report is divided into three sections. In the first part of the report, we consider the responses to a broad common question posed across each of the surveys which asked firms about the principal opportunities and challenges they face. As this question was common to all three surveys, it enables us to compare across 2021-2022. As well as identifying the negative and positive issues identified by firms, we also undertake sentiment analysis, which provides for assessing how strongly those positive and negative sentiments were expressed. We then move on to two specific trade-related areas which emerge from this analysis – first, the difficulties and disadvantages for firms arising from the EU-UK Trade and Cooperation agreement (TCA), and second, the issue of supply chain challenges. With regard to the TCA, a version of this question was posed both in 2021 and in one of the 2022 surveys. The questions related to supply chain challenges were only posed in the most recent survey, so we cannot elicit any changes in response over time. Nevertheless, the responses provide an insightful picture of the challenges faced by firms.

In this section, we consider the general perspective of firms as to the business challenges and opportunities they face. The question posed in each of the three surveys was: ‘Feel free to share your views on what you consider to be the biggest business challenges or opportunities for your business right now’. Unless explicitly stated in the answer, it is not always clear if respondents are listing difficulties or opportunities. To overcome this we take two approaches. First, we classify sentences as either positive or negative, i.e., as an opportunity or challenge respectively, using a binary text classifier; second we assign sentiment scores in order to measure the ‘intensity’ of the responses.

It is worth noting that this question is analysed at the sentence level because, even in cases where respondents have explicitly noted their opportunities and challenges, they are blended together in the same response. Therefore, answers must be split into individual sentences to be able to draw sensible insights.

1.1 Positive and negative sentence classification

The distribution across positive and negative sentences is highly asymmetric. Across the three surveys we have a total of 2807 responses which identify challenges, and only 190 identifying positive opportunities. So the share of positive responses is just over 6%. In and of itself this is indicative of firms’ perceptions of the economic environment they face. We note that this may also simply reflect the tendency to focus on negative concerns – as these are issues that need resolving by firms – as opposed to spending time on the positive opportunities.

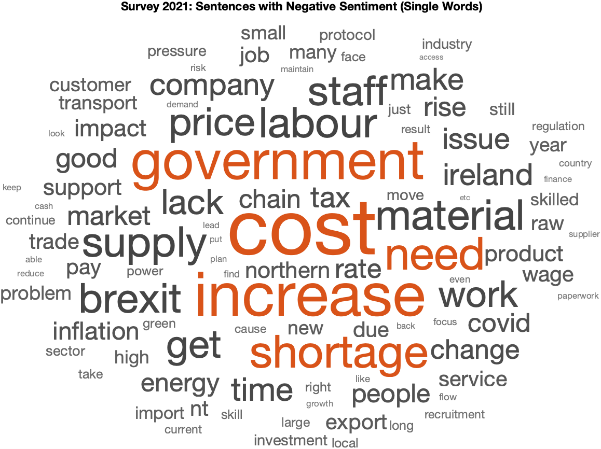

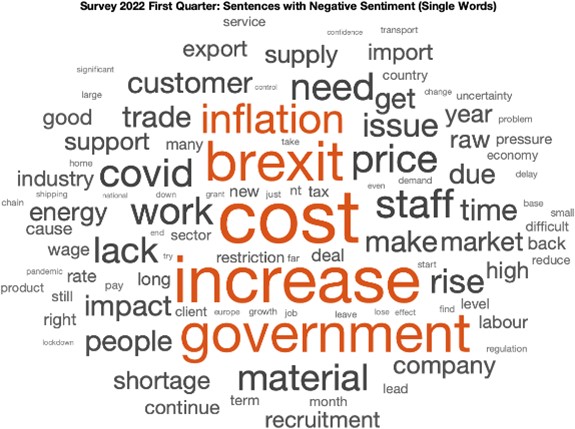

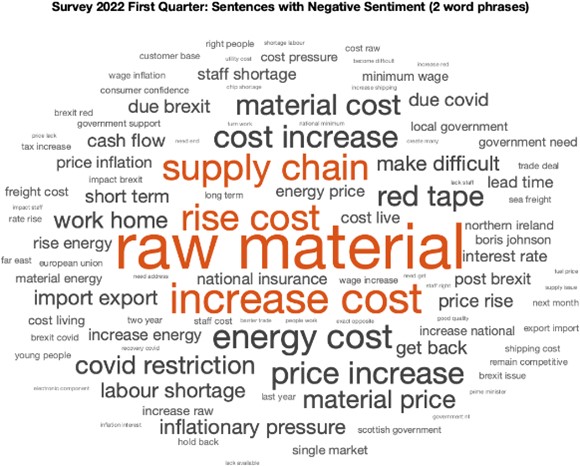

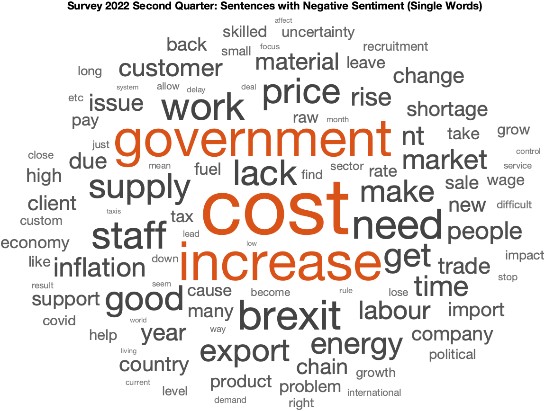

In Figure 1, in the left-hand column, we identify the most common single words used with negative sentiments across the three surveys; and in the right-hand column, the word clouds are based on combinations of two words. One reason for considering single words is, in a number of cases, the firms simply provided one-word answers (eg. “Brexit, inflation, labour”). From this, we see the relative importance of challenges relating to, for example, ‘cost’, ‘government’, ‘increase’, or ‘Brexit’. The disadvantage is the lack of context for these single words which could, for example, refer to ‘local government’, ‘central government’, or ‘government regulation’; or to ‘labour cost’, ‘energy costs’ or ‘trade costs’. The ‘two-word’ clouds overcome this issue, but in return fail to capture any single-word answers. From these ‘two-word’ clouds, we now see the importance of Northern Ireland in 2021, and then various issues relating to firms’ costs and ability to source either raw materials or access to labour.

Figure 1: Challenges facing firms – word clouds

| Single words | Two words | |

|

2021 |

|

|

|

2022(a) |

|

|

|

2022(b) |

|

|

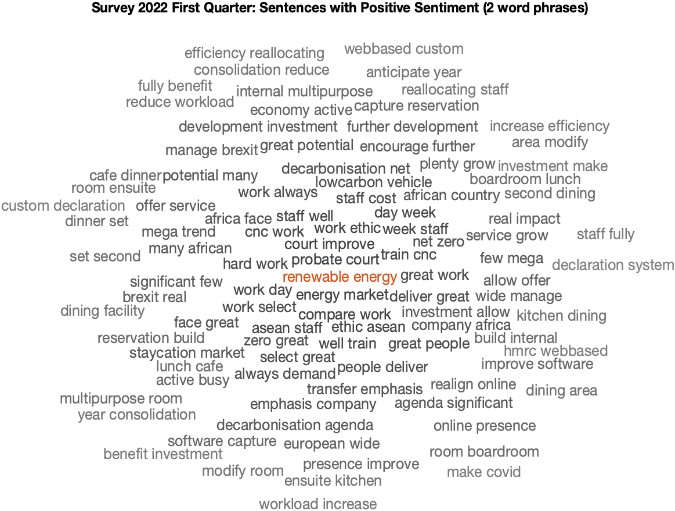

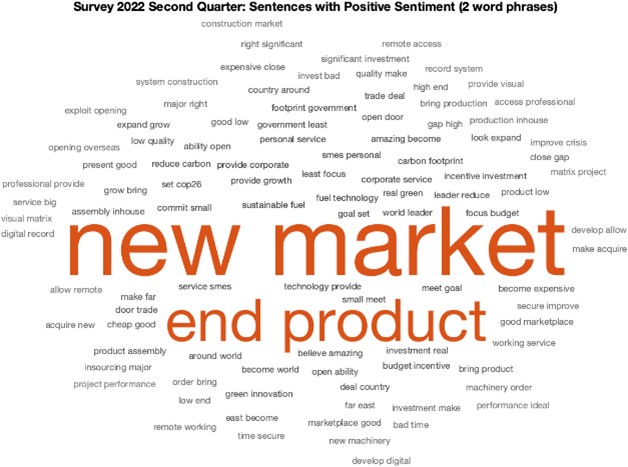

We then replicate the preceding analysis, but this time focusing on the positive responses. Analysis of the positive responses is more difficult because of the low response rate together with the lack of clear patterns of responses (notably in the first of the 2022 surveys).

Figure 2: Opportunities for firms – word clouds

Based on the responses and the word clouds, 17 categories of challenges, and 8 categories of opportunities for firms were identified.

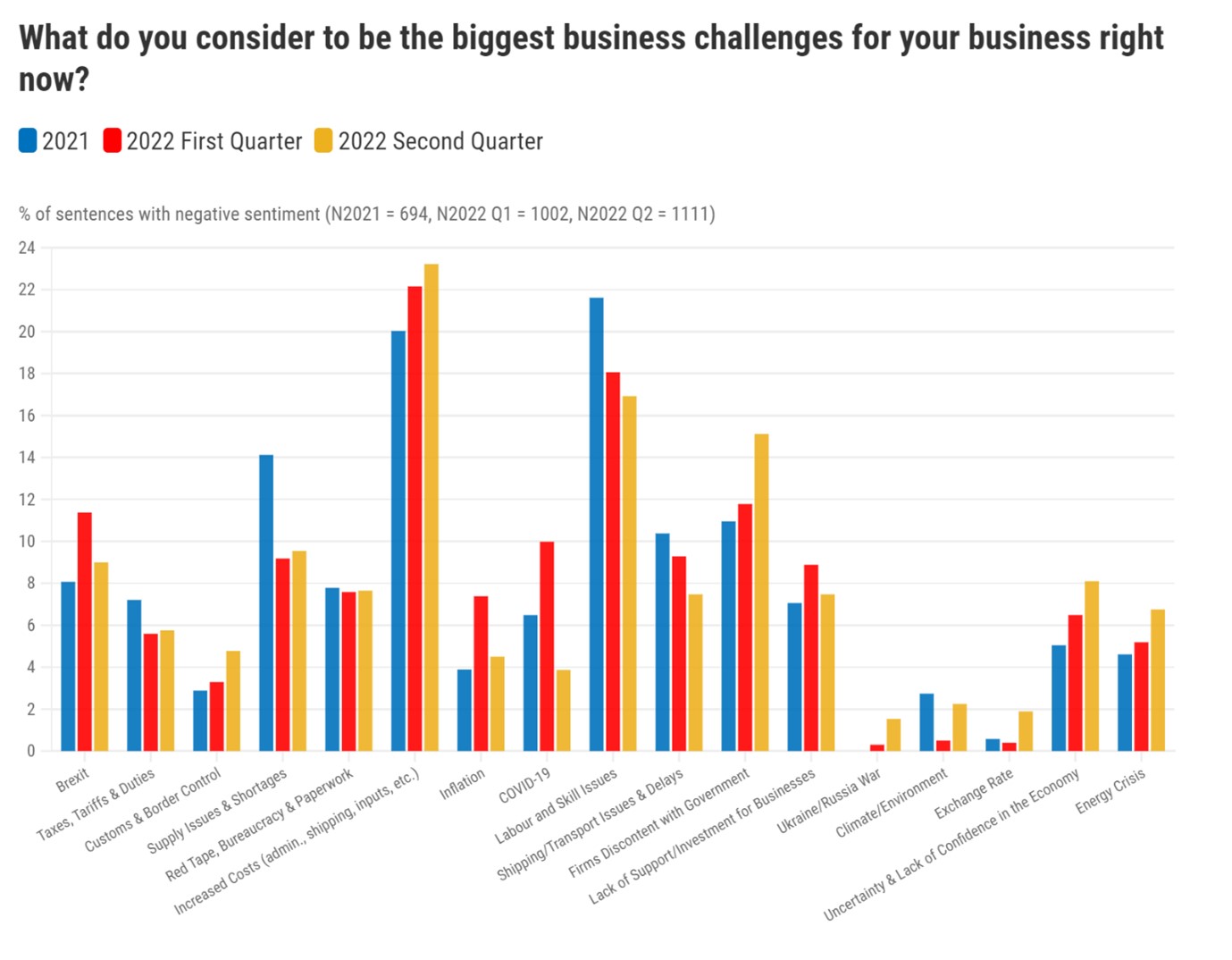

Figure 3 shows the frequency of the responses across the identified categories of challenges across all three surveys. Several key messages emerge from this graphic. The most significant challenge faced by firms, perhaps unsurprisingly, is that of increased costs, and the importance of this has grown over time with 20% of reponses reporting this as an issue in the first survey, and 23% in the final survey. Consistent with the word clouds, we also see the importance of labour and skill issues and shortages (though with a decline in the relative importance of this over time), and supply chain issues (which surprisingly also appear to have declined over time). Other key issues which emerge from this concern Brexit as well as firms discontent with government policy. Brexit is mentioned as an issue in, on average, 10% of the responses across the three surveys, while concerns about policy have risen from 11% to 15%. The challenges for businesses surrounding red tape, bureaucracy and paperwork; shipping/transport issues and delays; and customs and border controls have persisted through 2021 and 2022. Indeed, in a separate question in the 2022 survey, the top barriers to exporting were transportation costs (for 48% of the respondents), tariffs (48%), customs procedures (47%), and regulatory barriers (41%). We also see increased concerns over time, not surprisingly, with regard to the energy crisis, and with regard to economic stability.

Figure 3: Key Challenges for firms over time

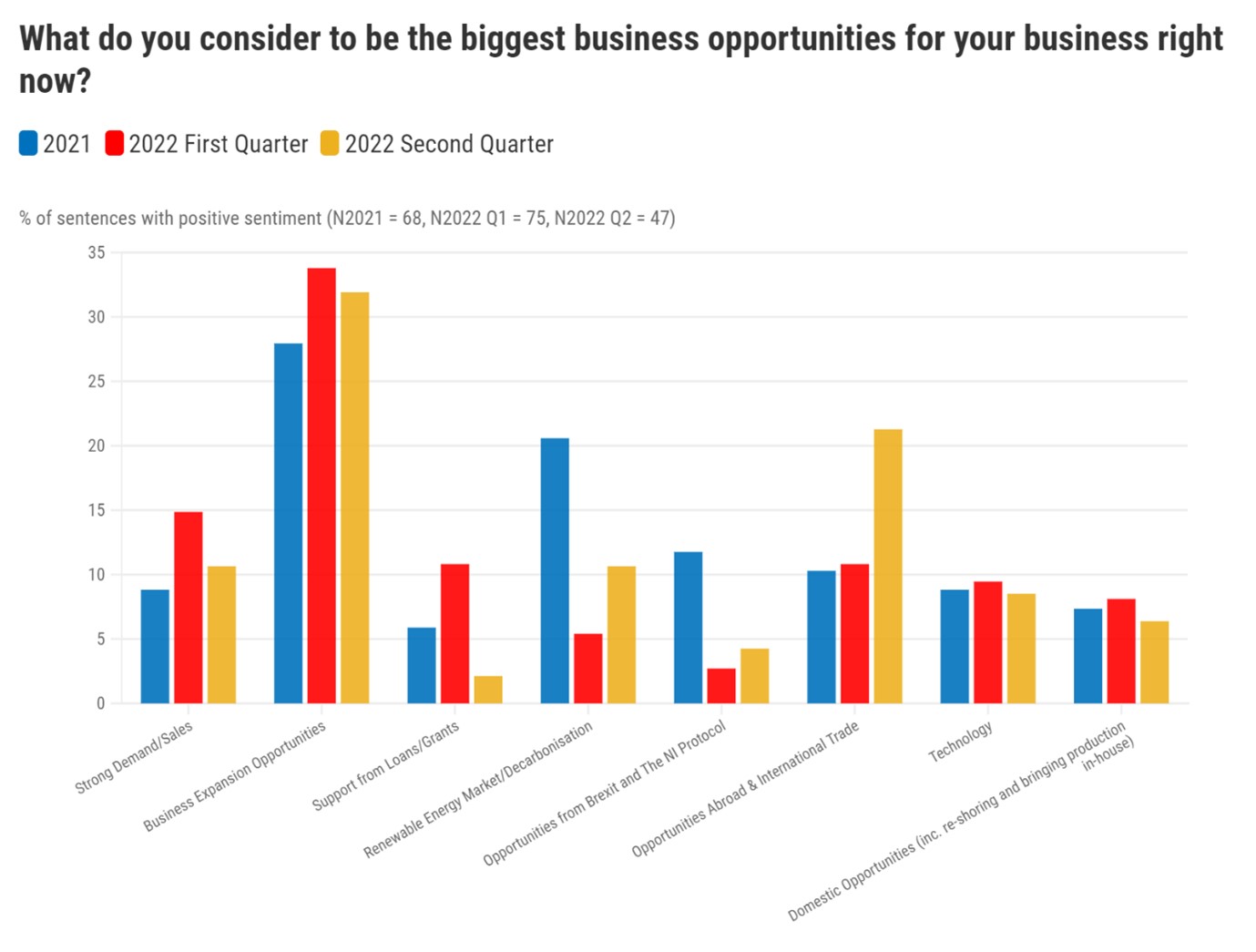

Analogously, in Figure 4, we consider the principal opportunities that firms identify in their responses. The most frequently cited opportunity refers generically to business expansion opportunities, which were mentioned by around 30% of the positive responses. Given the low number of positive responses, this means that less than 2% mentioned business expansion opportunities. The other categories have a fairly similar level of frequency with, in most cases, little change over time. The key exception here refers to opportunities abroad and international trade which saw a two-fold rise in the most recent survey. Here, it is also interesting to note that, in the 2022 survey, 79% of the respondents had not undertaken any assessment of what they would like to see from future UK free trade deals.

Figure 4: Key opportunities for firms over time

1.2 Computing Sentiment scores

The preceding classifies the sentiment of a sentence as either positive or negative, but there is no assessment of the intensity of the sentiment. To overcome this, an augmented deep learning model, which is a specific type of machine learning, is applied. The model employs a natural language processing ‘embedding’ technique based on how often a word appears close to other words. When conducted on a large scale it is possible to capture the semantics of the words used. To train such a deep learning model, a pre-classified dataset (an annotated list of words called sentiment lexicons) is required. Many of the available word lists have been developed for other disciplines, and thus tend to misclassify common words in financial and economic text. We use lists developed by Loughran and McDonald (2011), from a large sample of financial reports from 1994 to 2008. These lists incorporate words that are specific to economic and financial language, thus are expected to be far more suitable for this application than alternative lexicons and contribute to a more accurate model.

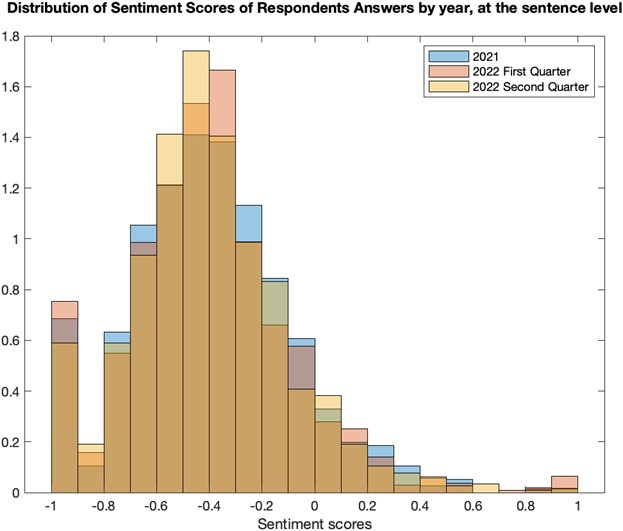

Figure 5 shows the distribution of sentiment scores for the word combinations across the three surveys. The sentiment score ranges from -1 to +1, where a negative score reflects a negative sentiment and vice versa. The figure shows that the distribution of sentiment is similar across the three surveys, and with a strong preponderance of negative sentiments.

Figure 5: Distribution of sentiment scores over time

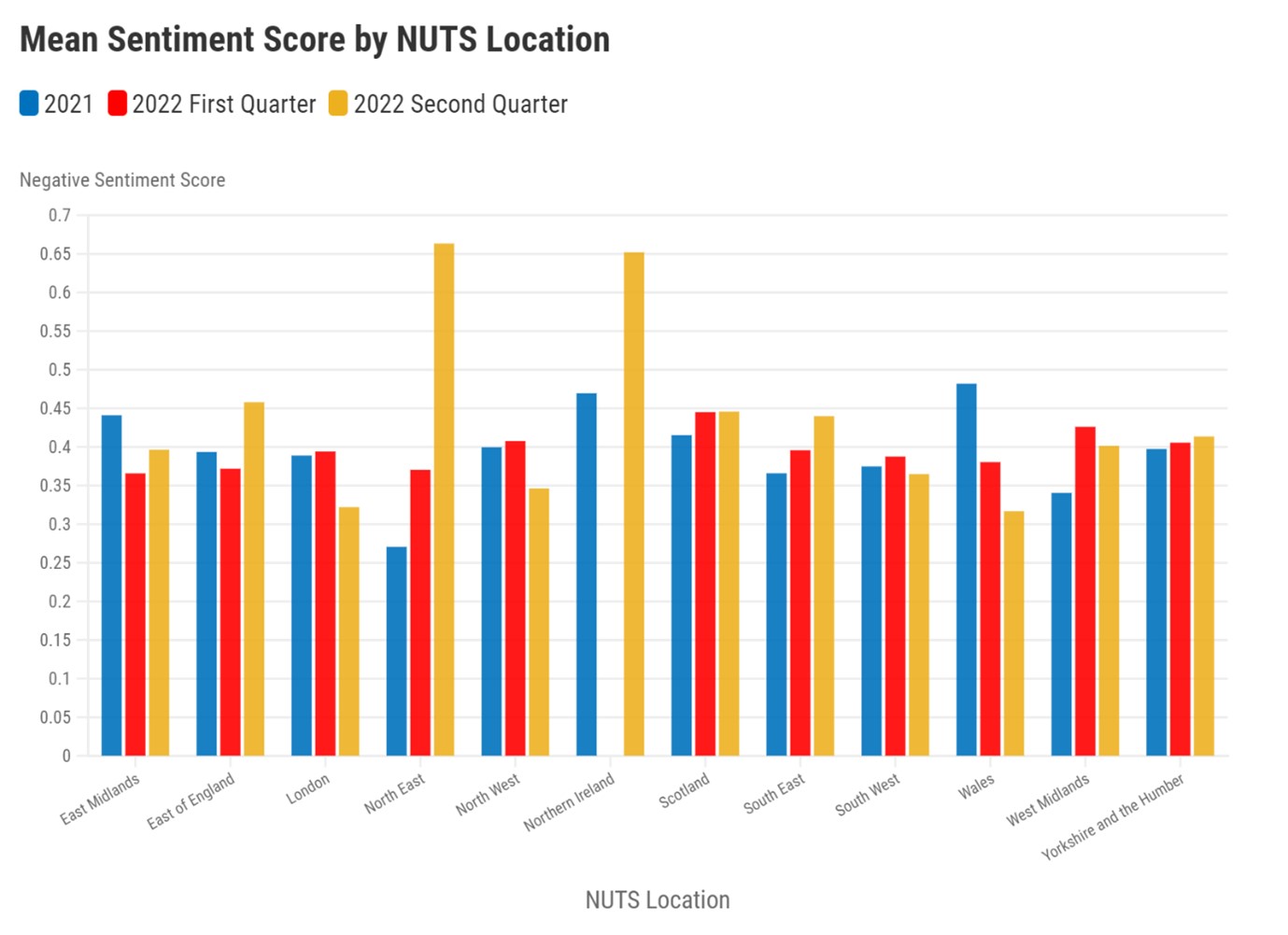

Sentiment scores by Location: Figure 6 shows the mean sentiment score by UK regions and across the survey years. There is a lot of similarity in the intensity of the overall negative sentiment across the regions, which is roughly around -0.4. There is a notable rise in negative sentiment in the North East and in Northern Ireland (data is missing for the middle survey), a smaller rise in negative sentiment in the South East, and Yorkshire and the Humber; and a modest fall in negative sentiment in London, the North West, and in Wales.

Figure 6: Sentiment scores by UK region over time

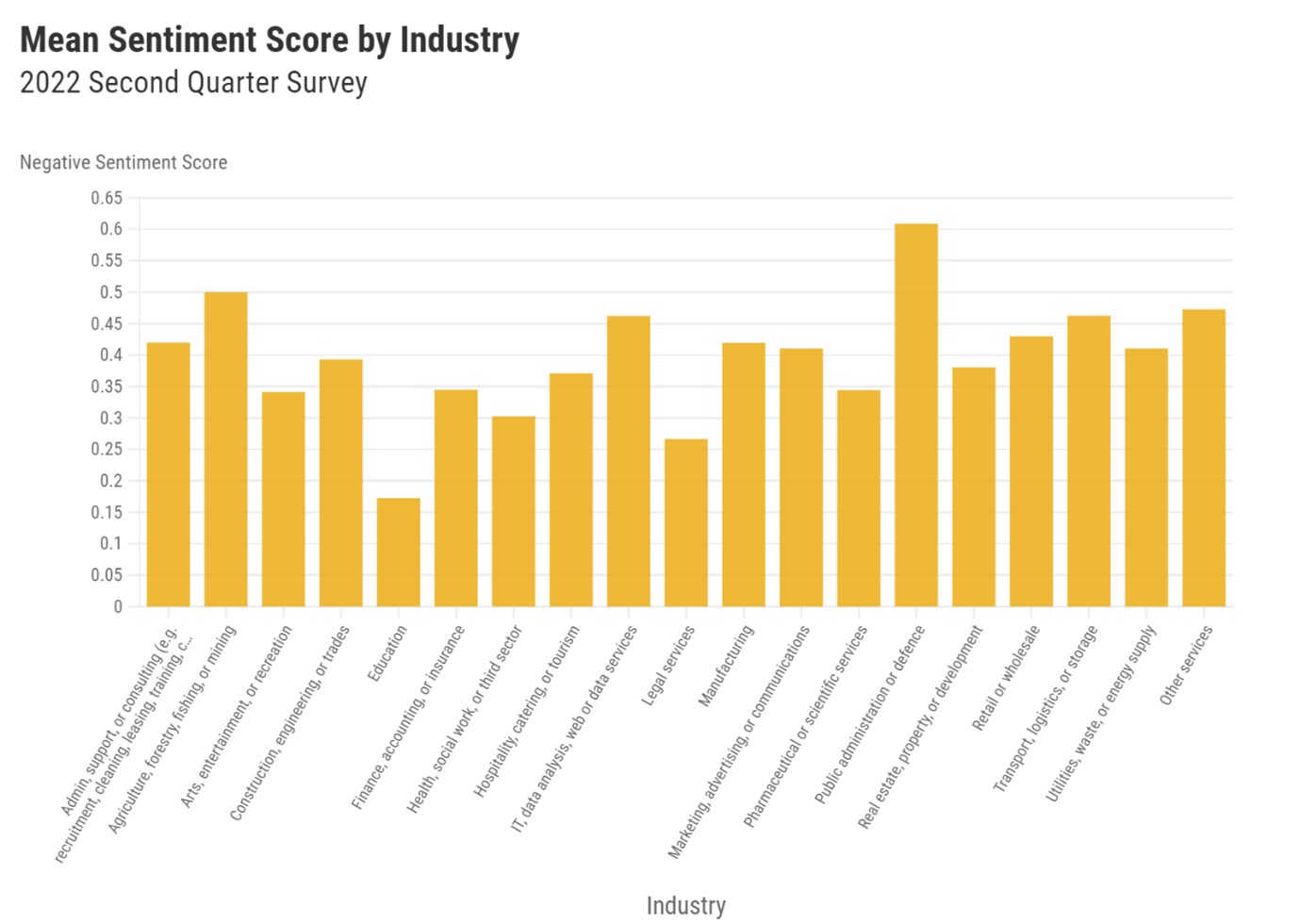

Sentiment by Industry: As well as looking at the sentiment scores by location, we also explored the differences across sectors, which can be seen in Figure 7. The categorisation of industries changed across the surveys, so here we focus on the most recent survey alone. The sectoral disaggregation here is largely focussed on different service industries, with only one category for manufacturing as well as for agriculture, forestry and fishing. Negative sentiment is the highest in public administration, and in agriculture, and is also relatively high in manufacturing. The lowest negative sentiment scores are in Education and Legal services.

Figure 7: Sentiment scores by industry over time

Sentiment by Firm Size: Finally, we consider the sentiment scores by firm size (number of employees) by year. Interesting here is the lack of variation by firm size. In the face of economic challenges, it is often argued that such challenges may be harder for smaller firms to deal with. There is little evidence of that here, except for the increase in negative sentiment scores for sole traders in the July 2022 survey.

Figure 8: Sentiment scores by firm size over time

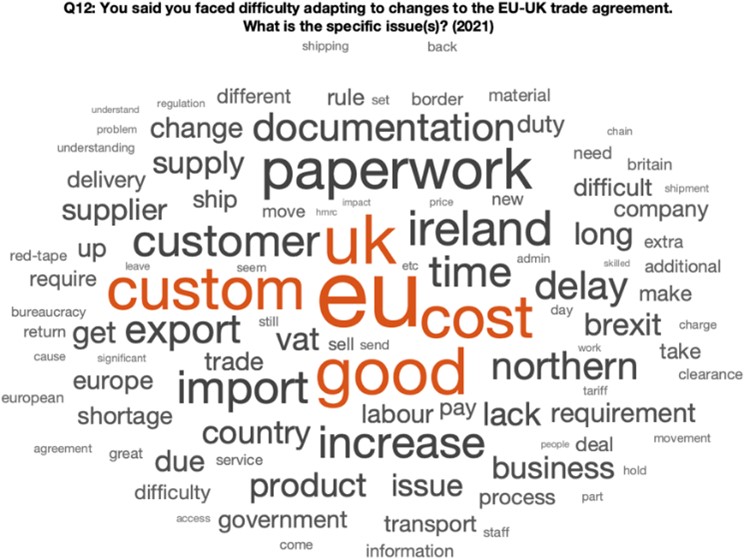

This section focuses on the issues that are specific to the introduction of TCA. We compare across the 2021 and 2022 surveys where firms were asked two very similar questions concerning the TCA. In 2021, they were asked about the difficulties they faced adapting to changes born about the TCA, and in 2022 they were asked about the specific disadvantages of the TCA[1]. The latest 2022 survey asked a different question which asked firms the extent to which the TCA is enabling their business to grow. Only 24% of firms agreed that this was the case, while 77% disagreed. Relatedly, firms were also asked whether or not they are managing to meet the TCA requirements for accessing the EU market. Approximately 20% of the respondents to the question answered that they could not meet the requirements, and for 75% of these, their exports have declined as a result. Interestingly too, for 18% of those firms that could meet the requirements, the TCA has induced them to export to new markets or to consider exporting to new markets.

The word clouds below are based on the common responses to the first two surveys, and help to identify common difficulties/disadvantages that respondents faced with the TCA.

Figure 9: Word clouds based on single words

Figure 10: Word clouds based on 2 words

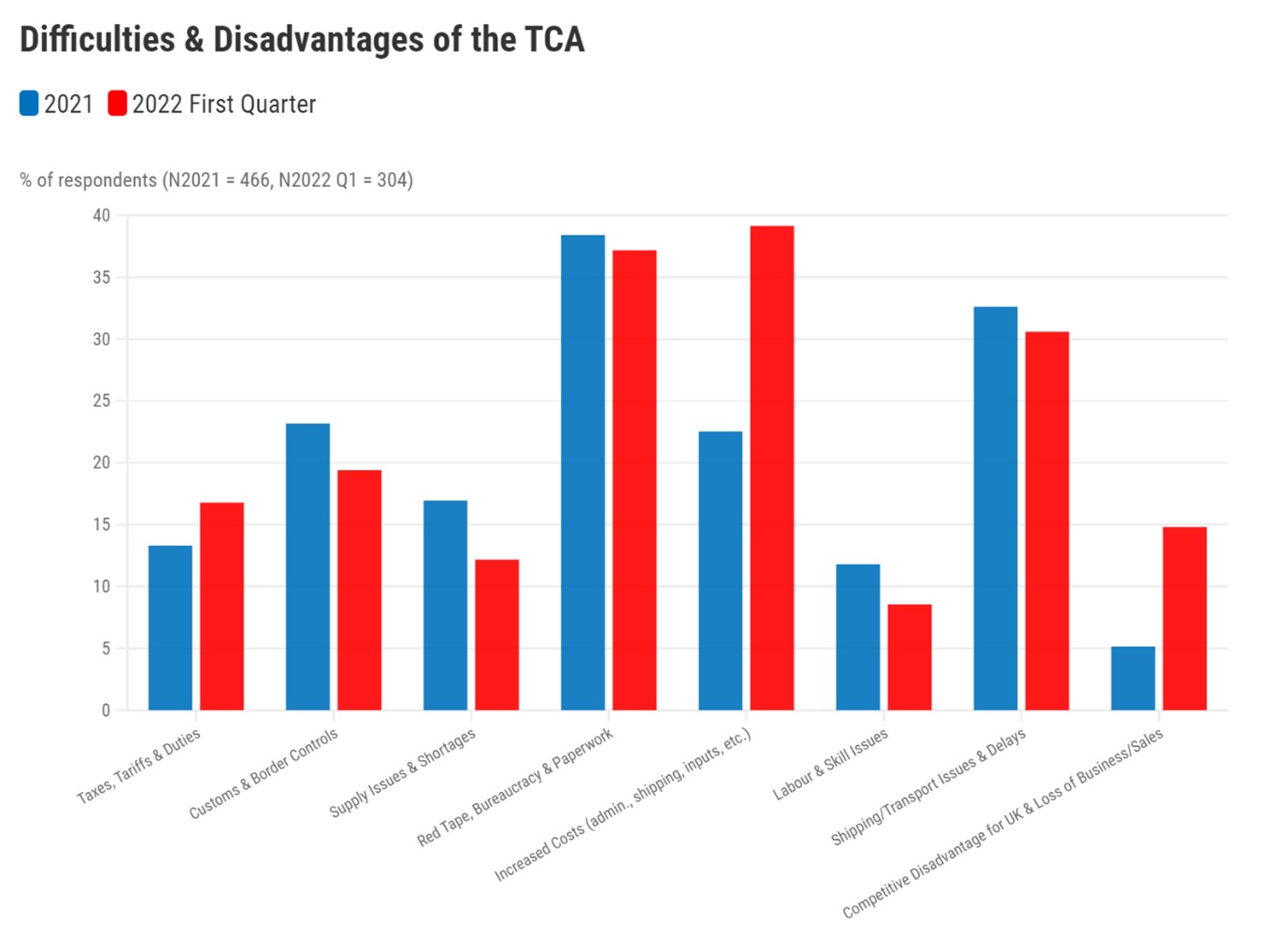

Based on the word clouds, eight categories of the main difficulties/disadvantages faced by firms were identified. There is of course inevitably a degree of overlap between some of these categories such as ‘customs and border controls’ and ‘red tape, bureaucracy and paperwork’. The bar chart (Figure 11) depicts the frequency with which the words within each of the categories appear in the 2021 and 2022 surveys. The frequency is computed as the number of answers that make reference to at least one of the terms in each category, divided by the total number of responses. Hence, for example, we see that between 35-40% of the respondents in both surveys report that red tape, bureaucracy and paperwork is an issue. It is important to mention that the instances are not double-counted. For example, suppose that the words ‘paperwork’ and ‘documents’ appear in the same answer for example “extra paperwork and documentation are needed”. In this case, only one instance will be counted and not twice.

Figure 11: Issues for firms working with the new TCA trading arrangements with the EU

There are several important messages from this chart. First, consistently across both 2021 and 2022, the more significant issues for firms working with the new TCA trading arrangements with the EU are those associated with red tape, bureaucracy and paperwork; shipping/transport issues and delays; increased costs; and customs and border controls. This is consistent with the message earlier regarding the main barriers to exporting. The least significant issue would appear to be labour and skill issues. Second, the biggest changes over time appear to be the rise in the significance of taxes, tariffs and duties for firms, the role of increased costs for firms, and the increased perception of a competitive disadvantage. Indeed, respondents made reference to their competitive disadvantage and loss of trade with the EU nearly three times more in 2022 than they did in 2021. Supply issues and shortages, and labour and skill issues seemed to have eased slightly since 2021.

The July 2022 survey also asked three questions with regard to supply chain challenges that firms may be facing. Over 50% of the firms responded that they are experiencing shortages, and for manufacturing firms, the share was 70%. In this final part of the report we highlight the key features of the textual responses from the firms. We first identify the perceived causes of the shortages being experienced by firms, and then we consider the main goods and services where firms experienced shortages, and finally, we examine the role of shipping cost uncertainties.

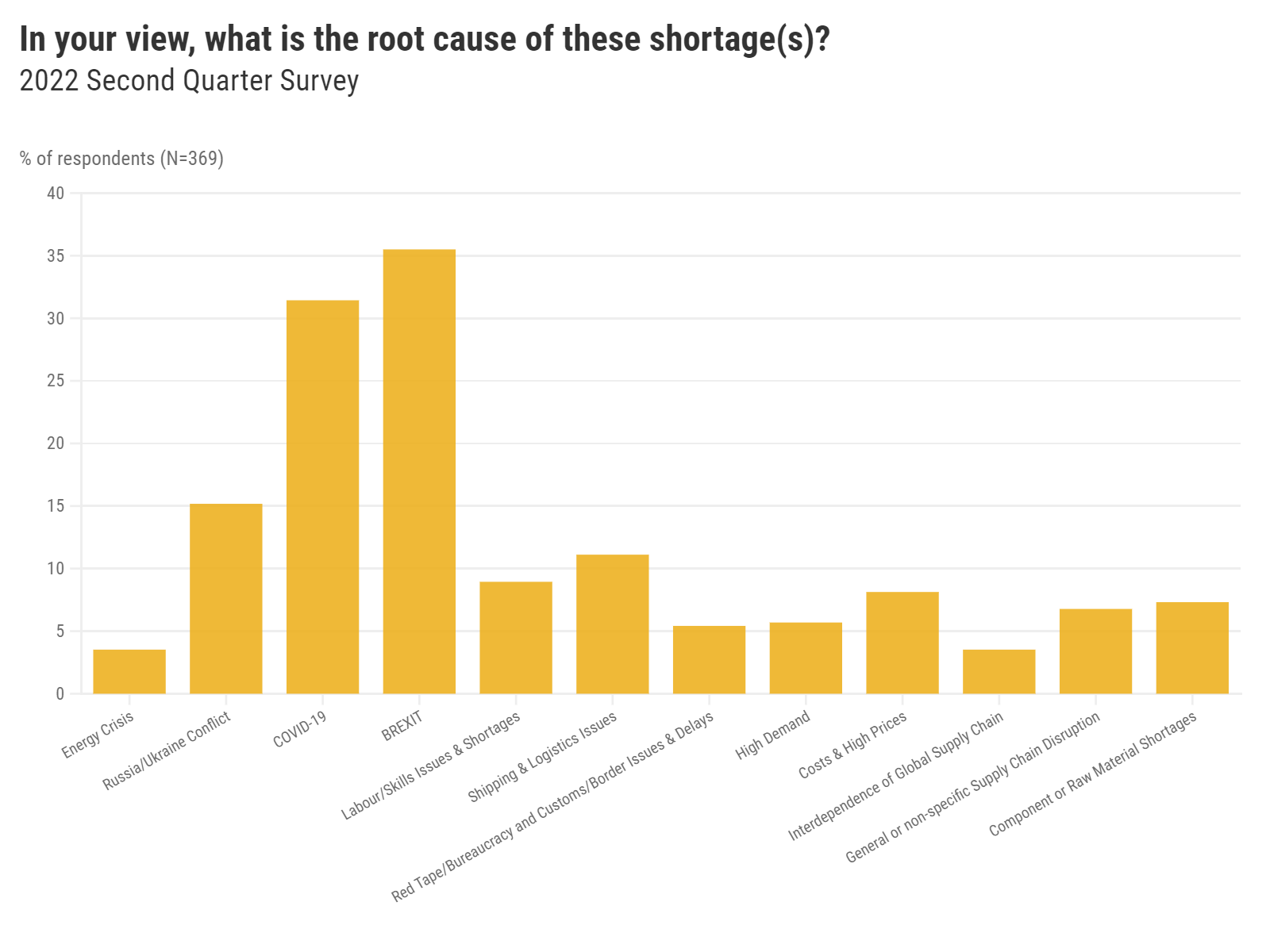

Firms were asked what the principal causes were of the supply chain shortages, and Figure 12 gives the 10 most significant factors which were identified. As earlier, we use text pre-processing and text mining to identify the most frequent occurrences. Top of the list is Brexit, with over 35% of the respondents to this question identifying this as a causal factor. This is closely followed by Covid-19. The third factor considered important relates to the Russia-Ukraine conflict. Note, however, that the final three columns indicate different aspects related to supply chain challenges, which impacted businesses.

Figure 12: Causes of supply chain shortages

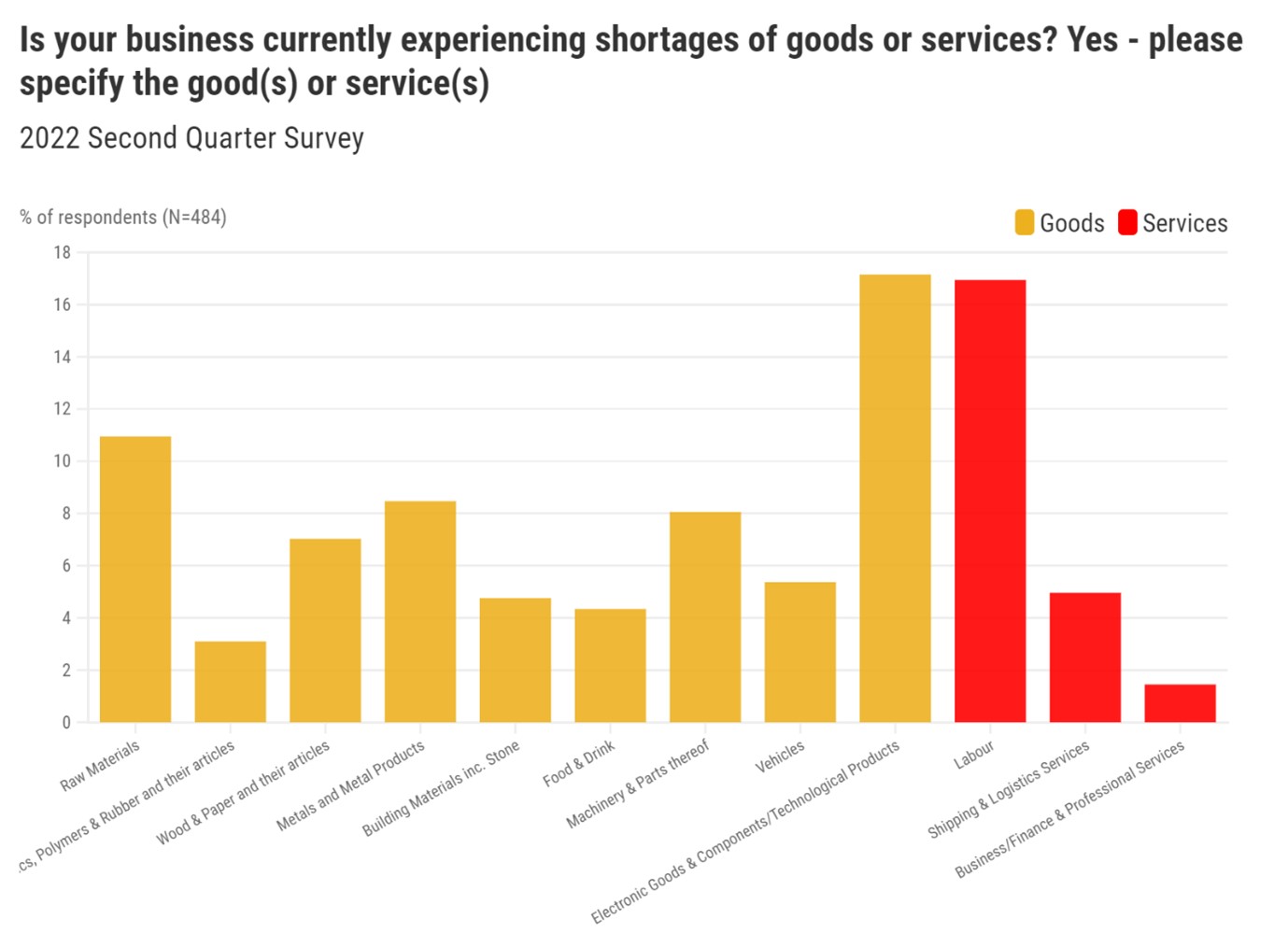

Figure 13: Shortages amongst goods and services

Figure 13 then considers the goods and services which appeared to be most problematic for firms experiencing supply chain problems. Here we see that the most significant were electronic goods, and labour, followed by raw materials, then metals and machinery and parts.

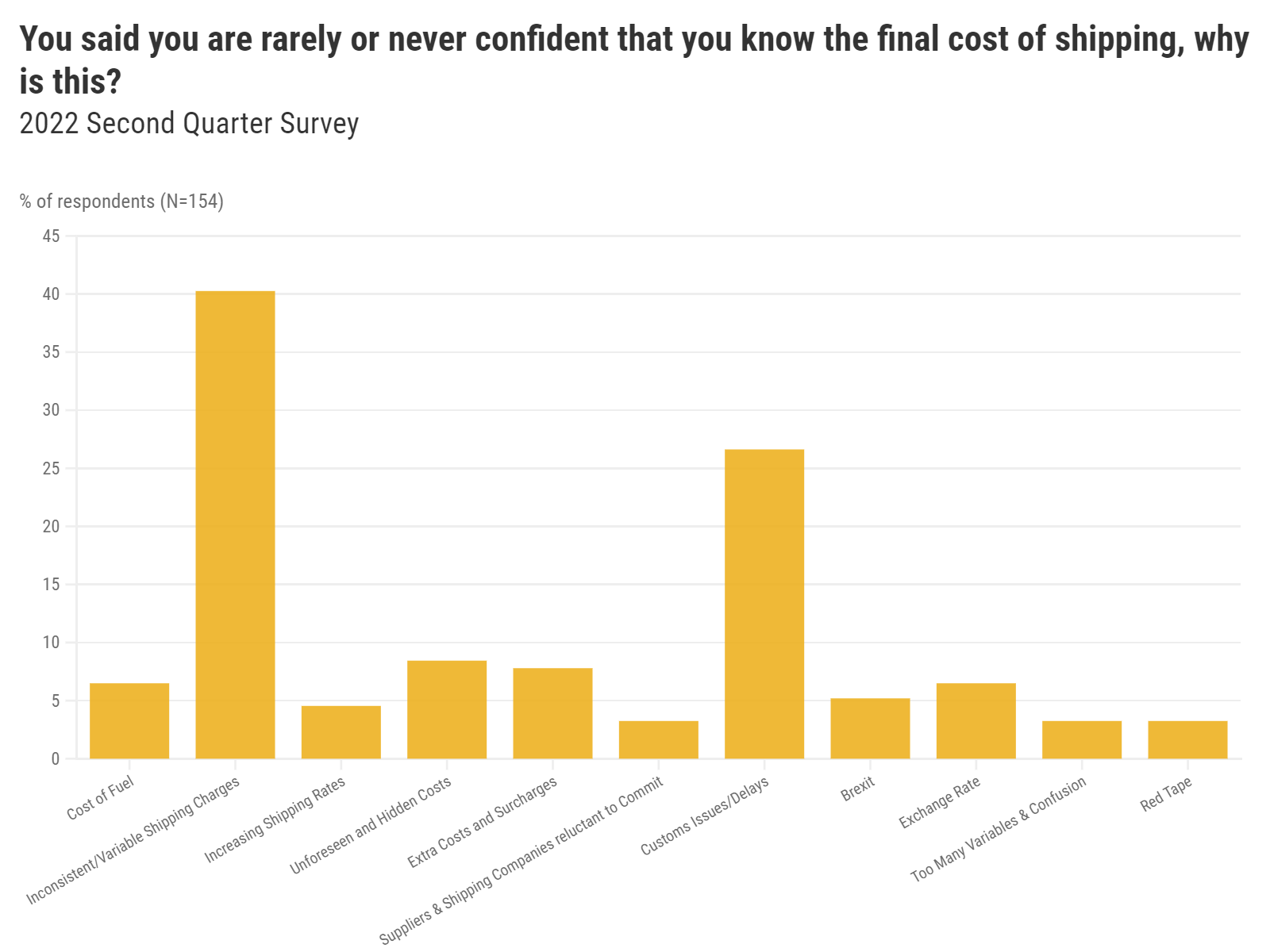

Figure 14: Underlying reasons behind uncertain shipping costs

Finally, the 2022 survey identified that 34% of the firms indicated that they were not confident about the final cost of shipping goods, and were then asked about the underlying reasons for this. The key responses can be seen in Figure 14. What emerges from this are two principal factors – uncertainty with regard to the shipping costs themselves, and secondly customs issues/delays.

In this Briefing Paper, we analyse and summarise the free text responses from three BCC surveys, undertaken across 2021 and 2022, which focused on the trade-related challenges and opportunities faced by UK businesses. The surveys paint a fairly grim picture with regard to the difficulties being faced. Perhaps not surprisingly, the principal overall difficulties are related to increased costs, and labour and skill issues. To the extent that businesses are facing increased costs – be this as a result of supply chain issues, increased red tape and bureaucracy arising from Brexit, or indeed from the energy crisis – we can be sure that sooner or later, it is likely these will be passed on to consumers. Equally, some business may go out of business if they cannot compete against other firms (e.g. in countries not experiencing such increased costs) leading to job losses. Given that the UK is already experiencing a cost of living crisis, this is a serious issue.

Brexit also appears to be an important factor and is cited most often as the cause of supply chain shortages faced by firms. Interestingly, there appears to be little difference by size class of firms, or by UK regions in the intensity of negative responses, which indicates the widespread nature of these challenges. Finally, it is important to note that these surveys reflect the immediate and more direct concerns of UK businesses. It is likely that these factors will impinge upon investment in the UK – both domestically driven and also foreign direct investment – and thus will also have longer run effects on UK businesses, employment and the UK economy. While this is beyond the scope of this Briefing Paper, it highlights the importance of a suitable policy framework to encourage productive investment, in which stability and transparency, and good trade relations with our closest and largest economic neighbour (the EU) will play an important role.

1. Text Pre-processing for Natural Language Processing (NLP)

To begin analysing the answers from the surveys, it is important to pre-process the text data by using a wide variety of text mining and natural language processing (NLP) techniques. These are as follows:

Pre-processing the text data with these NLP techniques assists the computer in understanding human language by structuring the information. The data is now far more useful and easier to process. For example, word clouds can be generated which are a useful tool for analysing open text responses such as the answers to the surveys. They enable you to visualise the responses and learn which words and n-grams appear most frequently. A key advantage of having lemmatised the text data before processing it is that, given that all the inflected forms of the words are grouped together as a single item, the frequency of the words and n-grams can be counted accurately, and the word clouds can be simplified.

2. Building a Binary Sentiment Classifier

A subsample of 988 sentences extracted from the responses of the 2022 survey have been manually classified with a positive or negative sentiment. This sample is then used to train a long short-term memory (LSTM) network. These types of neural networks are ideal for this application, as they are capable of recognising complex dependencies in sequential data. And thus, they are able to learn the semantic details that are more representative of each of the categories of interest; in this case the opportunities (positive sentiment) and challenges (negative sentiment). The training and use of this LSTM network, entails the following steps:

1. The pre-classified sample is partitioned into a training sample and a validation sample. The latter corresponds to 30% of the total number of sentences.

2. The sentences are converted into numeric sequences, that is, each word is assigned a numeric index using a word encoding.

3. The LSTM network is trained using the numeric sequences that have been manually classified as examples of sentences with positive or negative sentiment.

4. Once the network is trained, it can be used to predict the category of external data. In this case, the sentences extracted from the 2021 survey.

The training process produces high levels of accuracy. In particular, when the model is asked to predict the category of the sentences in the validation sample, 92.23% of the time the correct category is assigned. Using this trained network, all of the sentences from the 2022 and the 2021 surveys are classified.

3. Sentiment analysis

To train the deep learning model and to compute sentiment scores, the following procedure is implemented:

1. The words from the economic lexicon are partitioned into a training sample and a validation sample. The latter corresponds to 30% of the total number of sentences.

2. The words from the lexicon are converted into numeric vectors, using the word embedding.

3. A fit discriminant analysis model is trained using the numeric vectors that have been ex ante classified with positive or negative sentiment. The validation accuracy of the model is 99%.

4. Once the model is trained, each of the 999,994 words contained in the ‘fastText’ word embedding are classified.

1. Then a sentiment score for each word is computed, using the posterior probability of each category.

2. The posterior probabilities are normalised between -1 and 1, such that scores less than zero correspond to a negative sentiment, and scores greater than zero are associated with a positive sentiment.

5. Finally, to compute the sentiment scores for each sentence, the average sentiment is taken across the scores of each word.

[1] ‘You said you faced difficulty adapting to changes to the EU-UK trade agreement. What is the specific issue(s)?’ (2021); ‘What specific disadvantages do you think the TCA brings?’ (2022)