Little can be expected from market liberalisation

Rule-making is the key area of “ambition”

Area of ambition 1: Enhancing investment

Area of ambition 2: Promoting e-commerce and digital trade

What to do with unfinished business?

The Japanese and UK governments launched a bilateral trade negotiation on 9th June 2020 to create an “ambitious, high standard and mutually beneficial” Free Trade Agreement (FTA) based on the EU-Japan EPA.[2] The parties are aiming to conclude the FTA by the end of the post-Brexit transition period on 31 December and make a swift transition from the EU-Japan Economic Partnership Agreement (EPA) on 1st January 2021 so as not to interrupt business.

Although the political incentive to achieve the FTA is mounting on both sides, there is a lack of in-depth multi-disciplinary analysis which captures the whole picture of the negotiations. This paper aims to examine the issues we should consider when assessing its value. First, I argue that there are two key underlying challenges for this negotiation. Then I discuss what should be prioritised to make the Japan-UK FTA ambitious, taking into account the unprecedented short negotiating timeframe. Lastly, I address a few other outstanding issues and propose a possible mechanism to cope with unfinished business in order to make the agreement truly valuable from the long-term point of view.

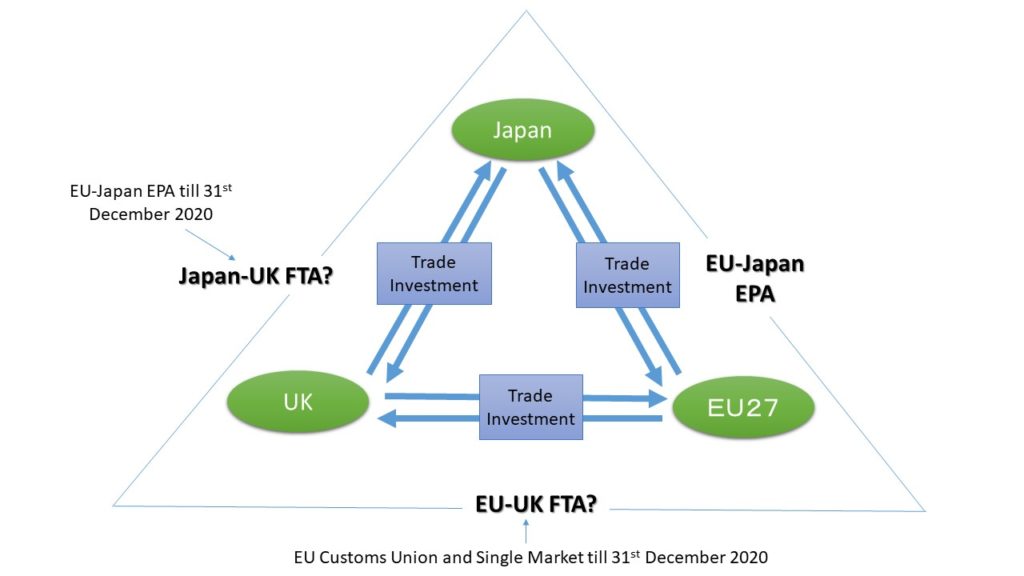

There are two significant challenges underlying the Japan-UK FTA negotiation. The first is that the Japan-UK FTA on its own cannot reflect the EU-Japan-UK trilateral relationship. Although the Japan-UK FTA negotiation is a completely independent bilateral negotiation from the EU-UK future relations, the EU-UK FTA does matter for business because the Japan-UK trade and investment relationship constitutes one side of the EU-Japan-UK trilateral relationship. (Figure 1).

This trilateral trade and investment relationship is the product of Japanese and UK firms’ engagement in Global Value Chains (GVCs) and supply chains in Europe. For Japanese business, this trilateral relationship is particularly important. As widely known, since the 1980s, Japanese firms have established a business model in Europe of using the UK as a hub for business in Europe or a gateway to the EU market. The precondition of this business model was that the UK is an EU member state. In other words, free movement of goods, services, people and capital as a part of the EU Customs Union and the Single Market were taken as granted.

The end of frictionless trade between the EU and the UK after the Post-Brexit transition period directly impacts the current Japanese business model. According to a survey, the top concern of Japanese companies doing business in the UK and the EU is the EU-UK future relationship. Notably, border frictions created by new border controls and customs procedures; tariff rates; and ending the free movement of people are listed as the factors that impact most heavily on Japanese business in Europe, especially manufacturers. Given that these factors threaten their day-to-day business, their interests in the Japan-UK FTA are overshadowed.[3] Of course, British firms also have far more at stake in the EU-UK FTA than the Japan-UK FTA and ration their attention accordingly.

The second underlying challenge is to strike a balance between “continuity” and “ambition”. The Japanese government expressed the necessity to complete the bilateral negotiations by the end of July, in order to fit the outcome into its domestic legislative process. This means a negotiation timeframe is less than two months since the negotiation has launched on 9th June. Even though the negotiation is based on the EU-Japan EPA, the negotiating timeframe is unprecedentedly short.

Both governments are currently negotiating a deal that prioritises “continuity” because high-level political pressures for achieving “continuity” are mounting. The UK government has recently conceded that a UK-US FTA will not be concluded before the US Presidential election this autumn despite the strong desire to make it a central in the “Global Britain” agenda. [4] Accordingly, striking a trade deal with Japan, the world’s third-largest economy, is expected to be the first major FTA deal for Post-Brexit Britain. For the Japanese government, there is strong pressure from Japanese business to achieve a smooth policy transition from the EU-Japan EPA to the Japan-UK FTA on 1st January 2021 in order to avoid business destructions.

On the other hand, Japan is wishing to pursue an “ambitious” FTA with the UK. It was Japan that rejected rolling over the EU-Japan EPA. There were two reasons for Japan’s rejection.[5] One reason is that Japan wanted to achieve a higher level of liberalisation and rule-making in the areas where Japan could not reflect its interests when it negotiated the EPA with the EU. This unfinished business for Japan includes immediate elimination of auto tariffs; an innovative chapter on digital economy; and a comprehensive investment chapter encompassing liberalisation, protection and dispute settlement. The second reason was the domestic legislative procedure. Even though Japan had concluded a “continuity agreement” with the UK which completely replicated the EU-Japan EPA, the Agreement was regarded as a new FTA. This means that it requires a formal approval procedure to pass the Diet (Parliament) of Japan, which is always time-consuming and not a straight-forward process. Once the continuity agreement is approved, it would become almost impossible to renegotiate.

From the UK’s point of view, a great advantage of making a new FTA with Japan is that it can directly reflect its economic interests. When the EU-Japan EPA was negotiated, the UK interests were marginalised and focus was given more to exports of agri-food products and processed agricultural products, non-tariff barriers on goods (i.e. TBT, SPS) and trade and sustainable issues. By creating a new FTA based on the EU-Japan EPA, the UK could focus on its economic interests, such as services trade and digital trade.

Then, in what way could both governments strike a balance between “continuity” and the scope and level of “ambitions”? Trade negotiations can be categorised into market access negotiations and rule-making. In the case of the Japan-UK FTA, market liberalisation in goods and services cannot be expected except for some outstanding issues, such as accelerating the schedule of tariff eliminations and inclusion of sectors currently exempted from the EPA.[6] For example, Japan shows strong interest in the UK’s immediate elimination of the auto tariffs (the current MFN tariff is 10%), which are scheduled to be eliminated in eight years in the EU’s commitments. In services, including audiovisual services, which is exempted from the EU-Japan EPA, due to EU’s principle on protecting the diversity of cultural expression, would be of mutual interest to Japan and the UK.

There are multi-layered reasons why the UK cannot expect EU-Japan EPA-plus market access. First, the negotiating timeframe, which is less than two months, is simply too short to do serious market access deals in goods and services. In addition, negotiating agricultural tariffs and tariff-rate quotas is completely unrealistic because this is domestically highly political.

Second, the EU-Japan EPA has achieved a high degree of market liberalisation. For trade in goods, it has achieved tariff eliminations of approximately 99% of the EU goods and 94% of Japanese goods.[7] The UK is already enjoying its benefits. Room for further liberalisation is extremely limited from the outset.

The third reason is more theoretical. Japan made concessions to the EU in the EU-Japan EPA when the EU was 28 countries, including the UK. Conventional negotiating theory tells that the size of the market is a major factor that constitutes bargaining power. Given that the size of the EU economy is about 3.5 times larger than the Japanese economy in terms of GDP and four times larger in terms of population, the EU exercised its bargaining power during the EU-Japan EPA negotiation.[8] Now that the UK is separate from the EU, its market is about 57% of the Japanese market in terms of GDP and about a half size in terms of population. This theoretically indicates that it is Japan that could exercise its bargaining power.

Lastly, the Most Favoured Nation (MFN) provisions in the EU-Japan EPA legally limit Japan’s capacity to commit to a higher level of market liberalisation with the UK than it has provided to the EU. According to the MFN provisions, if Japan accords a higher level of liberalisation to a future FTA partner, this should be unconditionally shared with the EU.[9] The MFN provisions in the EU-Japan EPA covers trade in goods, cross-border trade in services and investment liberalisation.[10] For example, if Japan grants a larger or faster tariff reduction, higher quota or any other more favourable treatment to the UK than it did to the EU, within three months from the date that the Japan-UK FTA enters into force, Japan has to start reviewing to offer the same preference to the EU and conclude the review within six months (Article 2.8.4).

The above envisages that rule-making beyond the EU-Japan EPA should play a pivotal role in creating value in the Japan-UK FTA. Given the very limited negotiating timeframe, the two governments have to narrow the scope of ambitions. We consider that there are two important areas of ambitions: investment, and electronic commerce and the digital economy.

Whereas the Japanese Government has a strong interest in improving investment rule, the UK Government seems to be not fully aware of its value.[11] The Japan-UK FTA should be broadly designed to serve investment for the following economic and policy reasons.

In terms of economics, Japan and the UK have a strong investment relationship. For the UK, Japan’s investment stock in the UK is the second-largest among non-EU countries after the US and the 6th largest (5.9%) if we include the EU members and the UK Offshore Islands.[12] For Japan, the UK is the second-largest foreign direct investment (FDI) destination following the US. It is important to note that Japanese investment to Europe has been concentrated in the UK, accounting for almost 40% of total FDI stock.[13]

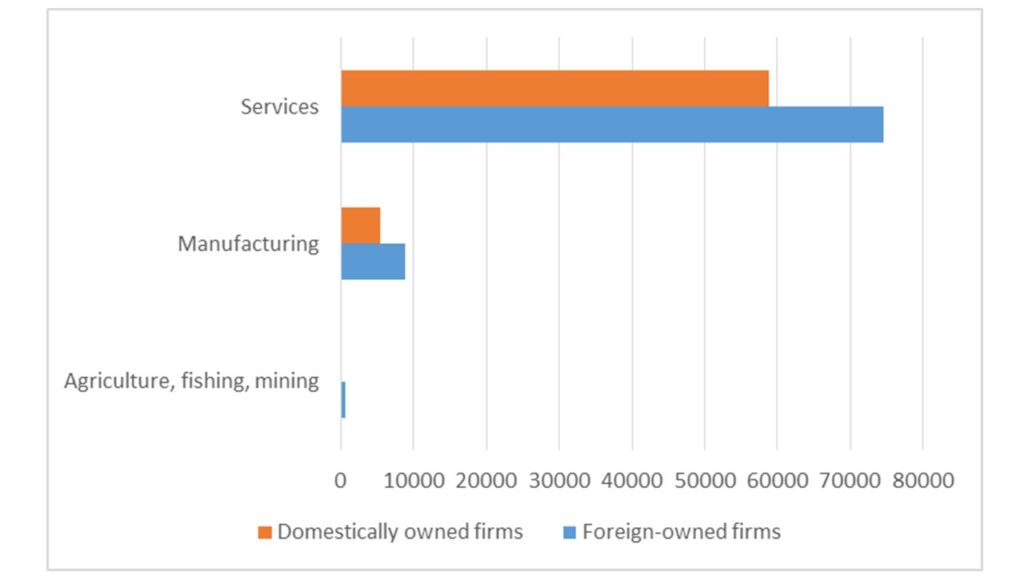

From the UK perspective, Japanese companies are an important source of employment, creating 130,000 jobs in the UK (2018).[14] What is not well known yet is the role of foreign-owned companies in UK exports, especially in services. More than half of UK services exports (£74.6 billion) are generated from foreign-owned firms including Japanese firms (Figure 2). For example, foreign-owned manufacturing firms in the UK, such as the automotive, chemical and pharmaceutical industries, generated £8.8 billion in services exports.[15] These are the sectors where Japanese firms have been investing. Given that Japan is the largest investor abroad in the world (14% of the world total in 2018),[16] whether the post-Brexit UK can continuously attract Japanese investment must be a highly critical issue for the UK economy.

Source: Table 1: UK services exports by broad industry categories (£million) in Borchert, I. and Magntorn Garrett, J. (2020), “Foreign Investment as a Stepping Stone for Services Trade”, the UKTPO blog. The original data is sourced from ONS dataset: UK trade in services by business characteristics, 2016-2018. Numbers are based on averages across 2016-2018 and exclude any values undefined by industry or business characteristics. Industry “Repair and installation of machinery and equipment” is included in Manufacturing, and industry “Electricity, gas, steam and air conditioning supply”, which makes up 0.1% of UK’s services exports by foreign and domestic firms, is excluded.

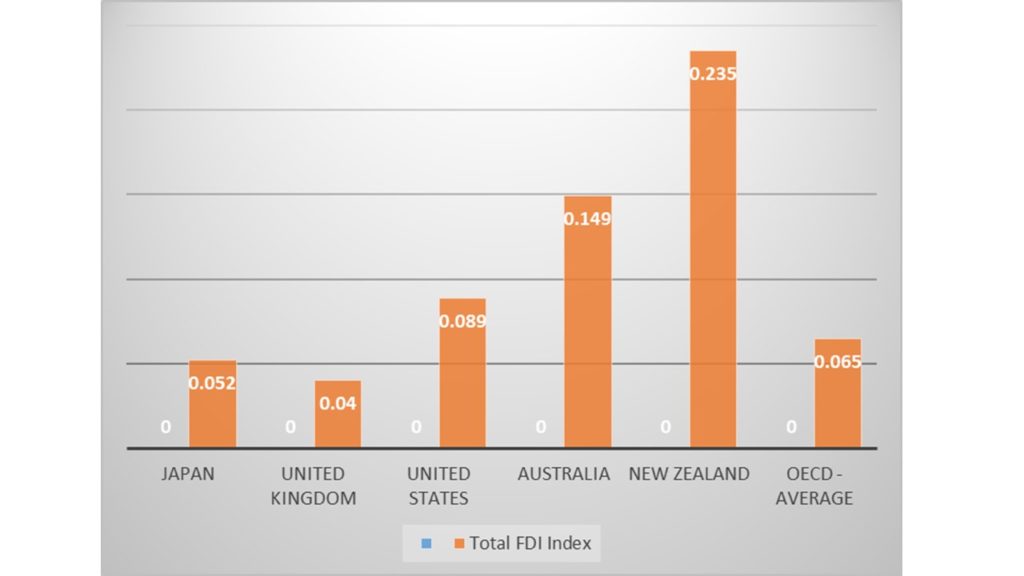

In terms of policy, there are four important points to be made. First, there is little room to negotiate investment liberalisation in an FTA in the first place since actual investment policy environments in both Japan and the UK are quite liberal. According to the OECD FDI restrictiveness index, both the restrictiveness of Japan and the UK is lower than the OECD average while those of other UK’s prioritised FTA negating partners, such as Australia, New Zealand, and the US, show higher restrictiveness than the OECD average (Figure 3).[17] The Index gauges the four main types of statutory restrictions on FDI, including foreign equity limitations; screening or approval mechanisms; restrictions on the employment of foreigners as key personnel; and operational restrictions (e.g. restrictions on branching and on capital repatriation or on land ownership). It does not cover other factors that may impact the FDI environment, such as degree of policy implementation, institutional quality and market structure. Nevertheless, the Index can show the degree of investment openness that FTAs could encompass. The scores of restrictiveness of Japan (0.052) and the UK (0.04) account for almost 0, which means almost completely open (as described in the note of Figure 3).

Source: OECD FDI Regulatory Restrictiveness Index 2018

Note: OECD FDI Regulatory Restrictiveness Index weights each restriction given a score based on assessment of its importance (Closed=1, Open=0). Aggregate score is weighted average of sectoral scores. The Index covers selected 45 sectors. More in detail, see https://www.oecd.org/investment/fdiindex.htm

The second important point is that the investment section of the EU-Japan EPA covers only investment liberalisation.[18] During the EU-Japan EPA negotiation, Japan tried to include a comprehensive investment chapter with the EU, but they could not agree on the investment dispute settlement issue. Although the issue was part of continuing negotiations towards a future bilateral investment treaty (BIT), its prospects look gloomy. This is because the EU is promoting the Investment Court System while Japan supports the Investor-State Dispute Settlement (ISDS).[19]

Third, there is no BIT between Japan and the UK. Japanese business shows a strong interest in concluding a BIT with the post-Brexit UK. [20] Given that Japanese firms have been exposed to Brexit-related uncertainty since the EU Referendum in 2016 and that the future political and legal uncertainty on the EU-UK future relationship after January 2021 prevails, they have a strong desire to ensure legal assurance to continue their business. Currently, the UK has 92 BITs in force, including a BIT with Korea that contains ISDS. In comparison, Japan has only 29 BITs in force. Thus, incorporating a comprehensive investment chapter into the Japan-UK FTA is a rational way to upgrade the investment policy framework.

Last but not least, the issue is also important if the UK is to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in the future. In general, states have been actively incorporating investment provisions into FTAs to promote investment liberalisation and investment protection since the early 1990s. The CPTPP has a comprehensive stand-alone investment chapter containing ISDS provisions. The UK could use the Japan-UK FTA as a stepping-stone for its future accession to the CPTPP.

From the economic and policy perspectives, the Japan-UK FTA should create real value by providing a comprehensive investment chapter that secures existing investment and provides incentives towards future investment.

There is no doubt that enhancing rules on e-commerce and digital trade would be mutually beneficial for the Japanese and UK economies. As COVID-19 is inevitably accelerating digitisation more than ever, the need for creating the EU-Japan EPA-plus rules to enhance digital trade is mounting across all business sectors in both Japan and the UK.[21] For small and medium-sized enterprises (SMEs), which tend to be behind larger sized companies in exploring international markets, a comprehensive digital trade chapter would play a role in facilitating their access to foreign markets through digital trade.[22]

Due to its economic significance, both the Japanese and UK governments share an interest in upgrading the rules on e-commerce in the EU-Japan EPA. As can be seen from Table 1, which compares the major e-commerce provisions in the EU-Japan EPA and those in the CPTPP, there is no stand-alone chapter of e-commerce in the EU-Japan EPA and the CPTPP’s coverage of e-commerce is wider than that of the EU-Japan EPA. It is likely that Japan proposes incorporating the CPTPP’s e-commerce chapter into the UK-Japan EPA and creating a comprehensive digital trade chapter.[23]

However, negotiation would not be so simple as a copy and paste of CPTPP provisions. One thing we should be aware of is a fundamental legal concept divide between the EU-Japan EPA and the CPTPP.[24] While the EU-Japan EPA’s approach values safeguarding data privacy and security based on the EU’s digital trade policy, the CPTPP’s approach values more market-driven economy, influenced by the US that was TPP’s central rule-maker before its withdrawal.[25] In general, Japan’s approach in the digital economy underlines business and innovation and seems to be not entirely, but much closer to the US approach than to the EU approach.

Looking at the language used in both agreements in detail, obligatory and best endeavours language are mixed in both agreements, reflecting the legal concept divide. The core question is whether the UK, which is currently under the EU policy regime, could accept the CPTPP approach that underlines trade more than public sensitivity on data privacy. Given that some UK stakeholders, such as civil society organisations, have expressed concern about data protection and privacy standards, ignoring the legal concept divide may cause anti-FTA sentiment among non-business stakeholders. The UK Government has to carefully examine the provisions where differences exist between the EU-Japan EPA and the CPTPP or the CPTPP provisions which are not addressed in the EU-Japan EPA.[26]

One example is data localisation. Whereas the EU-Japan EPA has no provision on data localisation, the CPTPP broadly prohibits data localisation except for government data, financial services and a general four-step exception.[27] The CPTPP’s provisions reflect the market-oriented approach and deems that business are to decide location of data.[28]

Another example is privacy and data flow related provisions. The EU and Japan did not incorporate a provision of free-flow data in the EU-Japan EPA negotiation. The EU insisted to separate the data protection issue from the EPA negotiation because the EU’s basic position denies interference between its EU’s General Data Protection Regulation (GDPR) and its FTA negotiations.[29] The EU and Japan had a separate negotiation of adequacy on data protection and concluded the EU-Japan data adequacy agreement (entered into force in January 2019) as a side product of the EU-Japan EPA.[30] In the end, the combination of the EU-Japan EPA with the EU-Japan data adequacy decision as a whole provides a higher level of regulatory cooperation on data protection and privacy standards than the CPTPP.

The UK could safely accept the consumer protection and privacy-related provisions in the CPTPP since Japan, Canada, New Zealand have all been granted adequacy decisions by the EU while they are members of CPTPP. But it would not be enough for the UK as the UK is likely to maintain GDPR, which is the highest standard data privacy rule in the world.[31] In order to achieve the high-standard of data protection, Japan and the UK would have to improve the consumer protection and privacy-related provisions in the CPTPP. Another option would be to replicate the EU-Japan data adequacy decision and create a new Japan-UK mutual adequacy agreement separate from the FTA negotiation as the EU did. Either requires detailed technical discussions between the regulatory authorities of both countries. [32]

| EU-Japan EPA:

Section F: Electronic commerce (Article 8.70-8.81) in Chapter 8 (trade in services, investment liberalisation, and electronic commerce) |

CPTPP:

Chapter 14: Electronic Commerce |

|

| Non-discriminatory principle | No | Yes

Article 14.4: Non-discriminatory treatment of digital products |

| Prohibition of custom duties | Yes

Article 8.72: Custom duties |

Yes

Article 14.3: Custom duties |

| Consumer protection and privacy | Yes

Article 8.78: Consumer protection + The EU-Japan data adequacy agreement (entered into force in January 2019)* |

Yes

Article 14.7: Online consumer protection Article 14.8: Personal Information protection Article 14.10: Principles on access to and use of the internet for electronic commerce |

| Free flow of data | No (in the EU-Japan EPA)

The EU-Japan data adequacy agreement (entered into force in January 2019) |

Yes

Article 14.11: Cross-border transfer of information by electronic means |

| Data localisation | No | Yes

Article 14.13: Location of computing facilities *Prohibition of imposing data localisation requirements |

| Source code | Yes

Article 8.73: Source code *Provides more policy flexibility to governments. |

Yes

Article 14.17 Source code |

*Note 1: The EU-Japan EPA: Article 8.81 provides to reassess inclusion of provisions on free flow of data within three years.

Source: The EU-Japan EPA text and the CPTPP text

Narrowing the scope of “ambitions” would inevitably result in leaving other outstanding issues unfinished. The two areas of priority cannot fully cover the interests of both countries and suffice the level of ambitions the two countries should aim at for the long-term economic prosperity and inclusiveness. In order to make FTAs truly valuable, the Japanese and UK governments have to clarify other outstanding issues and unfinished business. Then they should arrange possible institutional mechanisms to maintain momentum to solve these issues and continue policy dialogues.

For example, sectoral regulatory cooperation in services trade would be an important area to develop. The UK and Japanese services markets are de-facto open but many business interests are handled differently in the different regulatory regimes. To solve the problem, sectoral regulatory cooperation, such as mutual recognition and equivalence, have to be negotiated. Unfortunately, there will not be enough time to negotiate these to achieve “continuity”, since negotiations for these issues are time-consuming and sectoral regulatory cooperation requires the participation of domestic regulatory authorities supported by detailed input from a specific industry. Establishing an institutional arrangement, such as a sectoral committee, to continue policy dialogues, would be a rational option to ensure momentum for future regulatory cooperation.

Another important issue is the linkage between rules of origin (RoOs) and supply/global chains. As already noted, the Japan-UK FTA cannot be disconnected from the EU-UK FTA because of the EU-Japan-UK trilateral relationship. RoOs in the EU-UK future FTA would influence Japanese business strategy on regional supply chains in Europe and investment in the UK. Also, product-specific RoOs in relation to third countries would provide an important incentive to business with regards to global supply chains. In the EU-Japan EPA, certain inputs for automobile production that originated from a third country, which has an FTA with both the EU and Japan, are considered as originating materials as long as certain conditions are fulfilled.[33] Canada, Chile, Mexico, Singapore, Switzerland and Vietnam, fall into this category. If the UK concludes an FTA with the EU including such a provision, these inputs made in Japan could be considered as originating materials of the UK. [34]

Japan and the UK are trying to strike an FTA, which is expected to be the first FTA with non-EU countries for Post-Brexit Britain by the end of 2020. The two countries are like-minded, sharing the values of the liberal order and supporting the rules-based international trading system. The FTA would become a solid foundation to develop a bilateral strategic alliance in the 21st century. However, we do not know how the Japan-UK FTA could be substantially meaningful for the two economies.

This paper explained what we should know when we assess the value of the Japan-UK FTA. The Japan-UK FTA negotiations has two underlying challenges. The first challenge is the Japan-UK FTA negotiation itself cannot reflect the EU-Japan-UK trilateral trade and investment relation. In reality, the result of the EU-UK future relationship will greatly affect Japan-UK trade and investment. The second challenge is that the two governments have to strike a balance between the scope and the level of “ambitions” and “continuity”. Since little can be expected from market liberalisation, rule-making plays a pivotal role in this negotiation. In order to achieve the “EU-Japan EPA-plus” FTA, Japan and the UK should narrow their ambitions to enhancing investment and promoting e-commerce and digital trade. Needless to say, the two areas of ambition cannot cover the interests of both sides. The two governments have to clarify other outstanding issues and create an institutional mechanism to maintain the momentum to continuously negotiate these issues.

[1] For the paper, a series of informal interviews with Japanese Government officials and business was conducted. The author would like to thank to these interviewees. Special appreciation goes to Mr. Koji Tsuruoka, Japan’s former Ambassador to the UK (2016-2019), for providing his insights based on his dedication to multilateral and plurilateral trade negotiations for decades at the negotiating front.

[2] The Japan-UK Foreign Ministers’ Strategic Dialogue 2020, Joint press statement (8th February 2020).

[3] “Oushuu shinshutu nikkeikigyou jittai chousa” (in Japanese) –A survey on Japanese business in Europe. JETRO, December, 2019 https://www.jetro.go.jp/world/reports/2019/01/fe6334f4e426937e.html.

[4] “UK abandons hope of US trade deal by end of year Balls”, Financial Times, 22 July 2020.

Balls, E., Borumand, S., Redmond, J. and Weinberg, N. (2020). Will Prioritising A UK-US Free Trade Agreement Make Or Break Global Britain? Transatlantic Trade and Economic Cooperation through the Pandemic,

M-RCBG Associate Working Paper No. 136, Harvard Kennedy School.

https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/files/136_Final_AWP.pdf

[5] From an informal interview with the former Japanese Ambassador to the UK (2016-2019), Mr. Kouji Tsuruoka, July 2020.

[6] The scope of Chapter 8: Trade in services, investment liberalisation and e-commerce; and Chapter 12: Subsidies in the EU-Japan EPA.

[7] Japan: 100% elimination in industrial products and 82% tariff elimination in agriculture, forestry and fisheries products; and the EU: 100% elimination in industrial products and 98% elimination in agriculture, forestry and fisheries products. The elimination rates of customs duties is based on the number of liberalised tariff lines. Source: Ministry of Foreign Affairs, Japan.

[8] The GDP of the EU 28 accounts for $17.3 trillion while that of Japan accounts for $4.9 trillion.

[9] See MFN provisions in EU trade agreements in Magntorn Garrett, J. (2018). Most Favoured Nation clauses in EU Trade Agreements: One more hurdle for UK negotiators, UKTPO Briefing Paper 25, November 2018.

[10] See MFN provisions in goods (Article 2.8.4); investment (Article 8.9); and cross-border trade in services (Article 8.17) in the EU-Japan EPA.

[11] According to DIT (2020). UK-Japan Free Trade Agreement: The UK’s Strategic Approach, investment is not included in “Negotiating objectives for a Free Trade Agreement with Japan” (pp9-11).

[12] Source: ONS data.

[13] Source: JETRO Investment data.

[14] Source: Ministry of Internal Affairs and Communications, Japan.

[15] Borchert, I. and Magntorn Garrett, J. (2020), “Foreign Investment as a Stepping Stone for Services Trade”, the UKTPO blog, https://blogs.sussex.ac.uk/uktpo/2020/06/11/foreign-investment-as-a-stepping-stone-for-services-trade/#more-4866

[16] Source: UNCTAD.

[17] OECD FDI Regulatory Restrictiveness Index 2018

[18] The EU-Japan EPA, Section B: Investment liberalisation (Article 8.6-8.13).

[19] Fukunaga, y. (2018). International Arbitration and Japan: Stagnant, but Signs of Change?, Cambridge University Press 2018, American Society of International Law. Proceedings of the Annual Meeting, Vol.112, pp.100-102.

[20] Keidanren, “Policy Proposal on Investment Treaties”, October, 2019. https://www.keidanren.or.jp/en/policy/2019/082.html

[21] For example, Japan and the UK tech sector shared the view that a digital trade chapter in the future Japan-UK FTA is critical for developing economic relations between the two innovative economies. https://www.techuk.org/insights/news/item/17538-techuk-welcomes-the-launch-of-uk-japan-trade-negotiations

[22] Federation of Small Business and UK Trade Policy Observatory (2020). The representation of SME interests in Free Trade Agreements –Recommendations for best practice, https://blogs.sussex.ac.uk/uktpo/files/2020/01/FSB-Trade-TPO-Report.pdf

[23] Chapter 14: Electronic commerce (Article 14.1-14.18).

[24] Watanabe, P.J. (2017). An Ocean Apart: The Transatlantic Data Privacy Divide and the Right to Erasure, Southern California Law Review, 90 (5).

[25] Schwarts, P. M. and Peifer, K. (2017). Transatlantic Data Privacy Law, Georgetown Law Journal, 2017, Vol.106(1), p.115(65). And Wolfe, R. (2019). Learning about Digital Trade: Privacy and E-commerce in CETA and TPP, World Trade Review, 18:S1, s63-s84.

[26] See p. 18 in Department for International Trade (2020). UK-Japan Free Trade Agreement: The UK’s Strategic Approach.

[27] Article 14.13.3. See further explanation on the issue in Abe, Y. and Collins, D. (2018). The CPTPP and Digital Trade: Embracing E-commerce opportunities for SMEs in Canada and Japan, Transnational Dispute Management.

[28] Wolfe, R. (2019).

[29] Wolfe, R. (2019). And Fahey, E. and Mancini, I. (2020). The EU as an Intentional or Accidental Convergence Actor? Learning from the EU-Japan Data Adequacy Negotiations (May 20, 2020). International Trade Law and Regulation 2020 Volume 2, Available at SSRN: https://ssrn.com/abstract=3606087.

[30] EU GDPR Article 45 (Adequacy decision).

[31] Wolfe, R. (2019).

[32] In order to get the adequacy approval from the EU, Japan enacted the supplementary rule of protecting personal data from the EU. The rule applied the higher standards than Japanese law (Personal Information Protection Act, entered into force in April 2005) provides and it applies only to personal data from the EU.

[33] This applies to inputs (HS 8407, HS8544, and HS8708) used to produce vehicles (HS8703) See Annex 3-B, Appendix 3-B-1: Provisions related to certain vehicles and parts of vehicles.

[34] See debate relating to this in Holmes, P., Mangntorn Garrett, J. and Winters, L. A. (2020). UK-EU Free Trade Agreement: Please, Sir, I Want Some More, UKTPO Briefing Paper 43 – July 2020.