25 February 2019

25 February 2019

Julia Magntorn Garrett is a Research Officer in Economics at the University of Sussex and a fellow of the UK Trade Policy Observatory.

Two weeks ago, the UKTPO called for further transparency on the Government’s current progress on replicating the existing agreements between the EU and third countries. On Thursday last week, Secretary of State for International Trade, Liam Fox MP made a public announcement confirming that little had changed since he gave evidence to the International Trade Select Committee on the 6 February and that the progress has been minimal. So far, only six out of the 40 existing trade agreements have been signed, covering a total of 9 countries; Chile, Faroe Islands, Switzerland, Israel, Palestinian Authority, Madagascar, Mauritius, Seychelles and Zimbabwe. One further agreement is close to being finalised, adding another 2 countries (Fiji and Papua New Guinea) to the list. This still leaves about 60 Free Trade Agreement (FTA) countries without continuity agreements.

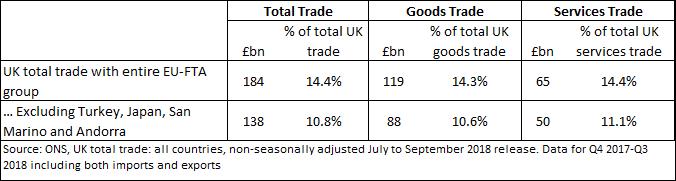

Dr Fox also announced that some agreements will definitely not be in place for exit day, those with Andorra, Japan, Turkey, and San Marino. The agreement with Algeria is also unlikely to be ready. When it comes to numbers, the announcement is thin on details. The Department for International Trade states that the EU-FTA agreements account for 11% of the UK’s trade, a figure that seems low to start with. No further information is provided as to how important the signed countries are to the UK’s trade, or how much of the UK’s trade with the rest of the FTA group is still at risk if we have a hard Brexit in about a month’s time. This blog aims to fill some of these gaps.

The 11% figure is based on ONS data for the year to end September 2018. Interestingly, the figure excludes Turkey, San Marino, Andorra and Japan, precisely the countries which Dr Fox confirmed will not have agreements ready for 29 March 2019. Including these four countries brings the total figure to over 14% of the UK’s trade. Using a slightly different data source (UN Comtrade), though still based on official UK data, the average share of these countries in the UK’s total goods trade (2015-2017) is over 14% for imports and 15% of exports. These statistics exclude Japan, as the EU-Japan FTA only came into force on 1 February 2019.[1] Further, while these figures represent the total across all industries, for some industries and firms the FTA group accounts for a much larger share of trade.

Using the ONS data again, but now only looking at goods, shows that the nine countries with which trade agreements have been signed account for around 2.2% of UK’s total goods trade (imports + exports) and 15.3% of UK’s total trade with the FTA group (including Japan), or 17.7% of UK’s trade with the FTA partners excluding Japan. This means that, at present, around 80% of the UK’s goods trade with the FTA group is still at risk come 29 March. The four countries which we have been informed will not have agreements ready by this date account for 3.8% of the UK’s total trade, a larger share than those that have been agreed. Excluding Japan from the former group (where the UK has traded without preferential access up until 1 February this year) brings this share down to around 1.8% of the UK’s total trade and 14.6% of the UK’s EU-FTA trade.

We welcome the release of this information, but the public has a right to know the reality of the situation we are now in. The full list of countries which the UK currently has trade agreements with (through its membership of the EU) account for at least 14% of the UK’s trade, not 11% as stated by the Government. The agreements that the Government has managed to replicate so far only account for a relatively small share of this.

Any agreement has to be laid before parliament for 21 sitting days before being ratified. After today, there remain only 21 sitting days until the day the UK is set to leave the EU. The alternative to the 21 days is ‘provisional application’ but – both from the UK’s legal perspective and that of partner countries’ – that is not straightforward. If no further advances are made in rolling over the remaining agreements, the majority of the UK’s trade with the FTA group risks losing the preferences that companies are currently relying on. Come 29 March 2019, ‘Global Britain’ might find itself not so global at all.

[1]See the UKTPO’s latest blog post on the topic, which uses data from Comtrade for the period 2015-2017. This blog uses a different data source and therefore some numbers in this blog differ from numbers reported in the earlier blog.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Excellent summary. The detail of the agreements is worth looking into too…

It is pretty poor for the sectors I represent – meat and dairy.

Regards,

J.P. Garnier

Meatwise International

[…] Magntorn Garrett, The UK’s Continuity Trade Agreements: Missing in Inaction, UKTPO blog, 25 February […]