11 June 2020

11 June 2020

Dr Ingo Borchert is Senior Lecturer in Economics and Julia Magntorn Garrett is a Research Officer in Economics at the University of Sussex. Both are fellows of the UK Trade Policy Observatory.

Since the beginning of the pandemic, attention has shifted away from the economic implications of Brexit and towards what a post-COVID economy might look like. This is understandable, yet by now it looks as if a hard Brexit might be just around the corner. Last week the fourth round of negotiations between the UK and the EU ended without visible progress, and the Government has repeatedly ruled out an extension to the transition period. Thus, in spite of the continuing impact of COVID-related restrictions, it seems warranted to put back into focus some features of the UK economy that are likely to change after the transition period has ended.

In that regard, the Office for National Statistics (ONS) recently published another set of experimental statistics that reveal interesting ways in which the UK economy is integrated with global markets. These statistics show that a substantial share of UK services exports emanates from foreign-owned enterprises, especially so towards EU markets. This close link to inward foreign investment makes Britain’s stellar services export position vulnerable to post-Brexit-related changes insofar as it may disrupt value chains and deter investment, which, in turn, would affect trade in services.

International integration reaches deeper than just goods trade, and these days also encompasses services trade and foreign direct investment (FDI). In fact, the UK is one—if not the—most services export-oriented economy in the world. ONS data help us understand just how much the UK services export performance is underpinned by foreign ownership. In terms of numbers, foreign-owned enterprises are few and far between but those that are here make a big contribution to trade. The reason is that on average they are larger and more productive than their domestically-owned equivalents. To illustrate, in 2017 just over 1% of all non-financial businesses in the UK were foreign-owned firms—i.e. had an ultimate controlling parent company located outside the UK. At the same time, more than a quarter (27%) of all UK businesses with more than 250 employees were foreign-owned.[1]

And here is why this is crucial for the UK’s top spot in services trade: Most of the foreign-owned non-financial businesses in the UK (82.9%) operate in services-related industries.[2] Over the past few years, foreign-owned businesses in the UK have on average exported around £85 billion worth of cross-border services annually. This is more than half (56%) of the UK’s total services exports by those businesses that can be classified as either domestic or foreign-owned (Table 1, ‘Services’ row).[3] Furthermore, these firms are particularly dominant in services exports to the EU, where they generate 60.4% of total UK services exports.

It is widely known that numerous value chains criss-cross the English Channel to link the UK economy to EU markets. While, for example, importing bumpers and exporting cars is perhaps the most visible part of value chains, services are also part and parcel (yes, increasingly) of value chain trade. One manifestation of this is the fact that manufacturing firms increasingly export services as well, often as part of a package along with their manufacturing products. Here, the heavy lifting is again done by foreign-owned firms: on average over 2016-18, manufacturing sector firms in the UK generated cross-border services exports worth around £14.2 billion annually (Table 1, column 3) and nearly two-thirds of these emanate from foreign-owned manufacturing firms.

| Table 1: UK services exports by broad industry categories (£million) | ||||

| Category | Foreign-owned firms | Domestically owned firms | Total | |

| (1) | (2) | (3) | ||

| Agriculture, fishing, mining | 711 | 171 | 882 | |

| Manufacturing | 8,787 | 5,377 | 14,164 | |

| Services | 74,624 | 58,774 | 133,398 | |

Source: ONS dataset: UK trade in services by business characteristics, 2016-2018. Numbers are based on averages across 2016-2018 and exclude any values undefined by industry or business characteristics. Industry “Repair and installation of machinery and equipment” is included in Manufacturing, and industry “Electricity, gas, steam and air conditioning supply”, which makes up 0.1% of UK’s services exports by foreign and domestic firms, is excluded.

A closer look into the industries behind these figures further corroborates the idea that these trade and investment flows arise from value chains. A large share of the £8.8 billion services exports generated from foreign-owned manufacturing firms (Table 1, column 1) comes from the automotive industry (£2.4 billion worth of services annually across 2016-18), as well as the chemicals and pharmaceutical industries (combined £1.3 billion), and machinery and equipment industries (£740 million). These are all industries that are commonly associated with a high degree of integration within Global Value Chains (GVCs), where goods cross borders many times during the production chain before reaching the final consumer.

Services are not just an important part of outbound manufacturing value chains. Here is another twist: the value added from UK-originating services is further processed in the destination country and then re-exported to yet another (third) country. Such chained transactions are known as “GVC forward linkages.” Exports from business services, financial and wholesale service sectors exhibit particularly high forward linkages, reflecting that they are intermediate inputs in their respective export destinations (IMF, 2019).

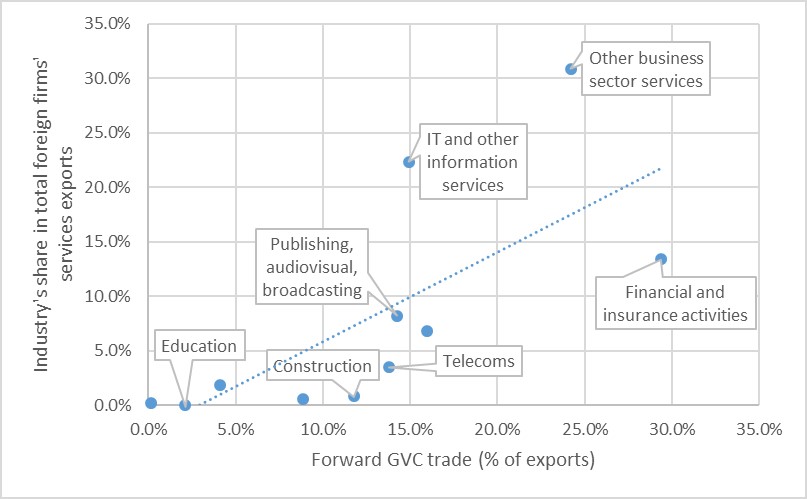

Indeed, services exports by foreign-owned firms tend to concentrate in services sectors with relatively high forward linkages (Figure 1).[4] The positive correlation suggests that foreign-owned firms in the UK tend to export services that, to a relatively high degree, are subsequently used in the production of other countries’ exports.

Figure 1: Forward GVC participation and foreign-owned firms’ services exports

Source: GVC participation calculations based on data from OECD Trade in Value Added (TiVA) database (2015 release); forward GVC linkages calculated using method by Belotti et al. (2019). Data on foreign-owned firms’ services exports from ONS (average for 2016-18), excludes non-service sectors and any services exports not classified by ownership type.

The UK is a services economy and a prolific services exporter. New ONS data show how closely services trade is linked to Global Value Chains, although the figures exclude exports from the financial, insurance and transportation industries. Specifically, a substantial share of UK services exports is transacted out of foreign-owned businesses that have established commercial presence in the UK, especially for exports towards the EU. Manufacturing firms—again mostly foreign ones—are exporting bundles of services and goods, and foreign-owned businesses are engaged in exporting services that are used in onward supply chains.

Thus, the end of the transition period may hit services trade due to its role for and within value chains: foreign-owned firms will be particularly sensitive to additional barriers to trade arising post-Brexit and may reduce investment in their UK plants, or even re-locate (which would affect certain regions of the UK more than others). Conversely, any decision by foreign investors to pull out of the UK could have stark consequences for services trade. Hence, new post-Brexit barriers to goods trade may affect service exports, and barriers to services trade—almost inevitable under current plans—could also affect goods trade.

[1] Data from ONS ‘Foreign-owned businesses in the UK: business count, turnover and aGVA’, from the Annual Business Survey (released 27 June 2019). The Annual Business Survey only covers the UK’s Non-Financial Business Economy, which accounts for approximately two thirds of the UK economy in terms of Gross Value Added.

[2] Ibid, ‘Services-related industries’ include construction, distribution and non-financial services.

[3] ONS data “UK trade in services by business characteristics” (released 10 March 2020). Figures based on an average across 2016-2018. The ONS data provide information on trade by ownership status for industries included in the International Trade in Services Survey (ITIS). ITIS excludes most travel, transport and financial services and, as a result, business characteristics for these sectors are listed as ‘unknown’. The analyses in this blog exclude any trade values not classified by ownership status, which accounted for 45.9% of total services exports in 2018.

[4] GVC participation calculated using method by Belotti, F., Borin, A., and Mancini, M. 2019. icio: Economic Analysis with Inter-Country Input-Output tables in Stata. Policy Research working paper; 6. World Bank. See also Borin, A., and Mancini, M. (2019). Measuring What Matters in Global Value Chains and Value-Added Trade. Policy Research Working Paper No. 8804. World Bank.