8 June 2023

Michael Gasiorek is Director of the UK Trade Policy Observatory and Co-Director of the Centre for Inclusive Trade Policy. He is Professor of Economics at the University of Sussex Business School. Peter Holmes is a Fellow of the UK Trade Policy Observatory and Emeritus Reader in Economics at the University of Sussex Business School. Manuel Tong Koecklin is a Research Fellow in the Economics of Trade at the UK Trade Policy Observatory and University of Sussex Business School.

Michael Gasiorek is Director of the UK Trade Policy Observatory and Co-Director of the Centre for Inclusive Trade Policy. He is Professor of Economics at the University of Sussex Business School. Peter Holmes is a Fellow of the UK Trade Policy Observatory and Emeritus Reader in Economics at the University of Sussex Business School. Manuel Tong Koecklin is a Research Fellow in the Economics of Trade at the UK Trade Policy Observatory and University of Sussex Business School.

Recently, there have been a series of reports in the media focussing on the challenges that electric vehicle (EV) manufacturers are likely to face, from the end of this year, in exporting electric vehicles tariff-free to the EU. The concern it because of the changes in the rules of origin (ROOs) requirements (for EVs and batteries) which will become more difficult from January 2024, and again from 2027 and 2028 onwards.

The issue was outlined in more detail in our recent blog on the 19th of May (see https://blogs.sussex.ac.uk/uktpo/2023/05/19/rules-of-origin-do-matter-after-all/#more-7817). There we suggested that the UK should seek an extension of the current rules, which would give EV manufacturers more time to adjust, and battery manufacturers more time to build capacity. An alternative solution was recently mooted by some EU officials – that the UK could apply to join the Pan-European Mediterranean (PEM) Convention on Rules of Origin.

The PEM is an agreement on common ROOs between the EU and a wide range of partner countries, including the Southern Mediterranean, the European Free Trade Area (EFTA) countries and the Western Balkan States, as well as Georgia, Moldova and Ukraine. The agreement covers all products and not just cars and car batteries.

Being part of the PEM may be beneficial to the UK, as we have previously suggested in response to government inquiries and consultations. A major factor behind this recommendation is that being part of the PEM enables countries to be freer to use inputs from any of the PEM countries, which then count as ‘originating’. This meets the required rules of origin to then export to any of these countries. The technical term for this is diagonal cumulation. Note that the UK has already agreed the PEM rules of origin with all the PEM convention countries, other than the EU, with whom it signed a continuity agreement[1].

This advantage should not be overstated. The share of the PEM countries in total UK imports of intermediate goods in 2019 (i.e. before the introduction of the TCA and COVID) was just under 10%. Over half of these imports came from Switzerland where the main intermediate was gold. In 2021 the share of intermediates from the PEM countries had fallen to just over 6% – arguably some of this could well be because of the lack of diagonal cumulation.

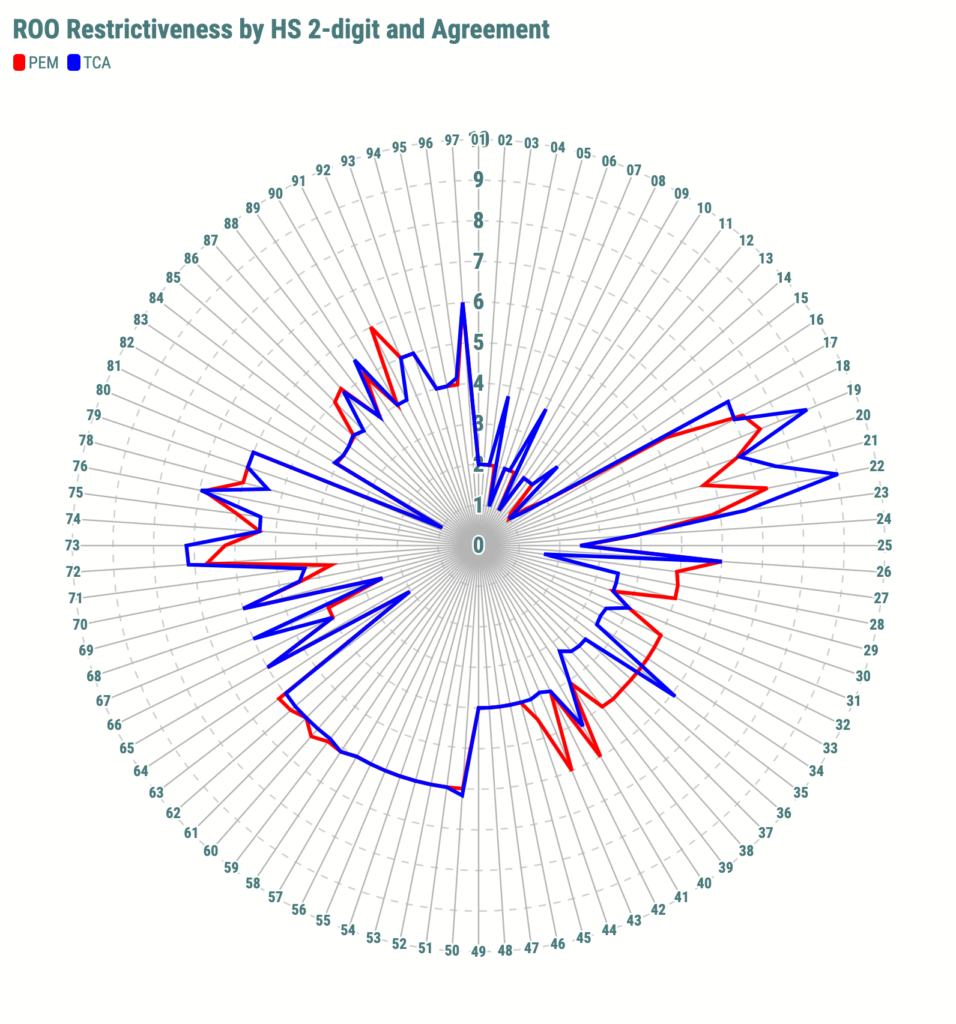

Another advantage of being part of the PEM could be if the product-specific rules of origin were less restrictive than those in the TCA. We have applied our Rules of Origin restrictiveness index (ROO-RI) developed by the UKTPO to both the TCA and the PEM. The index ranges from 1 (very low restrictiveness) to 10 (very high restrictiveness). The average ROO-RI across all the rules of origin in the PEM and the TCA is 4.49 and 4.26 respectively, so quite similar overall. The chart below compares the ROO-RI across 96 industries, using the HS 2-digit classification. The way to read this chart is that the rules of origin become more restrictive the further out along any given spoke. What we see is that the PEM rules of origin are more restrictive in some sectors (notably from HS 30 to HS 40 (except HS35), that they align closely for other sectors (such as HS 50 to HS 66) while for other sectors the TCA becomes more restrictive. In 22 cases the PEM is less restrictive, and in 28 cases it is the TCA that is less restrictive.

In terms of the discussion around electric vehicles and batteries, joining the PEM could make a difference, not because of the possibilities of diagonal cumulation with non-EU PEM countries, but because of the differences in product-specific rules. Diagonal cumulation is unlikely to make much difference because none of the PEM countries appear in the list of top 10 exporters (which between them account for over 99% of UK imports) to the UK in either EV batteries or electric vehicles. EV batteries are largely captured by HS code 850760 and electric vehicles by HS 870380. In 2021 46.5% of UK imports of HS 850760 came from the EU, and 50% from China, the US, Korea and Japan combined. Similarly, just over 50% of electric cars came from the EU and the bulk of the remainder from China, Korea and Mexico. Conversely, over 90% of UK exports of electric vehicles and 72% of EV batteries are destined for the EU.

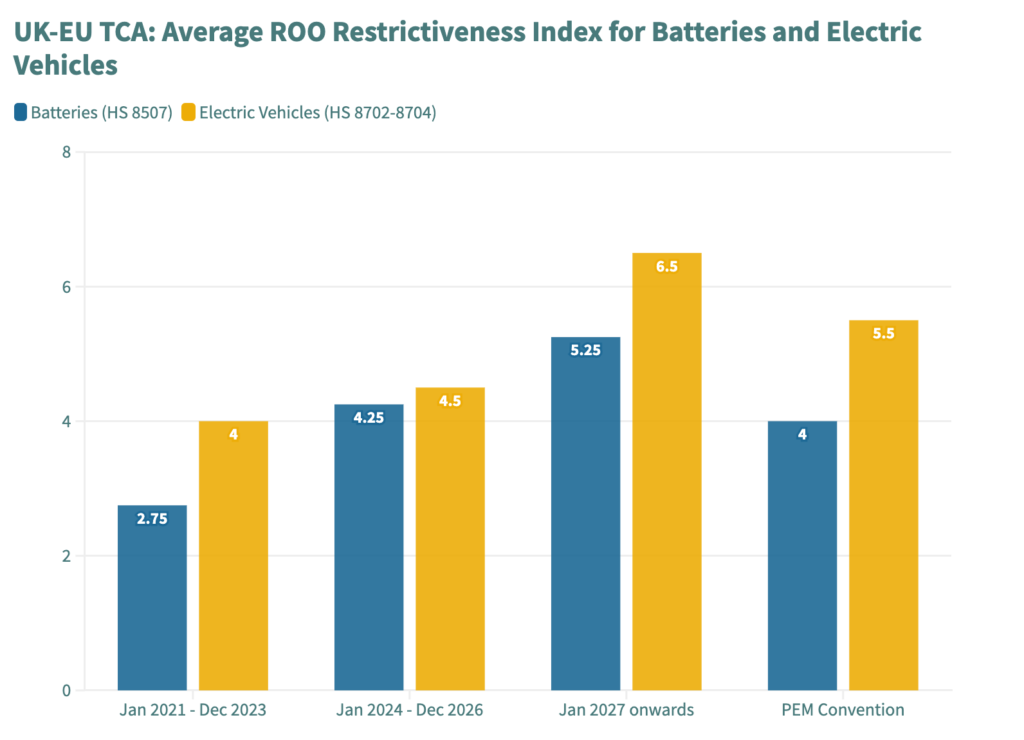

UK-EU bilateral cumulation is allowed for under the TCA and thus may well allow for some tariff-free trade – assuming that both parties are able to meet the rules of origin. However, if for example, a German battery producer cannot meet the battery rules of origin in exporting to the UK, then the bilateral cumulation will not be possible. From the end of this year, the TCA rules of origin will become increasingly difficult to meet and will require that the maximum amount of non-originating inputs cannot exceed 40% for battery packs, 50% for battery cells and 55% for vehicles. In comparison, the PEM rules constrain non-originating materials to 50% for batteries and 45% for electric vehicles.

The differences are reflected in the chart below which tracks the changes in restrictiveness over time, as agreed in the TCA, and compares this to the new PEM rules. What is clear from the chart is that if the EU agreed to the UK applying the PEM rules of origin in the TCA, this could ease the problems the UK EV car industry, and battery producers are may face by 2027 onwards. However, it would still represent an increase in ROO restrictiveness compared to the current situation.

Note, that under the terms of the TCA, changing the rules of origin is indeed possible and does not require renegotiating the TCA. However, the UK would have to request such a change, and the EU to agree to it (or, in theory, vice versa). However, the UK did not request to be part of the PEM in its TCA negotiations with the EU (one might ask why). It is also unclear why it should choose to do so now, and whether doing so would suit the car industry. Also, if a straight switch to PEM occurred, those industries that had to face more troublesome rules of origin may feel aggrieved. Equally, although the suggestion was made by EU officials, it is not clear whether the EU would agree to this.

Some have suggested that both sets of rules could operate in parallel – allowing producers to choose the rule that suited them best. It is true that (a) currently the PEM rules are being renegotiated and that while this is taking place, both the existing PEM convention rules and the transitional rules are operating in parallel. It is also the case that (b) once the CPTPP is ratified, the UK will be able to trade with Australia either using the UK-Australia ROOs or the CPTPP ROOs. However (a) is highly unusual and the EU is very unlikely to agree to this and (b) is the result of being a part of two overlapping FTAs. This is quite different to agreeing to two sets of ROOs for one FTA.

So, the bottom line is this: the application of the PEM could benefit the UK battery and EV manufacturers. But the obstacles to achieving this seem high. The more obvious answer is to extend the current arrangements. In the longer term, being part of the PEM is still desirable, but only for industry generally and will not solve the problems of the car industry specifically.

Footnote:

[1] These are: Albania, Bosnia and Herzegovina, Egypt, Faroe Islands, Georgia, Iceland, Israel, Jordan, Lebanon, Liechtenstein, Montenegro, Morocco, North Macedonia, Norway, Palestine, Serbia, Switzerland, Tunisia, Turkey, Ukraine.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

[…] window that might not be enough to scale up the EV industry sufficiently. Michael Gasiorek from the University of Sussex Business School argued that PEM Convention membership would be beneficial for the UK automotive industry, […]