16 February 2024

Michael Gasiorek is Director of the UK Trade Policy Observatory and Co-Director of the Centre for Inclusive Trade Policy. He is Professor of Economics at the University of Sussex Business School. Nicolo Tamberi is Research Fellow in Economics at the University of Sussex and Fellow of UKTPO.

Michael Gasiorek is Director of the UK Trade Policy Observatory and Co-Director of the Centre for Inclusive Trade Policy. He is Professor of Economics at the University of Sussex Business School. Nicolo Tamberi is Research Fellow in Economics at the University of Sussex and Fellow of UKTPO.

HMRC has just published statistics for trade in goods for December 2023, giving us three years of data after the implementation of the Trade and Cooperation Agreement (TCA) with the EU in 2021. This blog reviews trends in UK trade with the world and the effects of the TCA on UK-EU trade.

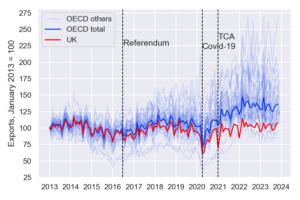

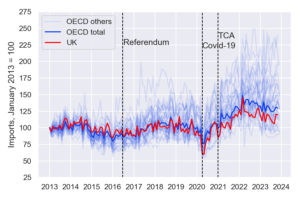

There is good and bad news for UK trade in goods. Starting with the bitter pill, the UK’s trade in goods with the world has underperformed compared to other comparable countries over the last few years. Figure 1 shows the exports (panel a) and imports (panel b) of the UK, marked in red, and other OECD countries in blue, together with the series for the OECD total in dark blue. While during the period 2013-16, the UK was in line with the OECD total, the UK’s imports and exports started to slow down since the Brexit referendum in June 2016. For exports, the gap with the OECD total increased substantially with the Covid-19 pandemic. Imputing causation in this setting is not easy; most likely, the Brexit referendum, a slow recovery from the pandemic and the UK’s exit from the EU all contributed to the underperformance of UK trade.

A) Exports B) Imports

Source: author’s calculations based on OECD data. Trade is measured on a Balance of Payment method.

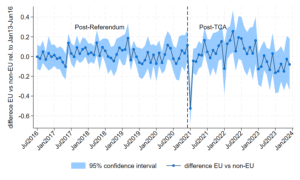

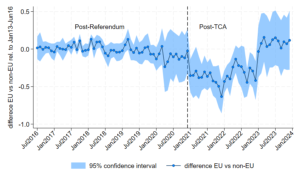

Our second bit of analysis looks at the geography of the UK’s trade by comparing UK trade with the EU to trade with other non-EU countries (ROW). With the caveats of having preliminary data for 2023, here comes the sweet news: three years after the TCA, the UK’s trade with the EU relative to non-EU is back to normal.

As shown in Figure 2, exports were affected only in January 2021, the month of entry into force of the TCA. But this is old news. Imports on the other hand were down by about 20-30% over the period 2021-22, but by the end of 2023, they have also recovered to pre-TCA levels relative to non-EU imports.

A) Exports B) Imports

Source: author’s calculations based on HMRC data. The figure reports the difference-in-difference coefficients of a PPML regression with partner-by-calendar month and time-fixed effects. The sample includes UK trade with the EU members and a control group composed by OECD+BRICS countries excluding Canada and Japan as FTAs between the EU and these countries entered into force in the period considered. We removed gold (HS 7108) and minerals (HS 27) from total trade due to the volatility of these products. Results are subject to some caveats, which we tried to address, as detailed below, to ensure that the results are robust.

After running these robustness checks, the results of Figure 2 remain solid. There can be many reasons beyond these results. One narrative is that big firms, which drive the bulk of trade, generally operate in many countries around the world and already know how to deal with customs formalities. Costs increase a bit, but things proceed as normal.

Our previous analysis (see the Economic Policy paper) showed strong sectoral differences in the effects of the TCA, especially for exports. We estimated the effects of the TCA on UK-EU trade for seven sectors up to October 2023.

For exports, two sectors were affected by the TCA and show no sign of recovery: Agrifood, down by 18%, and Textile and clothing, which is down by 55-60% over 2021-23. The TCA effect on imports on the other hand was quite similar across sectors in 2021, and so was the recovery. Only one sector remained substantially affected by the end of 2023: Textile and clothing (-19% in 2023). These sectoral results for Agrifood and Textiles and clothing are strongly in line with these sectors being where most trade restrictions are in place. Apparently, those restrictions are here to stay.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or the UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

[…] with the EU. The equally feeble performance across the UK’s trade partners means that in 2023, the EU share of goods imports and exports had returned to its pre-Brexit […]

[…] years after the TCA, the UK’s trade with the EU relative to non-EU is back to normal,” says Michael Gasiorek, Director of the UK Trade Policy Observatory at the University of […]