20 April 2020

20 April 2020

Julia Magntorn Garrett is a Research Officer in Economics at the University of Sussex and Fellow of the UK Trade Policy Observatory.

The economic consequence of the Covid-19 outbreak is undoubtedly the most immediate worry for most businesses world-wide currently. While businesses of all sizes are affected, Small and Medium-sized Enterprises (SMEs) are particularly vulnerable given their size and often limited resources.

In the UK, the SMEs (enterprises with up to 249 employees) that are able to weather the immediate crisis still face the consequences of Brexit. While the outbreak of the virus halted several of the scheduled negotiating rounds, the UK Government is still adamant that there will not be an extension to the transition period beyond December 2020.

Given the vulnerability of many SMEs, any additional barriers to trade that arise as a consequence of Brexit may hit SMEs harder than large firms. This blog uses a new experimental dataset on UK services trade by business size, published last month by the ONS, to analyse the exposure to Brexit of a sample of SMEs engaged in services trade.[1] Services trade is particularly relevant because a Canada-style trade agreement with the EU, which is the current aim of the UK Government, would do little to avoid increased regulatory barriers for UK services suppliers trading with the EU.

How much firms currently trade with the EU will affect their exposure to increased trading costs following Brexit. The data from ONS shows that the importance of the EU as an export market is roughly equal (around 40%) for firms across all business sizes. In contrast, 53% of all services imports (£13.4 billion) by SMEs came from the EU in 2018, compared with 42% of imports by large firms.

Much of the Brexit debate has focussed on the impact it will have on exporters. However, access to imports is also an important driver of business success. Indeed, it has been shown that in 2017, 49% of SMEs that imported from the EU viewed Brexit as a major obstacle to the success of their business, marginally higher than that reported by SMEs exporting to the EU (46.7%). The higher reliance on imports from the EU by SMEs indicates that any additional barriers which impede the UK’s services imports from the EU may hit SMEs relatively harder than large businesses.

Table 1 lists the 10 most important import industries in the ONS sample for SMEs. The most important industry in terms of the value of imports is computer programming, accounting for £4 billion of SMEs’ imports. This is closely followed by the industry supplying services auxiliary to financial services (£3.8bn of imports).[2] Together these two industries account for 31% of total services imports by SMEs.

The table also gives the share of imports that SMEs account for in each industry. SMEs make up the majority of imports in industries such as employment activities, motion pictures, supporting services for financial services, advertising and marketing research, wholesale trade and telecoms. As can be seen in the final column of the table, in many of these industries a large share of UK’s services imports come from the EU.

| Table 1: Top 10 services import industries for SMEs | ||||

| Industry | SME imports (£bn) | Share of SMEs in total imports | Share of total UK imports coming from EU | |

| 62 Computer programming | 4.0 | 38.5% | 41.0% | |

| 66 Activities auxiliary to financial & insurance services | 3.8 | 56.4% | 28.7% | |

| 46 Wholesale trade, except of motor vehicles | 2.3 | 53.9% | 56.9% | |

| 61 Telecommunications | 2.2 | 51.9% | 66.1% | |

| 70 Activities of head offices; mngmnt consultancy | 1.9 | 51.8% | 40.0% | |

| 59 Motion picture, video and TV production | 1.2 | 63.0% | 35.3% | |

| 73 Advertising and market research | 1.0 | 56.2% | 49.7% | |

| 82 Office administrative, office support | 0.9 | 44.4% | 44.4% | |

| 71 Architectural & engineering activities | 0.8 | 22.1% | 33.5% | |

| 78 Employment activities | 0.6 | 82.9% | 63.9% | |

| Note: Based on averages 2016-2018. Excludes any industries classified as ‘unknown’. The final column gives the share of UK’s imports that come from the EU in each industry by all business sizes. | ||||

How these industries will be affected by Brexit depends on the regulatory environment in which they operate. For example, for the computer programming industry, the governance of Intellectual Property rights (IPs) over source codes will likely be important, whereas in industries such as architectural and engineering services the issue of mutual recognition of qualifications will be crucial.

As it stands, we do not know what the trade relationship between the UK and the EU will be in the future. However, as an indication of the conditions that may face UK and EU services suppliers we can use the OECD’s Services Trade Restrictiveness Index (STRI).

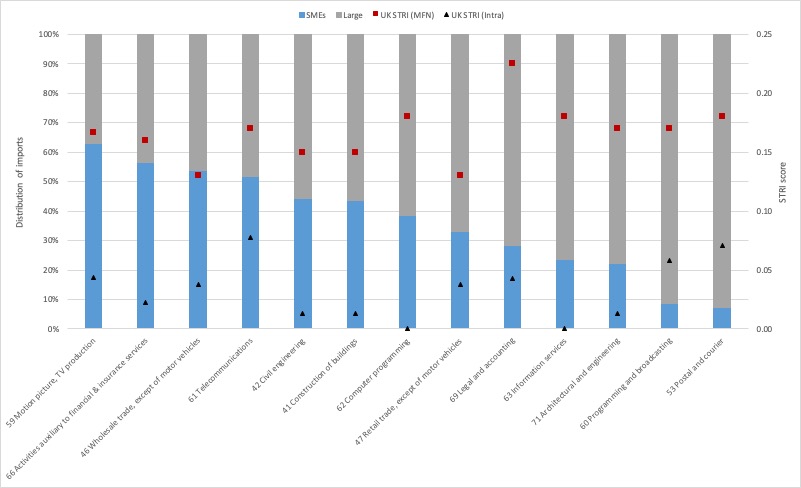

The STRI quantifies the restrictiveness of services regulations across 22 sectors. The original (MFN) STRI covers applied regimes for countries that do not benefit from preferential treatment, whereas the intra-EEA STRI gives information about the regulatory barriers affecting services trade within the European Economic Area (EEA). The gap between the two provides an approximation to the change in regulatory barriers that UK firms face when moving from trading with the EU as an EEA country to trading with the EU as a third country.

Figure 1 gives the UK’s intra-EEA STRI and MFN STRI, as well as the share of imports in each industry generated by SMEs and large firms respectively. If no trade agreement on services is reached between the UK and the EU, the UK’s MFN STRI defines the basis on which UK firms will import services from the EU. It may seem that the UK government could unilaterally decide to continue the existing regime for imports from the EU, but, under WTO rules, it cannot do so unless it extends the liberalisation to all partners. [3]

SMEs account for around 40% of total imports in the computer programming industry. This sector has a particularly large gap between intra-EEA and MFN regulatory restrictiveness. Similarly, the legal and accounting sector has one of the largest gaps between intra-EEA and MFN STRI, although SMEs account for a relatively smaller share of UK’s imports in this industry.

Of the industries in the ONS dataset for which we can identify STRI scores, SMEs account for the majority of imports in the motion picture industry, the industry providing supporting activities to financial services and the telecommunication industry, which would all face increased barriers if imported from the EU on an MFN-basis. The increase in trade barriers would make imports from the EU more expensive, which in return would increase costs for those SMEs that are reliant on these imports in their operations.

Source: Author’s own calculations based on data from the OECD’s Services Trade Restrictiveness Index for year 2019 and UK services trade data by firm size from ONS.

The new data from the ONS shows that SMEs are more reliant on services imports from the EU than large firms, and as a consequence may be particularly negatively affected if increased barriers make it more expensive for UK firms to import services from the EU. SMEs’ services trade is highly concentrated in only a few industries, some of which could face considerable barriers once the current transition period ends.

Many SMEs are already under considerable economic stress due to the current pandemic. Those that get through it will likely be more vulnerable than before, and may therefore be unable to bear the added costs arising from Brexit. SMEs make up a large portion of businesses and jobs in the UK, and are a group for which the government regularly expresses its support and concern. Indeed, in the UK Government’s objectives for a UK-US trade agreement, the potential benefits for SMEs were made a focal point. In this respect, it is noteworthy that while the EU’s negotiating mandate for the UK-EU trade deal asks for a dedicated chapter for SMEs, the UK’s mandate makes no mention of SMEs at all.

Extending the transition period would go some way towards alleviating businesses’ immediate worries. More generally, the UK Government should ensure that the interests of SMEs are kept in mind as it negotiates the future trade agreement between the UK and the EU.

[1] The data from ONS gives information on trade by business size for all industries included in the International Trade in Services Survey (ITIS). ITIS excludes most travel, transport and financial services, and as a result, business characteristics for these sectors are listed as ‘unknown’. The analysis of this blog is based only on values which are specified by firm size, any values classified as having ‘unknown’ business characteristics have been excluded. For trade by business size, 57% of UK’s total exports and 68% of UK’s total imports were generated by firms with unknown business size.

[2] This statistic refers specifically to auxiliary services to financial and insurance services. Financial and insurance services by themselves are excluded as data on business size is missing for these industries.

[3] The STRI covers 22 sectors, but not all are covered in the ONS data by business size, notably transport services and financial services. These STRI sectors have therefore been excluded. Some industries, for example the architecture and engineering industry, cover more than one STRI sector. In such cases we have taken a simple average across the relevant STRI sectors to generate a score for the industry. For auxiliary services to financial & insurance services, an average of the STRI for commercial banking and insurance services is used.

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

Excellent as well as informative . Please write down some on research paper service for students. i need it. Thanks