L. Alan Winters CB is Professor of Economics and Director of the Observatory and Julia Magntorn is Research Officer in Economics at the UKTPO.

There is much to digest in the White Paper on The future relationship between the United Kingdom and the European Union and much to clarify. This blog is devoted entirely to trying to understand the Facilitated Customs Arrangement (FCA) that aims to deliver frictionless trade in goods between the UK and the EU after Brexit.

The FCA matters because trade that is ‘as frictionless as possible’ with the EU is now accepted by nearly everyone as desirable and has been characterised by much of business as essential. It also matters in the short term, however, because it is the UK government’s offer to the EU on how to ensure that there is no border between Northern Ireland and the Republic. Without a solution to this latter problem there will be no Withdrawal Agreement and no transition.

Brexit undermines the currently wholly open border between the UK and the EU, but the FCA aims to reconstruct it by ensuring that any good entering the EU via the UK is treated identically to any good entering the EU directly. That is, it wants to replicate the conditions of the current customs union for UK exports to the EU while allowing the UK to negotiate different tariffs with third countries. The solution offered is ingenious at a theoretical level, but at the expense of massive complication and bureaucracy. Indeed, ‘FCA’ might well stand for the ‘Fantastically Complicated Alternative’.

The Problem The FCA Solution

The FCA foresees perfectly open borders between the UK and the EU and accepts that any good imported from the EU to the UK may enter with no tariff or other conditions.[1] On goods imported into the UK from outside the EU, it aims to ensure that goods destined to be consumed in the UK pay the UK tariff, while those destined for the EU pay the EU tariff. Many of us have argued that this requires that non-EU imports pay the EU tariff at the UK border and that only when they have been proven beyond reasonable doubt to have been consumed in the UK, may importing firms claim a tariff rebate down to the (presumably lower) UK level. This seems to require that the vast majority of such goods be carefully tracked in order to determine their final place of consumption.

But paragraphs 16 and 161 of Chapter 1 of the White Paper, on the other hand, state that 96 percent of non-EU imports ‘would mostly likely to be able to pay the correct or no tariff upfront’ – i.e. as they enter the UK. That is, only four percent of imports would require tracking to ascertain whether they should pay the UK tariff rather than the EU one. We do not challenge the possibility of tracking imports per se, but we argue that four percent is a serious underestimate of the need for tracking, and, in doing so, that tracking poses more challenges than the government appears to realise. Setting aside the slippery ‘most likely’, the White Paper is in error on this point.

The White Paper tells us the information used in this calculation but not the way it is used; we don’t know whether this is bad faith or just bad practice, but we need to see the details because such calculations depend on several judgement calls. When we tried to reconstruct the four percent figure, we found a simple and crude approximation that generates precisely that number! We describe our approach in the Appendix below and from that demonstrate why four percent is not credible.

Of course, we could very well be wrong about the calculation, but in that case, it is incumbent on the government to make its calculations and assumptions clear, at least to MPs in a locked room, but ideally more widely so that they have to meet the minimum standards of transparency that commentators have to meet.

Paragraph 16a: tells us that if ‘the destination can be robustly demonstrated by a trusted trader [goods will pay the correct tariff at the UK border.] This is most likely to be relevant to finished goods’.

A second complication is the suggestion (paragraph 17c) that rebates can be paid quickly, before the stage of final consumption – ‘for example, at the point at which the good is substantially transformed into a UK product’. This would accord with the practices of a regular Free Trade Agreement (FTA) in which goods can cross into the partner country if they satisfy Rules of Origin (ROOs). But ordinary FTAs have to have border formalities on inter-member trade, precisely to check these sorts of issues. The FCA, on the other hand, is intended to obviate the need for ROOs altogether and leave the EU indifferent between whether the goods (and their components) enter directly to the EU or indirectly via the UK.[3] If indirect imports receive the rebate on meeting some ROO in the UK, this latter objective will be violated. After the rebate, the transformed good will have paid UK tariffs on its inputs and would compete with local products made with EU direct imports which will have paid the higher EU tariffs.

The circumstance that usually gives rise to the greatest tariffs is the imposition of anti-dumping duties (ADD – trade remedies). Despite the White Paper saying that the EU and the UK will be treated ‘as if in a combined customs territory’ (para. 12a), this cannot be the legal position. Each will have its own ADD procedures and will have to determine ADDs on the basis of its own trade and production conditions. There is no reason to suppose that the answers will be the same, even usually, let alone invariably. And since ADDs can be very large we are looking at potentially large differences between UK and EU import duties.

Where the EU ADD exceeds that of the UK, the situation is as above, but just with a large incentive to cheat. Where the UK has the higher ADD, however, the situation is more complicated. The UK has conceded (para. 17a) that the EU will not levy UK tariffs at its border, so it will be open to UK firms to circumvent UK ADDs by importing via the EU. The White Paper declares (para. 162) that ‘the UK would make it illegal to pay the wrong tariff, and use risk and intelligence based checks across the country, rather than at the border to check that the right tariffs are being paid.’ This will be very intrusive and very costly administratively.[4] It also raises questions of WTO-consistency that we will consider on another occasion, and of consistency with Article 43 of the Withdrawal Agreement which commits the UK to ‘the avoidance of a hard border, including any physical infrastructure or related checks and controls’ in Ireland.

Paragraph 17a suggests that the EU and the UK agree a formula for transferring revenues that each collects on goods destined for the other. This may or may not be acceptable to the EU, but it is important to note that the proposal is to rebate some of the EU tariff that has been collected on goods destined for the UK, not to collect the UK tariff at the EU border. This is why the European Reform Group’s amendment to the Trade Bill on 16th July is destructive of the FCA. It insists that the EU collects UK tariffs on its borders, and of course it will not.

As we noted at the outset, there is much to clarify in the White Paper, and by extension, the FCA. We have worked hard to understand it and our interpretation above suggests that it could work, but only at substantial – arguably prohibitive – cost. However, there are phrases in the White Paper that do not quite square with our interpretation. For example, paragraph 15 promises ‘frictionless trade for the majority of UK goods trade’. Why not all UK goods trade? And paragraph 23b refers to ‘no routine requirements for rules of origin’. Why only routine?

If our interpretation is wrong, it would be useful for a clearer statement from government about what exactly they have in mind.

[1] Standards and regulations also need to be approximated for this, but the White Paper deals with them under the heading of the ‘common rule book’, which we will deal with on another occasion.

[2] You can probably rely on detecting any cheating on the initial declaration with cars (EU tariff 10%) because they have UK-specific features (right-hand drive) and are, anyway, all numbered and then licenced for use. But this is a very special case.

[3] Actually, paragraph 23b refers to ‘no routine requirements for rules of origin’. But any ROO creates a friction and needs, in principle, a border, so the ‘routine’ qualification is difficult to interpret. Likewise, paragraph 15 promises ‘frictionless trade for the majority of UK goods trade’ – why only the majority?

[4] To be clear, the proposal is not to clear the goods through an inland customs post – a practice that has plenty of precedents – but ‘across the country’.

The FCA is the UK’s proposal to ensure that goods imported from outside the EU and destined for the UK pay the UK tariff, while those destined for the EU pay the EU tariff. Paragraphs 16 and 161 of Chapter 1 of the White Paper state that 96 percent of such goods ‘would mostly likely to be able to pay the correct or no tariff upfront’ – i.e. as they enter the UK. That is, only four percent of imports would require tracking to ascertain whether they were consumed in the UK, and therefore should pay the UK tariff, or in the EU and pay the EU one. We do not challenge the possibility of tracking imports per se, but we show that four percent is an obvious underestimate of the need for tracking. In doing so, we also show that tracking poses more challenges than the government appears to realise. Both demonstrations show that the cost of implementing the FCA will be considerably higher than the government appears to accept.

The White Paper tells us the information that is used in its calculation of four percent, but not the way it is used; we don’t know whether this is bad faith or just bad practice, but either way, we need to know because such calculations depend on several judgement calls that may not be universally agreed. Fortunately, however, when we tried to reconstruct the four percent figure, we found a simple and crude approximation that generates precisely that number! We describe our approach below and from that demonstrate why four percent is not credible.

Of course, we could very well be wrong, but in that case it is incumbent on the government to make its calculations and assumptions clear, at least to MPs in a locked room, but ideally more widely so that they have to meet the minimum standards of transparency that commentators have to meet.

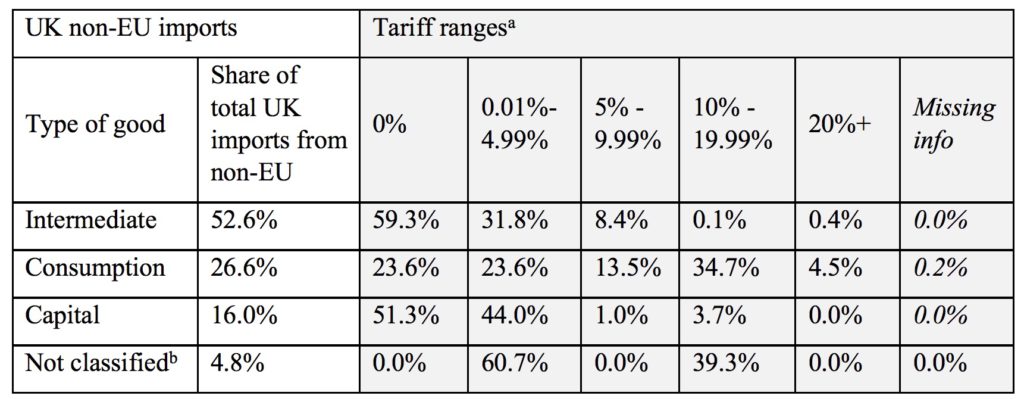

Our calculation is based on the numbers in table 1 below. They relate to statements in Chapter 1 of the White Paper as follows.

Paragraph 16a: tells us that if ‘the destination can be robustly demonstrated by a trusted trader [goods will pay the correct tariff at the UK border.] This is most likely to be relevant to finished goods’.

a Percent of UK non-EU imports facing the respective EU tariff rate. b ‘Not classified’ includes, inter alia, passenger cars and motor spirit. Source: BEC categories for classification of goods; UN Comtrade HS 2012 6-digit for trade; TRAINS 6-digit MFN applied tariff data (incl. ad-valorem equivalents). Figures are averages for 2015-2017.

If we take intermediates as the base (52.6% of the total), remove 59.3% of them because they face zero tariffs, about 21% of imports need to demonstrate destination, and if we then remove 81% of these that are assumed to be imported by AEOs, we end up with 4% of total non-EU imports that do need tracking – the government’s number.Source: BEC categories for classification of goods; UN Comtrade HS 2012 6-digit for trade; TRAINS 6-digit MFN applied tariff data (incl. ad-valorem equivalents). Figures are averages for 2015-2017.

So why is this figure not credible? Remember that where the UK tariff on a good is lower than the EU tariff, the issue is to persuade the EU authorities that the UK can administer the scheme well enough to ensure that no goods paying a lower UK tariff leak into the EU if the border between them is left unpoliced. Particularly in the light of its poor record of customs administration while within the EU, the UK will not get much benefit of the doubt. The incentive for a good to leak from the UK to the EU is greater the greater the difference between the UK and EU tariffs. These incentives are likely to be largest where EU tariffs are highest.

We used UN Comtrade HS 2012 6-digit level data for UK imports from all non-EU countries for years 2015-17.

The White Paper (footnote to para. 16b) states that “MFN tariff schedules“ were used in the calculations. We therefore used TRAINS tariff data, HS combined 6-digit, for EU MFN tariffs including tariff equivalents, to non-EU countries (as a combined group) for years 2015-2016. Using MFN rates does not account for imports under preferential rates, however, including preferential tariffs rates does not appear to substantially change the results. Both trade and tariff data were downloaded from World Integrated Trade Solution (WITS).

The concordance table for HS 2012 to BEC was taken from WITS and used to add a BEC code to each 6-digit HS code.

We categorised the BEC (and corresponding HS codes) into intermediate/consumption etc. using the specification on p. 8-9 in UN(2016).

There are 3 categories in this document which are specified as ‘not classified’, this includes motor fuel and passenger motor vehicles. We have left these as ‘not classified’ in order to avoid making assumptions.

UN(2016) Classification by Broad Economic Categories Rev.5, Department of Economic and Social Affairs, Statistics Division, Statistical Papers Series M No.53, Rev.5, ST/ESA/STAT/SER.M/53/Rev.5

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or UK Trade Policy Observatory.

Republishing guidelines

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.

I think that you have conclusively (and tactfully) proved that M. Barnier’s preliminary (and tactful) analysis was correct. Ingenious but unworkable. Might one observe that much of the difficulty would fall away if the UK signed up to a legally binding undertaking to implement and maintain EU regulations and standards on goods and apply the same tariffs-until such time as it wished to give formal notice that it intended to diverge. Up until then UK Customs could indeed act as the EU’s agent. This would (of course) only be a “temporary” arrangement until such time as acceptable draft FTAs might be concluded with the US, Canada, Australia, New Zealand, China and India and sufficient progress had been made in replacing the other 60+ EU agreements with third countries such as Japan and Korea. No red lines need be crossed-provided the right words were used such as Temporary Customs Co-ordination and Facilitation Arrangement.

Why should the EU allow the UK – as a third party non-member – to act as its agent to collect its own CET customs dues?

As this WTO analysis explains, it can be expected that where the UK tariff was less than CET, an incentive would exist for importers to secure arbitrage profits; some loss of revenue to the EU would be inevitable, unless the UK was made to pay over the odds to cover that potential loss.

On timescales getting repalcement FTA’s in place would take years; so the ‘temporary’ FCA arrangement would hardly be that.

[…] hope that is not evidence-based. A forensic analysis by the UK Trade Observatory, for example , in Decoding the facilitated customs arrangement points that out the stated or implicit assumptions, which the white papes appears to rely upon to […]

Thank you for attempting to de-mystify the ‘Fantastically Complicated Alternative’, but as director of a UK SME, I disagree on one point – I DO challenge the possibility of tracking imports per se. I cannot see how it could work.

Our company imports, stocks and distributes intermediate and finished goods worldwide. At import, we have no way of knowing where these goods will be sold other than to say, historically, that our turnover has been about 60/20/20% to the UK, the EU and to “third countries”, respectively.

Contrary to the assertions implicit in the Government’s white paper that 96 percent of goods imported from third countries ‘would mostly likely to be able to pay the correct or no tariff upfront’, our imported finished goods will require tracking to ascertain whether they are re-exported to the EU. It is likely that the financial and administrative cost of such tracking will cause us to cease direct exports to the EU. Of course, this will create a market opportunity for our UK customers, and we haven’t a hope of tracking our imported finished goods after we have sold them in the UK…

Similarly, our imported intermediate goods are typically incorporated into finished articles by our customers, so we have no idea where they end up.

The White Paper and FCA seem to have been dreamt up by people who have never run a bath, let alone a small import/export business, and who wouldn’t have a clue how to complete a Single Administrative Document.

Bang on Peter.

I’m a very small business wholesaling service parts in the marine safety sector. I import from EU and RoW as well as sourcing from the UK. Some of my UK suppliers are supplying UK origin goods, but also RoW and EU goods.

I sell to UK, EU and RoW and sometimes I sell to re-sellers.

How anyone thinks my UK supplier, bringing in items from China, can sell them to me and claim their duty back, I then sell them on to a ship supply business in Southampton that sells them to an Italian service centre…..

It’s just a complete mess.

My old industry was footwear and that’s even more of a mess as it is heavily penalised by anti-dumping duty and having seen how some of these businesses have ducked and dived to escape the clutches of the ADD and quota measures particularly in the past, I can quite easily see how creative entrepreneurs could exploit this system.

I’ve traded in goods since the 80s, either for myself, or for others. The stand-out for me is how clearance has streamlined so you almost don’t notice it. 15 years ago we had to provide original docs to Felixstowe before Customs would clear goods.

They were sometimes delayed.

Now it’s all electronic and goods mostly just come straight through whether coming from EU or RoW accepting that some categories like livestock may be more complex.

So why not an FTA, whether standard or enhanced one?

Why not mutual recognition? Why not efforts to create the most advanced customs clearance in the world?

The economic knock-on effects would be huge for everyone on both sides of the borders.

Davis was heading down this route had he not been obstructed along the way.

[…] the difficulties of tracking goods are much greater than the Chequers White Paper acknowledges: see Decoding the Facilitated Customs Arrangement by Prof L. Alan Winters […]